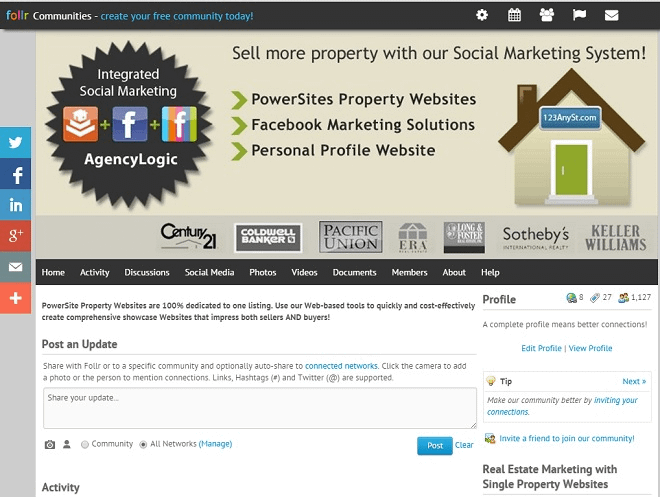

We regularly cover the activities and great software features coming out of Follr but did you know about the AgencyLogic Real Estate Community?

The community allows real estate agents to:

1. Chat and share ideas with other agents

2. Read real estate news

3. Sign up for referrals

4. Laugh at the ‘Just for fun’ posts 🙂

5. View social media content

6. Watch videos

And lots, lots more! If you want specific content added including new discussion threads just let us know.

Did we mention it’s free? To join the community simply click here!