Businesses, regardless of what services or products they offer, are constantly being evaluated and compared on their level of customer service. As a successful Realtor and small business owner, how can you provide the best customer service?

AgencyLogic single property Websites can help by providing real estate agents with a way to share documents including inspections, contracts, marketing documentation and spreadsheets. Not only does this help answer questions but also provides more property related information than is available anywhere else on the Web, eases the sales process, saves time and therefore money for all parties and finally demonstrates technical ability and obviously outstanding customer service on the part of the real estate agent.

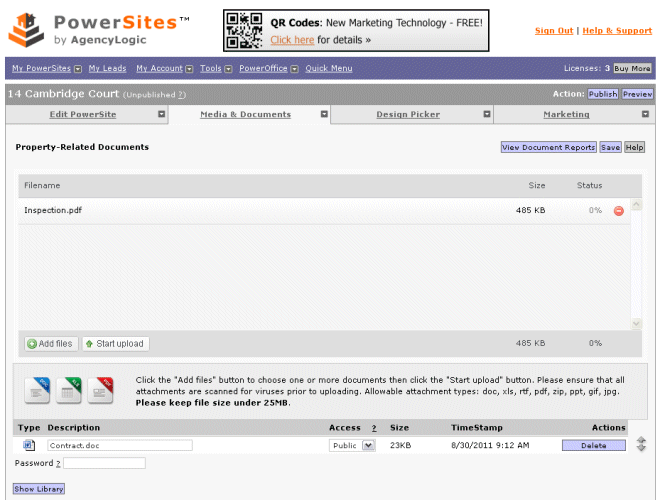

Agents can upload several file formats including Word, Excel, PowerPoint, Zip and PDF (plus others). It is also possible to create a central document library thereby saving time whenever files need to be used across multiple single property Websites.

Documents on AgencyLogic single property Websites have three levels of security:

- Open – Anyone who views the site can access the information

- E-mail Address Required – An e-mail address must be entered before accessing documentation

- E-mail Address and Password Required – An e-mail address must be entered and the Realtor must be contacted directly in order to obtain the password

Utilizing the third level of protection ensures any interested person interested contacts the Realtor directly, therefore generating solid leads and reliable contact information.

The question isn’t really why should you use a single property website, it’s how can you market effectively without one?

If you’re interested in single property Websites, visit AgencyLogic.com today!