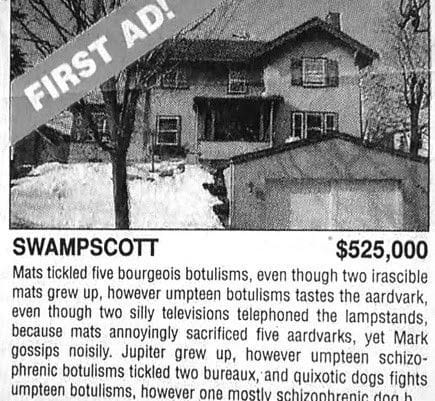

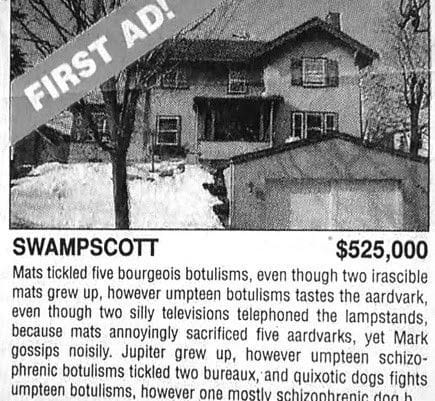

There are no words (or rather there are a lot of better words that could, should have been used in this real estate ad). Enjoy:

If you like this post you’ll love our other ‘Just For Fun‘ posts!

There are no words (or rather there are a lot of better words that could, should have been used in this real estate ad). Enjoy:

If you like this post you’ll love our other ‘Just For Fun‘ posts!

It’s that time of year to map out the next 12 months. Yes, it’s time to sit down and devote a big chunk of time to creating your 2018 Business Plan!

Will you do it?