— Purchasing a home still more expensive in majority of larger metros

— Monthly cost to purchase the U.S. median home was $1,600, compared to the median monthly rent of $1,319 In the fourth quarter of 2019

— Monthly cost to buy fell 1 percent year-over-year, while rent increased by 4 percent

— On average, the cost of buying the median home fell, now accounting for 30 percent of the national median income, while renting remained level at 25 percent

Santa Clara, CA – Jan. 29, 2020 (PRNewswire) After years of skyrocketing home prices, the combination of rising rents, lower mortgage rates and moderating home prices are making purchasing a home more attractive in many of the nation’s largest metros, according to realtor.com®‘s quarterly Rent vs. Buy report released today.

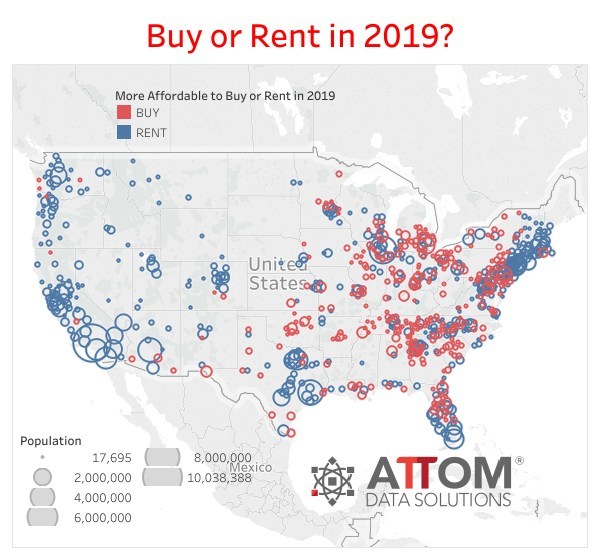

The report, which analyzed the cost of buying versus renting in 593 counties across the U.S., in the fourth quarter of 2019, found that it was cheaper to buy than rent in 16 percent of the counties with populations of 100,000 or more, up from 12 percent a year earlier. Despite homeownership becoming more affordable, it is still cheaper to rent than buy in 84 percent of the nation’s largest counties, including New York City, San Francisco and Los Angeles.

“The move toward a more balanced equation is good news for home sellers during this spring home buying season as more people, especially the large cohort of millennials who turn 30 this year, begin to weigh the cost of buying versus renting,” said realtor.com® Senior Economist George Ratiu. “Due to a combination of factors, we saw the monthly cost to buy a home fall 1 percent year-over-year, while rents increased 4 percent during the same time frame.”

The monthly cost to buy the national median-priced home was approximately $1,600, or 30 percent of the national median household income, in the fourth quarter of 2019, in line with the budgeting rule of spending no more than 30 percent of gross income on housing costs. The cost to rent increased to $1,319, representing 25 percent of the median household income in the fourth quarter of 2019.

Over the past year, 26 of the 593 counties analyzed shifted from being more affordable to rent to being more affordable to buy, including in the Cleveland, Bronx County, N.Y., Indianapolis and Columbia, S.C, areas.

Although it is still cheaper to rent than buy, some of the nation’s most expensive housing markets, including Kings and New York counties in N.Y., along with Santa Cruz County, Calif., saw the gap between renting and buying decrease the most: by 24 percent, 20 percent, and 18 percent, respectively.

Counties Where Buying is More Attractive

The median listing prices in the counties where buying a home was more affordable were on average 53 percent lower than the national median listing price of $300,000. Median rents, while still less expensive, were only 11 percent cheaper on average.

| Rank | County | Percent of Income to Buy | Percent of Income to Rent |

| 1 | Clayton, Ga. | 18% | 32% |

| 2 | Baltimore City, Md. | 23% | 35% |

| 3 | Cumberland, N.J. | 21% | 32% |

| 4 | Richmond, Ga. | 17% | 28% |

| 5 | Vigo, Ind. | 12% | 22% |

| 6 | Wayne, Mich. | 18% | 27% |

| 7 | Muscogee, Ga. | 20% | 28% |

| 8 | Cambria, Pa. | 11% | 19% |

| 9 | Hampton city, Va. | 22% | 30% |

| 10 | Jefferson, N.Y. | 24% | 31% |

Counties Where Renting is More Attractive

The median listing prices in the counties where renting is more affordable, were on average 260 percent higher than the national median of $300,000. Median rents, while also more expensive, were only 79 percent more expensive on average.

| Rank | County | Percent of Income to Buy | Percent of Income to Rent |

| 1 | New York, N.Y. | 117% | 30% |

| 2 | Santa Barbara, Calif. | 116% | 38% |

| 3 | Monterey, Calif. | 90% | 31% |

| 4 | San Mateo, Calif. | 77% | 31% |

| 5 | San Francisco, Calif. | 79% | 33% |

| 6 | Marin, Calif. | 77% | 33% |

| 7 | Napa, Calif. | 69% | 28% |

| 8 | Los Angeles, Calif. | 77% | 36% |

| 9 | Kings, N.Y. | 81% | 42% |

| 10 | Maui, Hawaii | 64% | 30% |

Notes on Methodology

*Purchase and rent costs reflect current costs and do not take into account holding period, price and rent appreciation, and inflation. Purchase costs do include taxes and insurance and are calculated based on realtor.com county-level residential listing price data and mortgage rate data for December 2019. Rental prices are from the U.S. Department of Housing and Urban Development (HUD) data for 2019 50th-percentile rent estimates. Household income data and home-ownership data are from Census Housing Vacancies and Home-ownership data and 2019 Claritas estimates are based on Census data. Only counties with populations of 100,000 or greater are included in the top lists in this analysis.

About realtor.com®

Realtor.com® makes buying, selling and living in homes easier and more rewarding for everyone. Realtor.com® pioneered the world of digital real estate 20 years ago, and today through its website and mobile apps is a trusted source for the information, tools and professional expertise that help people move confidently through every step of their home journey. Using proprietary data science and machine learning technology,realtor.com® pairs buyers and sellers with local agents in their market, helping take the guesswork out of buying and selling a home. For professionals,realtor.com® is a trusted provider of consumer connections and branding solutions that help them succeed in today’s on-demand world. Realtor.com® is operated by News Corp [Nasdaq: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. under a perpetual license from the National Association of REALTORS®. For more information, visitrealtor.com®.

Media Contact

Cody Horvat – cody.horvat@move.com