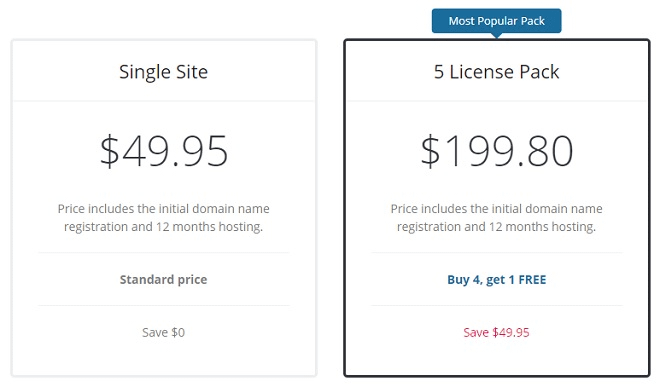

We are often asked:

Here is the answer and your options – remember once you buy a single property Website license for the new AgencyLogic PowerSite Pro they do not expire, ever!

Let us know if you have questions by clicking here.

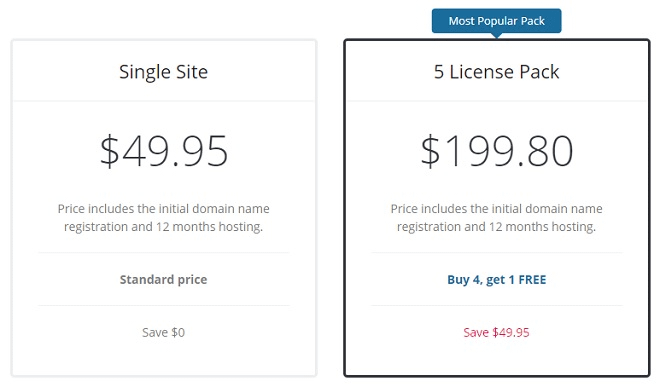

We are often asked:

Here is the answer and your options – remember once you buy a single property Website license for the new AgencyLogic PowerSite Pro they do not expire, ever!

Let us know if you have questions by clicking here.

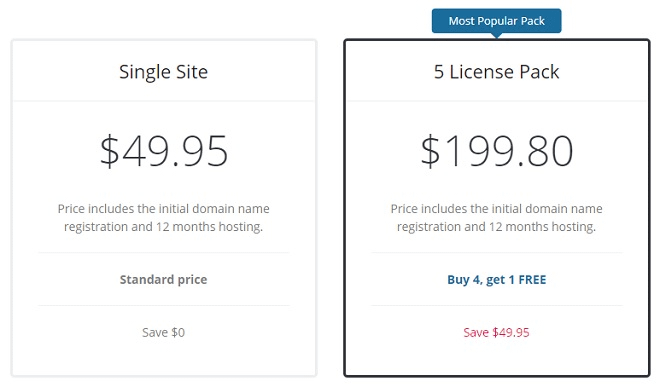

We are often asked:

Here is the answer and your options – remember once you buy a single property Website license for the new AgencyLogic PowerSite Pro they do not expire, ever!

Let us know if you have questions by clicking here.

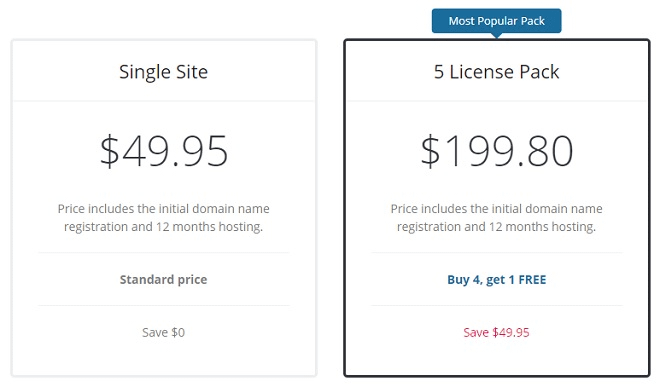

We are often asked:

Here is the answer and your options – remember once you buy a single property Website license for the new AgencyLogic PowerSite Pro they do not expire, ever!

Let us know if you have questions by clicking here.