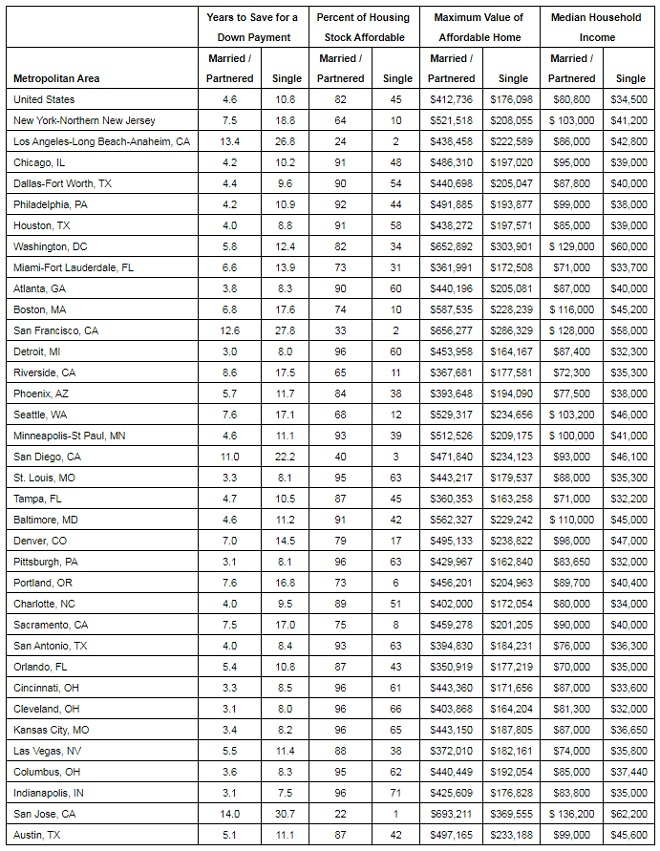

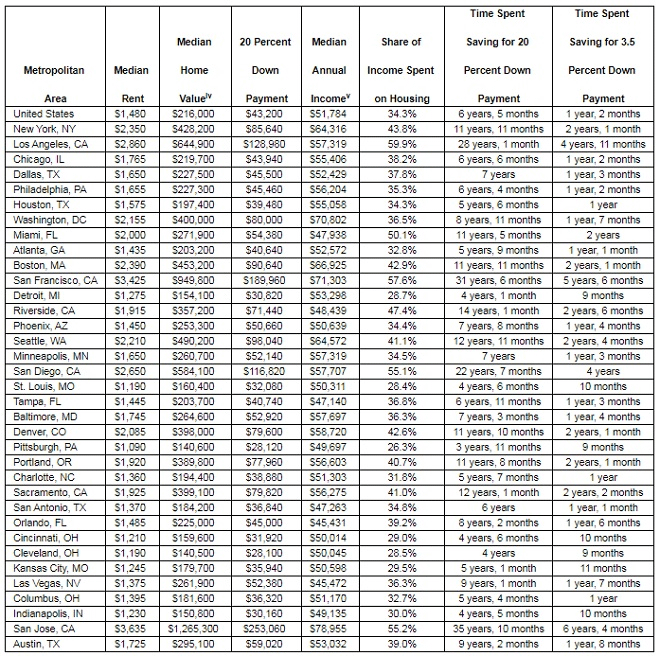

– Renters in expensive California markets can expect to spend more than two decades saving for a 20 percent down payment on the median valued home

– Rising rents and home values extend the amount of time it takes to save up for a down payment on a home – it takes a typical U.S. renter six years to save enough to put 20 percent down.

– Renters in 13 of the country’s 35 largest markets can expect to spend more than 10 years saving enough money to put 20 percent down on the typical home.

– The typical U.S. renter spends 34 percent of their income on housing.

San Francisco, CA – July 13, 2018 (PRNewswire) Renters can expect to spend nearly six and a half years saving for a 20 percent down payment on a home, according to a new HotPads® analysis.(i)

![]()

The median home value in the U.S. is $216,000, which means a 20 percent down payment would be $43,200. If a renter making the median income saves 20 percent of their income each month – as financial experts recommend — they would have enough for a down payment in 77 months, which is nearly six and a half years.

Rising rental costs make it even harder for renters to save for a down payment. Nationally, the median rent is $1,480 per month, up 2.5 percent from a year ago. Experts recommend spending no more than 30 percent of income on housing expenses, but the typical U.S. renter spends 34 percent of their income on housing.

In the country’s most expensive housing markets like San Jose, Los Angeles and San Diego, it could take renters 22 years to save up a 20 percent down payment on the median home, assuming they can afford to set aside 20 percent of their income each month. Currently, renters in these markets are spending more than 55 percent of their income on rent.

Meanwhile, it will take a typical renter in Pittsburgh, Cleveland, Detroit and Indianapolis less than four and a half years to save for a 20 percent down payment. Renters in these markets spend 30 percent or less of their income on housing, making it easier for them to save.

Rising rents aren’t the only thing keeping renters out of the housing market. With home values continuously on the rise, saving for a 20 percent down payment becomes more difficult every month. U.S. home values rose 8 percent over the past year and are forecasted to rise another 6.5 percent over the next 12 months.(ii)

“Aspiring first-time buyers have to balance their current housing needs with their dreams of homeownership before they can think about saving for the future,” said Joshua Clark, economist at HotPads. “Home prices are outpacing incomes in many of the country’s largest markets, which makes saving for a home more difficult. On top of that, the current generation of first-time buyers is dealing with unprecedented levels of student debt, making the down payment a major factor keeping young renters out of the housing market even though many young people say they have ambitions to buy. While some high earners may manage to save more than the recommended 20 percent of their income, or may have the good fortune of windfalls such as family assistance, inheritance, or large bonuses, most young adults struggle to save. Sustained increases in home values and rents suggest that lower down payments may become more popular as first-time buyers continue to be pinched on both sides of the market.”

While most home buyers expect to put 20 percent down on a home, buyers can qualify for loans that require a much smaller down payment. In 2017, about 29 percent of first-time buyers put down between 3 and 9 percent on their home purchase.(iii) Renters who save 20 percent of their monthly income can expect to save enough for a 3.5 percent down payment – the minimum required amount for most FHA loans — on the median home in a year and two months.

HotPads is a Zillow® Group-owned apartment and home search platform for renters in urban areas across the United States. For more information on the U.S. rental market, visit HotPads.com.

HotPads

HotPads is an efficient rental search platform for urban areas across the United States, with features designed for competitive markets such as map-based search, real-time notifications and detailed information on landlords and property managers that help renters spend less time searching and more time feeling excited about their next home.

Launched in 2005, HotPads is based in San Francisco and is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG).

HotPads is a registered trademark of Zillow, Inc.

(i) HotPads analyzed median rents, median home values and median incomes to determine how long renters can expect to spend saving for a down payment. This analysis assumes renters save 20 percent of the median monthly income each month for a down payment.

(ii) Zillow Real Estate Market Reports, May 2018

(iii) Zillow Group Report on Consumer Housing Trends, 2017. https://www.zillow.com/report/2017/buyers/money-financing/

(iv) Zillow Real Estate Market Reports, May 2018

(v) Income data from the U.S. Census Bureau