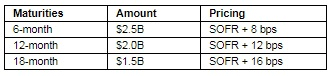

Washington, D.C. – July 26, 2018 (PRNewswire) Fannie Mae today issued the market’s first-ever Secured Overnight Financing Rate (SOFR) securities. The three-tranche $6 billion SOFR debt transaction is scheduled to settle on July 30, 2018.

“We are proud to lead the market in issuing this landmark transaction. With this milestone, our objective is to accelerate the development of the SOFR market and we encourage other issuers in the debt markets to follow,” said Nadine Bates, Senior Vice President and Treasurer of Fannie Mae. “As a member of the Federal Reserve’s Alternative Reference Rate Committee, we are honored to demonstrate our support to the ARRC in its tremendous efforts to help develop an alternative to USD LIBOR.”

The floating rate notes, offered in three maturities, were met with strong investor demand from a broad and diverse investor base.

Barclays Capital Inc., Nomura Securities International, Inc., and TD Securities USA are the lead managers on this inaugural transaction.

This press release does not constitute an offer to sell or the solicitation of an offer to buy securities of Fannie Mae. Nothing in this press release constitutes advice on the merits of buying or selling a particular investment. Any investment decision as to any purchase of securities referred to herein must be made solely on the basis of information contained in Fannie Mae’s applicable Offering Circular, and no reliance may be placed on the completeness or accuracy of the information contained in this press release.

You should not deal in securities unless you understand their nature and the extent of your exposure to risk. You should be satisfied that they are suitable for you in light of your circumstances and financial position. If you are in any doubt you should consult an appropriately qualified financial advisor.

Fannie Mae helps make the 30-year fixed-rate mortgage and affordable rental housing possible for millions of Americans. We partner with lenders to create housing opportunities for families across the country. We are driving positive changes in housing finance to make the home buying process easier, while reducing costs and risk. To learn more, visit fanniemae.com and follow us on twitter.com/fanniemae.