Low credit scores and high delinquency rates are key themes among millennials without a mortgage

Costa Mesa, CA – Aug. 23, 2018 (PRNewswire) Experian®, the world’s leading information services company, released a study today that highlights the borrowing behaviors of millennials, the largest credit population in the United States. The study revealed only 39 percent of millennials without a mortgage have a prime or better score and the majority are facing higher delinquency rates.

“This data presents good news for younger, thin file millennials interested in buying a home. We’re seeing that small changes in financial behaviors such as building a history of on time payments and improved credit practices can help lenders shift from viewing millennials as high-risk to low-risk relatively quickly,” said Michele Raneri vice president analytics and business development at Experian. “Knowing where you stand from a credit perspective is critical to improving or maintaining your financial well-being.”

To better understand the borrowing behaviors of the next big wave of homebuyers, Experian looked at personal loan trends, credit scores, bankcard behaviors and mortgage trends of 60 million millennial consumers.

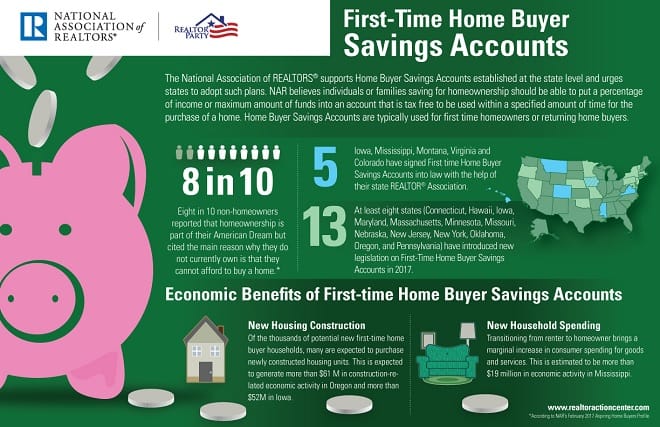

According to a recent study from the National Association of Realtors, 86 percent of millennials believe that buying a house is a good financial investment, yet Experian’s research shows only 15 percent have a mortgage today. In addition, with 61 percent of millennials near prime or worse, many will need to improve personal loan and bankcard usage habits to obtain lower rates when they’re ready to secure a mortgage.

“Often, young people start their credit journey with a couple of mistakes first, but in the end, these mistakes create opportunities to learn how to use and build credit responsibly,” said Rod Griffin, director of consumer education and awareness at Experian. “We believe everyone deserves access to quality credit and homeownership. This study presents clear areas of opportunity for millennials as they age and prepare to enter the mortgage market.”

Key study findings

- In the U.S., the average consumer VantageScore® is 677 and credit scores generally become more prime (661-780) as people age. Younger millennials (age 22-28) have an average near prime score of 652 with older millennials (age 29-35) at the prime score of 665.

- Millennials without a mortgage have an average age of 28, income of $33,000, 623 VantageScore and eight trades on file. Of them, 39 percent are viewed as prime or better (661 or higher).

- Personal loan originations are dominated by older generations. Over the last four years, millennials account for 21 percent of all new personal loan dollars with a 40 percent increase in balances since 2011.

- Younger millennials have an average per loan balance of approximately $7,300 while older millennials have an average balance of approximately $11,700.

- Nationally, delinquency rates on personal loans are on the decline at 1.32 percent. Millennial delinquency rates as of 4Q17 stand at 2.08 percent for younger millennials and 1.51 percent for older millennials.

- As of the fourth quarter in 2017, millennials account for 20 percent of new bankcard dollars. On average, younger millennials carry a balance of just under $3,000 with older millennials carrying approximately $7,500. Millennial bankcard delinquency rates are higher than the U.S. average of 1.54 percent at 2.33 percent for younger millennials and 2.18 percent for older millennials.

Today’s millennial homebuyer

In the last quarter of 2017, millennials accounted for 23 percent of newly originated mortgage dollars. On average, millennial homebuyers are 31 years old with an income of $64,000. The average mortgage balance for younger millennials is $167,000 and $210,000 for older millennials.

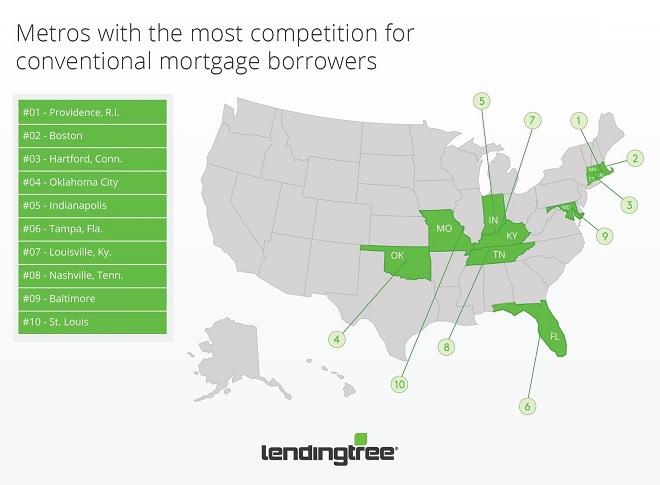

When it comes to credit scores, 77 percent of millennials with a mortgage have a 661 VantageScore or greater with an average score of 716 and 16 trades on file. Geographically, millennial homebuyers are most prevalent in the south and west regions where three-four percent of the millennial population have a mortgage.

About Experian

Experian is the world’s leading global information services company. During life’s big moments – from buying a home or a car, to sending a child to college, to growing a business by connecting with new customers – we empower consumers and our clients to manage their data with confidence. We help individuals to take financial control and access financial services, businesses to make smarter decisions and thrive, lenders to lend more responsibly, and organizations to prevent identity fraud and crime.

We have 16,500 people operating across 39 countries and every day we’re investing in new technologies, talented people and innovation to help all our clients maximize every opportunity. We are listed on the London Stock Exchange (EXPN) and are a constituent of the FTSE 100 Index.

Learn more at www.experianplc.com or visit our global content hub at our global news blog for the latest news and insights from the Group.

Media Contact:

Amanda Irving

Experian Public Relations

(714) 830 – 7923

Amanda.irving@experian.com