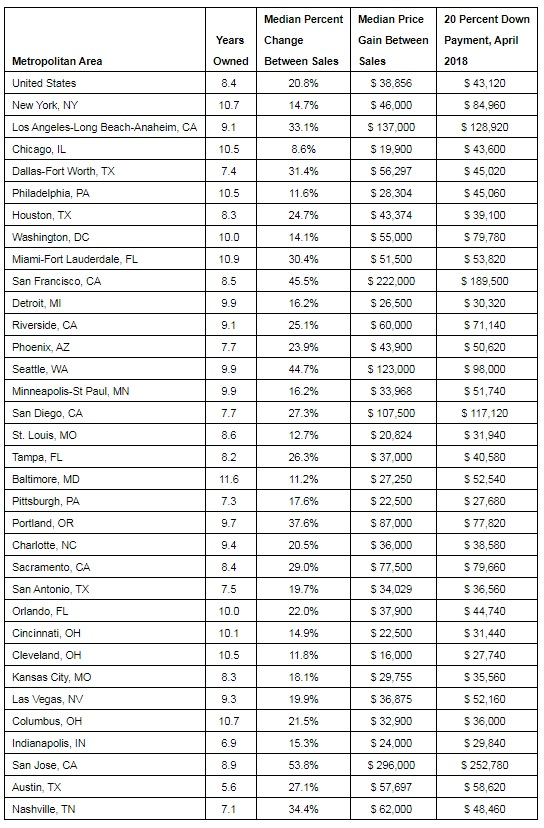

– Home sellers in San Jose sold their homes for 54 percent more than they paid, for a median gain of $296,000

– Nationally, home sellers in 2017 made about $39,000 after owning their homes for eight and a half years. That’s a profit of about 21 percent.

– San Jose, where sellers are making the biggest profits, is seeing the fastest home value appreciation and the biggest declines in inventory.

– Most sellers are also trying to buy another home at the same time they are selling.

Seattle, WA – June 26, 2018 (PRNewswire) Through 2017, the West Coast saw some of the biggest home value increases over the past decade, and home sellers are seeing big profits as a result.

Nationally, home sellers last year made nearly $39,000, or 21 percent, when compared with what they originally paid for the home, according to a Zillow® analysis(i). The typical seller had lived in their home for 8.4 years before selling it.

In San Jose, Calif., the typical home sold in 2017 earned the sellers 54 percent more than they originally paid for it nine years earlier, the highest profits of the metros analyzed. In the San Jose and San Francisco metros, sellers made more than the median value of a typical U.S. home.

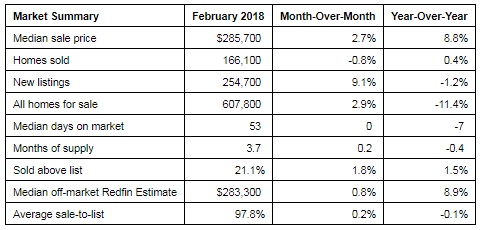

A short supply of homes for sale has kept upward pressure on home prices, especially in markets where available homes are hardest to find. The profits are welcome news for home sellers who are able to cash in on higher home prices, but demonstrate how difficult the market is for buyers. It is increasingly common for homes to sell for more than the listed price – in 2017, nearly a quarter of all homes sold for more than the asking price, up from 18 percent in 2012(ii).

“In a housing market that’s been plagued by low inventory and increasing demand, homeowners in the nation’s hottest markets have been able to cash in when they sell their homes,” said Zillow Senior Economist Aaron Terrazas. “A home is typically the biggest investment someone makes, and it’s paid off for longtime owners in many markets across the country. Today’s typical seller bought in 2010 – just before the national housing market bottomed out in 2012. Of course, these sellers typically are buyers as well, but the profits from the sale of their former home give them an advantage over first-time buyers who may be coming in with smaller down payments.”

Nashville sellers sold their homes for a median of 34 percent more than they paid for it, the fifth highest percent gain among the markets Zillow analyzed. They made these profits faster than markets where home sellers saw larger returns – sellers in markets that saw bigger gains than Nashville sellers had owned their homes for at least a year longer before selling.

Most sellers – 71 percent – are simultaneously trying to buy their next home(iii). In 25 of the markets analyzed, the profits sellers made are not enough for a 20 percent down payment on the median home in that same area. Sellers only made enough to cover a down payment in places where they saw the biggest percent gains on the sale.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with great real estate professionals. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow Group’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

(i) This analysis only looked at homes that were sold by individual sellers in 2017, and didn’t sell twice within a 60 day period. Only markets with at least 100 transactions were included.

(ii) https://www.zillow.com/research/home-sales-above-list-price-17875/

(iii) https://www.zillow.com/report/2017/sellers/typical-american-home-seller/

Like this:

Like Loading...