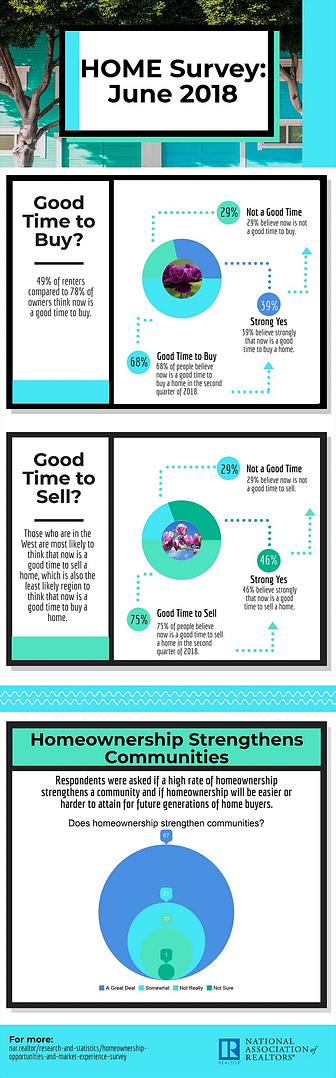

Washington, D.C. – June 21, 2018 (nar.realtor) New findings from the National Association of Realtors® show that a high number of Americans, 75 percent, believe that now is a good time to sell a house, while 68 percent think it is a good time to buy.

That’s according to NAR’s second quarter Housing Opportunities and Market Experience (HOME) survey(1), which also found that a majority of consumers believe prices have and will continue to increase and that homeownership strengthens our nation’s communities.

Optimism that now is a good time to buy remains stagnant from last quarter; 39 percent strongly agree that now is a good time to buy, while 29 percent moderately agree. Among renters, however, those positive feelings have fallen significantly from 55 percent in the first quarter to 49 percent this quarter. Optimism is highest among older buyers (65 or over) and those living in the South and Midwest regions (73 and 71 percent respectively).

NAR Chief Economist Lawrence Yun says affordability and low inventory are eroding buyer confidence. “Inventory remains the driving force in real estate, affecting everything for rising prices to household formation. Improving supply conditions is critical to improving buyer optimism and helping to remove some of the barriers holding back potential first-time buyers.”

As home prices continue to climb across the country, the number of respondents who believe now is a good time to sell remains high with 46 percent strongly agreeing (up from 42 percent last quarter) and 29 percent moderately agreeing. Twenty-nine percent believe that now is not a good time to sell a home, and that drops to 19 percent for current homeowners.

“Hopefully this strong seller optimism will lead to an increase in inventory later on in the year,” said Yun.

Respondents were also asked about their perception of home prices in their communities. Sixty-eight percent believe that home prices have gone up in their area in the last 12 months, up from 63 percent last quarter. Fifty-five percent also believe that home prices will continue to increase in their communities in the next six months, also up from the previous quarter (53 percent).

A near high of 58 percent of households believe that the economy is improving – slightly down from 60 percent last quarter but up from 54 percent last year. People in rural areas are more likely to view the economy as improving (63 percent) than in urban areas (51 percent).

The HOME survey’s monthly Personal Financial Outlook Index(2), showing respondents’ confidence that their financial situation will be better in six months, dropped slightly from 63.8 in March to 62.1 in June. A year ago, the index was 57.2.

Forty-six percent of those surveyed say they do not believe it would be difficult to obtain a mortgage, up from 36 percent last quarter. “This is most likely a reflection of the current positive outlook on the direction of the economy,” said Yun. “Healthy job creation and faster wage growth mean that homeownership is viewed as a more attainable goal than it was a year ago.”

Homeownership’s effect on communities, future generations

In this quarter’s survey, homeowners and non-homeowners were asked if a high rate of homeownership strengthens a community. Sixty-seven percent of those surveyed said that homeownership strengthens communities a great deal, and that number jumps to 76 percent for current homeowners and 77 percent for those 65 and older.

“Homeowners are more likely to be involved and engaged in the issues facing their communities, since they tend to be more rooted in the area than renters,” said NAR President Elizabeth Mendenhall, a sixth-generation Realtor® from Columbia, Missouri and CEO of RE/MAX Boone Realty. “This involvement – homeowners are more likely than renters to vote, volunteer their time at local charities and support neighborhood upkeep – helps shape and strengthen our nation’s communities, as well as drive the national economy.”

Respondents were also asked if homeownership will be easier or harder to attain for future generations. Seventy-three percent believe that it will be harder for future generations to purchase a home, compared to only 11 percent who think it will be easier. Seventy-four percent of respondents 34 or under believe it will be more difficult to become homeowners.

About NAR’s HOME survey

In April through June, a sample of U.S. households was surveyed via random-digit dial, including a mix of cell phones and land lines. The survey was conducted by an established survey research firm, TechnoMetrica Market Intelligence. Each month approximately 900 qualified households responded to the survey. The data was compiled for this report and a total of 2,707 household responses are represented.

The National Association of Realtors® is America’s largest trade association, representing 1.3 million members involved in all aspects of the residential and commercial real estate industries.

# # #

1. NAR’s Housing Opportunities and Market Experience (HOME) survey tracks topical real estate trends, including current renters and homeowners’ views and aspirations regarding homeownership, whether or not it’s a good time to buy or sell a home, and expectations and experiences in the mortgage market. New questions are added to the survey each quarter to reflect timely topics impacting real estate. HOME survey data is collected on a monthly basis and will be reported each quarter. New questions will be added to the survey each quarter to reflect timely topics impacting the real estate marketplace.

2. Index ranges between 0 and 100: 0 = all respondents believe their personal financial situation will be worse in 6 months; 50 = all respondents believe their personal financial situation will be about the same in 6 months; 100 = all respondents believe their personal situation will be better in 6 months.