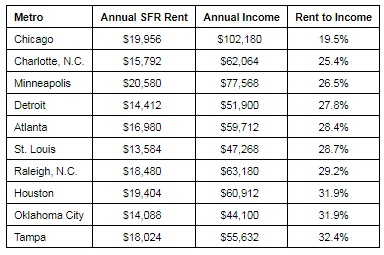

Irvine, CA – Jan. 23, 2018 (PRNewswire) HomeUnion, a leading online real estate investment and management firm, has released a list of the most and least affordable rental housing markets in the U.S.. Chicago tops the list as the most affordable metro, while Oakland, Calif., is the most expensive rental market, based on rent-to-income ratios.

“With its low cost of living, relatively large housing inventory levels and high affordability, Chicago is an excellent market for residents entering the renting pool,” explains Steve Hovland, director of research for HomeUnion. It’s is the only metro in the country where typical renters spend less than 20 percent of their annual income on housing. Emerging neighborhoods like Logan Square and other West Side locations have become increasingly popular areas for young professionals, making Chicago an excellent choice for millennials.

The second location on HomeUnion’s list – Charlotte, N.C. – also has a low cost of living and high affordability, with average annual rents of under $16,000. “About one-quarter of the average income of a typical Charlotte resident goes to rental housing, making it appealing to millennials as well,” notes Hovland.

Here’s a list of the 10 most affordable rental markets in the nation:

Here’s a list of the 10 most expensive rental markets in the nation:

Sources: HomeUnion Research Services, MPF Research, a division of RealPage

“Low affordability negatively impacts all renters in the Bay Area, Denver, Southern California and Washington, D.C., because of strong local job market conditions, intense demand for rental properties, and high mortgage costs for owner-occupied housing,” Hovland says.

Established and mature markets, such as Cincinnati and Cleveland, where home prices remain affordable, negatively impact renters’ wallets. “A significant number of potential young renters are migrating out of Ohio to Chicago or booming western metros such as Denver, the Bay Area and Los Angeles, leaving mostly low-wage earners to occupy rentals,” Hovland concludes.

For more information on metro-level rents, visit Where a Landlord Can Find High Annual Returns on HomeUnion.com.

About HomeUnion

HomeUnion is a leading online residential real estate investment firm that provides individuals with all the services needed to invest remotely in both wholly-owned and crowdfunded real estate using a combination of big data, proprietary analytics and local market expertise. Based in Irvine, Calif., the firm currently operates in six markets nationwide.

Like this:

Like Loading...