– Ten of the top 20 and seven of the top 10 fastest-growing buyer first names are predominantly millennial female names

– Home deeds with predominantly millennial first names grew 5.3 percent year-over-year

– Home sales associated with traditionally Hispanic first names increased 4.1 percent year-over-year

Santa Clara, CA – Jan. 9, 2019 (PRNewswire) The future of real estate will be significantly influenced by women, millennials and Hispanics, according to realtor.com®’s analysis of first names on 2018 home sales deeds.

![]()

Single women are one of the fastest-growing demographics in the housing market, according to the data. Although older Baby Boomer and Silent Generation women are leading the charge, the increase in deeds with female names is particularly visible when comparing genders within the millennial generation. Looking solely at names with a peak year between 1981 and 1997, millennial female names are outpacing millennial male names, with home sales with female names beating male name home sales by 1.5 percent (6.9 percent versus 4.4 percent on average year-over-year, respectively). Seven of the top 10 fastest growing buyer names are predominately millennial female names, and all of them peak in the 1980s and 1990s.

Overall, Hannah, Austin, Alexis, Logan, and Taylor — of which three are predominantly female names — were the top five fastest growing first names on home sales deeds in 2018, with their frequency seeing an average increase of 22 percent from 2017. While Michael, John, David, James, and Robert were still the top five first names on sale deeds by sheer volume, these names saw a 3 to 5 percent decline over 2017.

“First names associated with women — especially millennial women — saw a significantly faster level of home sales growth in 2018, giving us a sneak peek of homeownership trends in 2019,” said Javier Vivas, director of economics research at realtor.com®. “Hispanics and millennials names overall also saw a surge in home purchases last year. If these buyers can continue to break through the affordability barrier, they are likely to make up a larger share of owners than ever before and dominate the market for years to come.”

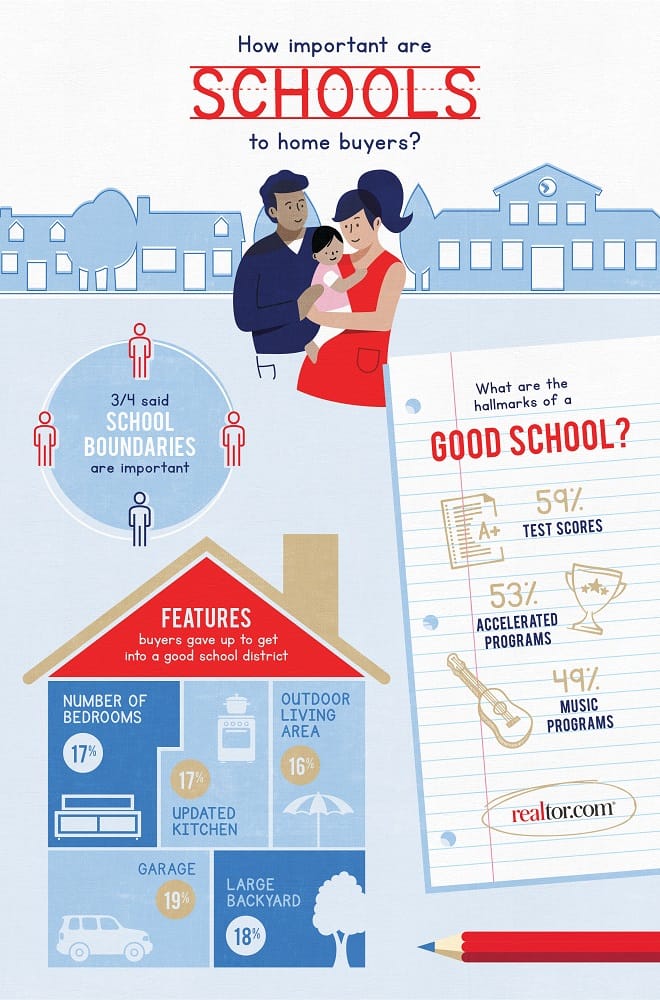

Back-To-School Infographic (PRNewsfoto/realtor.com)

Millennials are NOT the rent generation

In 2018, home sales with millennial names(1) increased 5.3 percent, followed by Gen X names at 0.8 percent. Names of Boomers (born 1946 to 1964) and the Silent Generation (born before 1945) fell 2 percent and 3.5 percent, respectively.

Geographically, millennial buyer names are particularly overrepresented in Kansas, Indiana, Louisiana, Missouri, and Utah – states where housing affordability remains above national levels – confirming that jobs and availability of entry level homes act as magnets for young buyers.

The rise of Hispanic influence

Deed data also shows a growth in Hispanic names. In 2018, home sales associated with traditionally Hispanic names and partially Hispanic names increased 4.1 percent and 3.7 percent, respectively year-over-year. While sales with non-Hispanic names remained virtually flat at 0.1 percent year-over-year.

Notably, 26 of the top 100 fastest-growing names are traditionally of Hispanic origin. Within this category, Hispanic buyer names skew slightly older than their non-Hispanic counterparts, with a median birth year of 1979 and 1982 respectively.

Geographically, Hispanic buyer names are naturally concentrated in the South and Southwest. California, Texas, Nevada, New Mexico, and Arizona are among the top states, unsurprising given their proximity to Central America. On the East Coast, sales to buyers with Hispanic names are overrepresented in Florida, Illinois, and New Jersey, where demand for homes from domestic and international buyers of South American and Caribbean origin tends to be concentrated.

Methodology

This analysis looks at all arms-length, residential non-corporate transactions for the period of January through September 2018. Sales for 2017 are also analyzed to enable year-over-year comparisons.

Realtor.com® compared name demographic data from the Social Security Administration to deed record buyer information to understand how younger age groups are expanding their influence in the housing market. For example, the data showed that half of Hannahs were born before 1993, and 80 percent of them between 1987 and 1997, thus giving Hannah a high likelihood of being a millennial buyer. Millennial names are identified as those peaking between 1981 and 1997, Gen-X names between 1965 and 1980, Boomer names between 1946 and 1964 and Silent names before 1946.

Buyer names are identified by parsing the first name from the primary name on the deed record at the time of the transfer of ownership. Middle names and last names are not parsed. In cases when the deed has more than one buyer name recorded, the information is used to identify multi-name deeds but non-primary names are not parsed. Some limitations include home buyers not always going by their first name and not all names listed as primary are necessarily being heads of the household.

For more details on methodology, visit www.realtor.com.

About realtor.com®

Realtor.com®, The Home of Home Search℠, offers an extensive inventory of for-sale and rental listings, and access to information, tools and professional expertise that help people move confidently through every step of their home journey. It pioneered the world of digital real estate 20 years ago, and today is the trusted resource for home buyers, sellers and dreamers by making all things home simple, efficient and enjoyable. Realtor.com® is operated by News Corp [NASDAQ: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. under a perpetual license from the National Association of REALTORS®. For more information, visit realtor.com®.

1. The birth year for all five fastest-growing primary buyer names peaked in the early 1990s, with an estimated median year of 1993. All but one of the top 20 fastest-growing names peaked between the 1980s and 1990’s, with an estimated median year of 1989. The one exception is Victoria, a timeless name that peaked once in the 1950s and again in the early 1990s.

Media Contact:

Lexie Puckett

Lexie.Puckett@move.com