As National Homeownership Month Approaches, Survey Shows Which Neighborhood Vibes Appeal Most to Today’s Home Buyers

Sandy, UT – May 31, 2018 (PRNewswire) Where one lives is more than just a house, it reflects a lifestyle that’s important to the homeowner. But is America’s preferred neighborhood vibe still “Leave It to Beaver”: a three-bedroom house with a white picket fence? Not necessarily, according to a new independent survey from Ally Home of more than 2,000 U.S. adults. Released in tandem with the start of June’s National Homeownership Month, the survey asked respondents how important a neighborhood “vibe” is when choosing a home and which vibe they liked best.

Location + Character

Most people know the old adage about the “three most important things when it comes to real estate are location, location, location.” But picking a neighborhood goes beyond considering merely a pinpoint on a map or certain attributes such as median home price. It encompasses a look and feel, or vibe. In this latest survey from Ally Home, the majority of respondents believe a neighborhood’s vibe is a critical component of calling somewhere home:

- Almost nine in 10 Americans surveyed (88%) say the vibe of a neighborhood is important in deciding where to live, with half of those respondents (49%) saying it is very important.

- Four in five U.S. adults (80%) say their neighborhood has to fit their personality. In fact, more than four in five (82%) say if they didn’t like their neighborhood, they would consider moving.

- Nearly three-quarters (73%) of respondents also said they would be willing to settle for a smaller house and/or pay a little more for a house in their perfect neighborhood.

“Our survey reminds us that where you live remains just as important a consideration as the house you live in,” said Diane Morais, president of Consumer & Commercial Banking Products at Ally Bank. “The home buying process can feel overwhelming at times, and it can be easy to lose sight of the important factors. If consumers think ahead of time about the characteristics that make up their ideal neighborhood – whether it’s an area with a close-knit community, a place that’s walkable to stores or restaurants, or even a neighborhood that is guaranteed strong cell phone coverage, it can help them target which neighborhoods would be the best fit for them and put them in a stronger position to find that perfect home.”

Majority of Americans Prefer the “Quiet and Quaint” or “Modern Millennial” Vibe

- More than one-third of Americans (36%) want that “Quiet and Quaint” life similar to the neighborhood depicted in the popular TV show “This Is Us”: one with curb appeal, lots of friendly people, and less of a concern to lock the doors.

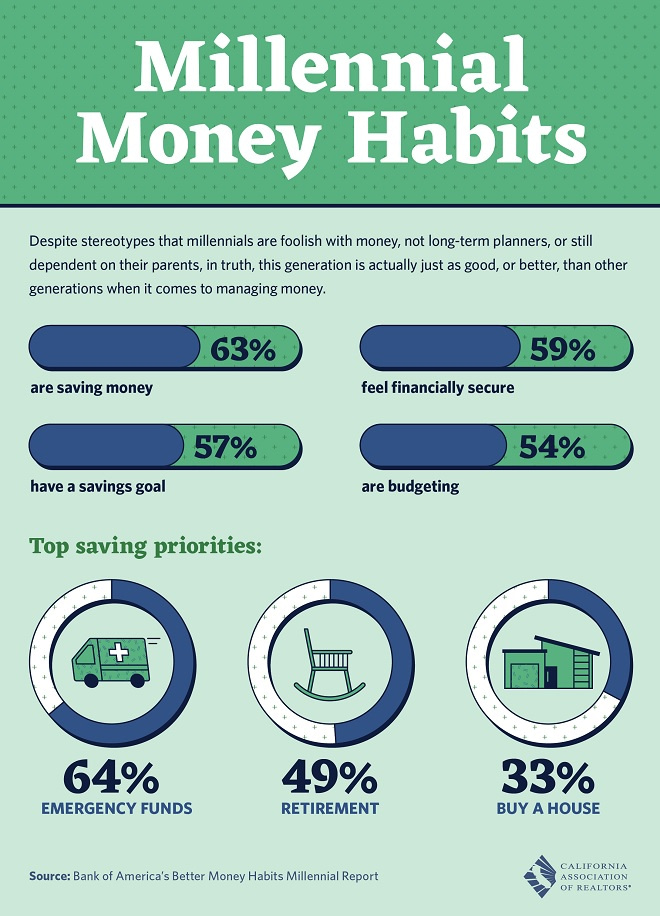

- The rising participation of millennials in the home buying market was reflected by nearly three in 10 (28%) survey respondents identifying with more of a “Modern Millennials” vibe: they prefer a neighborhood where they can walk to everything, with reasonably priced bars, restaurants, and coffee shops nearby. Click here to see an infographic of additional millennial homebuyer data points.

- Ample outdoor space is important to one-quarter of Americans (25%) who value being close to organic farms, farmers’ markets and hiking trails, while 21% prefer a “Family Centric” neighborhood where families live in close proximity to one another and are close to schools and playgrounds.

- Less important neighborhood characteristics included cultural attractions (15% of respondents); a tech-friendly neighborhood with good cell phone coverage and electric vehicle chargers (12% of respondents); or an up-scale urban setting (9% of respondents).

The survey also detailed age and gender differences when it comes to considering the neighborhood vibe: 58% of respondents between 30-39 say a neighborhood vibe is very important to them in deciding where to live compared to those 18-29 (49%), 40-54 (49%) and 55-older (42%). Women were also more likely than men to say the vibe of a neighborhood is important to very important to them (91% vs. 85%).

In addition to the survey, Ally Home asked consumers about their neighborhood preferences. Click here to see what they had to say.

To discover the Neighborhood Vibe that suits you best, visit the Ally Community to take the quiz.

Survey Methodology: This online survey was conducted by Regina Corso Consulting on behalf of Ally Home between March 22 and 26, 2018 among 2,062 U.S. adults, aged 18 and older. Figures for age, gender, education, income, employment and region were weighted to bring them into line with their actual proportions in the population. Because the sample is based on those who agreed to participate, no estimates of sampling error can be calculated.

About Ally Financial Inc.

Ally Financial Inc. (NYSE: ALLY) is a leading digital financial services company with assets of $170.0 billion as of March 31, 2018. As a client-centric company with passionate customer service and innovative financial solutions, Ally is relentlessly focused on “Doing it Right” and being a trusted financial partner for its consumer, commercial, and corporate customers. Ally’s award-winning online bank (Ally Bank, Member FDIC and Equal Housing Lender) offers mortgage-lending services and a variety of deposit and other banking products, including CDs, online savings, money market and checking accounts, and IRA products. Ally also promotes the Ally CashBack Credit Card. Additionally, Ally offers securities brokerage and investment advisory services through Ally Invest. Ally remains one of the largest full-service auto finance operations in the country with a complementary auto-focused insurance business, which together serve more than 18,000 dealer customers and millions of auto consumers. Ally’s robust corporate finance business offers capital for equity sponsors and middle-market companies.

For more information and disclosures about Ally, visit https://www.ally.com/#disclosures.

Media Contacts:

Andrea Puchalsky at Ally

(313) 656-3798

Andrea.Puchalsky@ally.com

Kathy Wilson at Tier One Partners

(781) 652-0499

kwilson@tieronepr.com