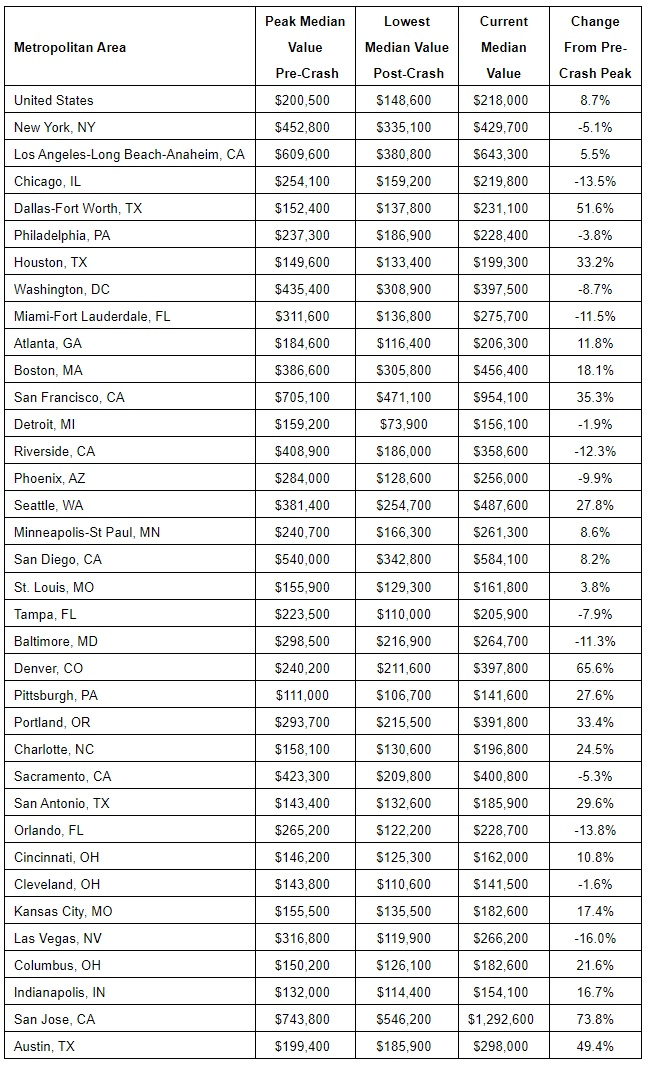

– A Handful of Powerful Markets Lead the Nation’s Recovery, But Millions of Homeowners Are Still Waiting to Regain Lost Value

– The median home value nationwide is 8.7 percent higher than it was at the height of the housing bubble.

– Twenty-one of the top 35 metros have more than recovered from the bust. San Jose and Denver lead the recovery with huge gains, while Las Vegas, Orlando and Chicago have been the slowest to recover.

– Nationwide, home values now are nearly equal to what they would have been had values continued along the pre-bubble trend without a bubble or bust.

Seattle, WA – Sept. 13, 2018 (PRNewswire) A decade after the collapse of the housing market and start of the Great Recession, home values have more than recovered in most of the nation’s largest markets, a Zillow® analysis shows. The markets with the highest gains above the mid-2000s bubble are primarily in the West and Southwest.

San Jose – the nation’s most expensive metro – leads the way with a current median home value of $1.29 million, 74 percent higher than the top of the bubble and more than double its post-crash low. Denver follows with its median value of $397,800 representing a 66 percent increase from the bubble’s peak, though, unlike other parts of the country, Denver never experienced a rapid run-up of prices during the bubble years. In all, home values in 21 of the nation’s largest 35 markets are higher than their pre-recession peaks.

But plenty of markets are still struggling to recover their lost value. Homes in Las Vegas, which have seen some of the steepest gains in the country over the past year, remain 16 percent below their pre-bust median value. Orlando and Chicago home values remain nearly 14 percent below.

September 15 marks the 10th anniversary of the collapse of Lehman Brothers, generally considered the start of the Great Recessioni. By the end of 2011 home values nationwide had dropped 17 percent, and close to a third of homeowners were underwater in their mortgages. Millions of people lost homes to foreclosure.

Today, median home values nationwide are about 8.7 percent above what they were at the bubble’s peak, and more than half the nation’s homes have regained their lost value. Less than 10 percent of homeowners are underwater on their mortgages, though that number jumps to the mid-teens in markets like Chicago and Baltimore where recovery has been stubbornly slow.

“A decade after the financial crisis it’s clear that, just as the bust was felt very differently across the country, so has the recovery. Looking back, the housing bust was a rare historical moment when housing markets across the country moved in sync,” said Zillow Senior Economist Aaron Terrazas. “While markets like San Jose, San Francisco and Denver have led the country out of the bust and are doing very well – in many cases now dealing with an affordability crisis – plenty of markets continue to bear visible scars from the crash. Homes that still are worth less than they were a decade ago mean more long-term homeowners remain tethered to underwater mortgages, still struggling to regain that lost value. In the markets that have seen the strongest recoveries, a combination of strong job growth, tight supply and low interest rates have pushed home values upward. But in places that continue to struggle, the stimulus of low mortgage rates is quickly turning to a headwind and the window for a full recovery is quickly closing.”

Following the crash, lending tightened significantly and inventory shrank throughout the country. Nationwide, the median home value is now about what it would have been had values continued on the pre-bubble trend without a bubble or bust. Homeownership rates nationally are beginning to climb but are still down more than four percent from 2006.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

(i) According to NBER, the official arbiter of U.S. economic expansions and contractions, the recession started in December 2007, nearly a full year before the Lehman crash. For more information, visit http://www.nber.org/cycles/recessions.html