– Saving for a down payment on the median U.S home takes six years longer for a single person than a couple, according to a new Zillow analysis.

– Less than half of all U.S. homes are affordable for a single homebuyer.

– A single buyer can afford a home up to $176,100, less than the national median home value.

– A married or partnered couple could afford a home worth more than twice as much as a home a single homebuyer could afford.

Seattle, WA – Feb. 9, 2018 (PRNewswire) In today’s highly competitive housing market, finding an affordable home can feel increasingly out of reach, especially for singles.

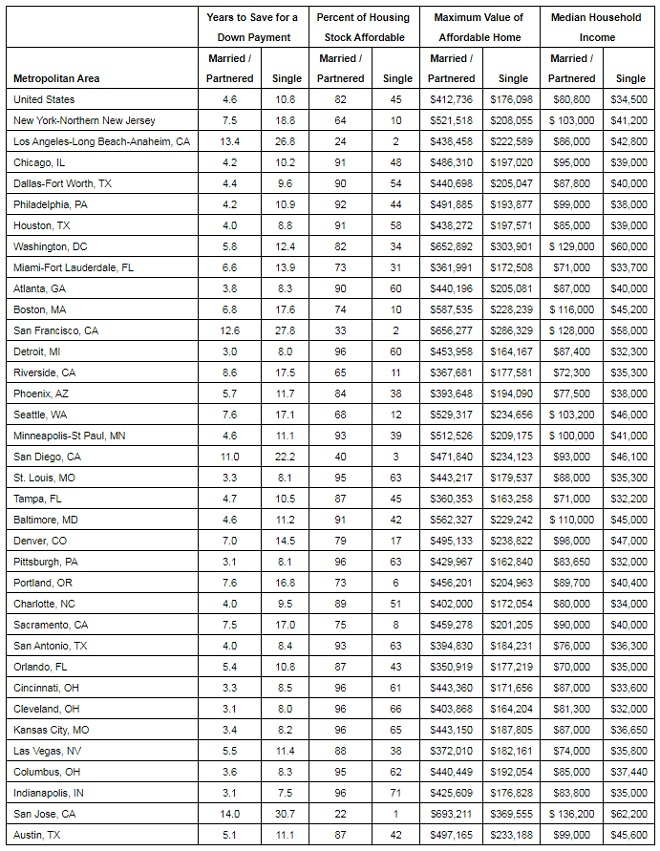

A single homebuyer would need to save for nearly 11 years to reach a 20 percent down payment on the typical U.S. home, according to a new Zillow® analysis. However, for married or partnered couples, it would take less than five years. In San Jose, California, a single buyer would need more than 30 years to save for a down payment – longer than the lifespan of a typical home loan.

Zillow’s analysis combined home values and income data from Census to estimate how long it would take for both an individual and couple to save for a 20 percent down payment on the median-priced home, assuming they saved 10 percent of their income every year.

Single buyers typically have a smaller budget than couples, which leaves them with fewer homes to choose from and limits them to the most in-demand portion of the housing stock. The number of homes for sale is limited across the country, down nearly 11 percent over the past year, and nearly 18 percent for the least expensive homes. A single person could afford to buy less than half (45 percent) of the U.S. housing stock, compared to a married or partnered couple, who could afford 82 percent of all homes.

“Nearly two-thirds of Americans agree that buying a home is a central part of living the American Dream, but for unmarried or un-partnered Americans, that dream is increasingly out of reach,” said Zillow senior economist Aaron Terrazas. “Single buyers typically have more limited budgets, which means they are likely competing for lower-priced homes that are in high demand. Having two incomes allows buyers to compete in higher priced tiers where competition is not as stiff.”

The difference between what a single person could afford compared to a couple is greatest in Portland, Oregon, and Sacramento, California. In Portland, 73 percent of homes are affordable to a couple, but only 6 percent are affordable to a single buyer. For Sacramento buyers, a couple could afford 75 percent of homes while a single homebuyer could afford 8 percent of homes.

Single buyers will have it easiest in Indianapolis, where saving for a down payment takes less than eight years, and they can afford the highest share of homes among the largest American housing markets.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with the best local professionals who can help. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts, and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG), and headquartered in Seattle.