Charlotte, NC – June 27, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released a new analysis of personal loan offers to LendingTree users that found shopping around for personal loans can save consumers 35 percent. The difference in APRs is especially pronounced in personal loans, and LendingTree analysts found a wide variety of APRs offered to the same consumers, representing substantial amounts of money over the course of a loan.

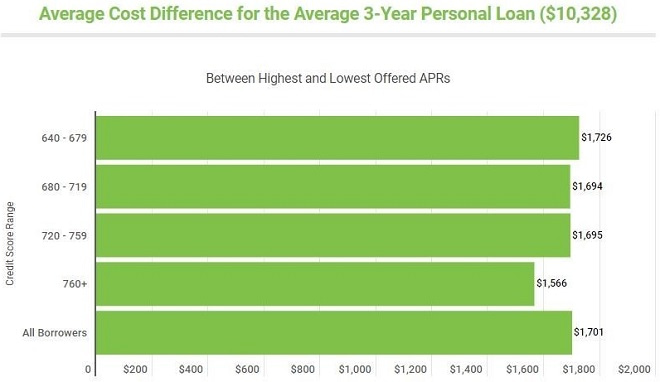

LendingTree’s study found eligible borrowers can save an average of $1,700 ($47 a month) over the course of a three-year personal loan by shopping for a lower rate — potential savings of 35 percent. LendingTree’s analysis assumed borrowers took out a $10,328 personal loan for three years — the average amount sought by borrowers. The differences in cost become more dramatic as the loan amounts and the length of the loan term increase.

“APRs on personal loans tend to run higher than they do for collateralized debt, which may account for the large spread between the lowest and highest offers consumers receive on the LendingTree platform,” explained Kali McFadden, senior research analyst at LendingTree. “The takeaway is quite clear: Consumers can, and absolutely should, bargain hunt for personal loans.”

Analysis findings:

- Eligible borrowers can save an average of $1,700 ($47 a month) over the course of a three-year personal loan by shopping for a lower rate, a difference of 35 percent.

- The range (spread) between the highest APR and lowest APR offered to the average consumer is 8.79 percentage points (879 basis points).

- Consumers with lower credit scores (640 to 679) can save up to an average of $1,726 ($48 a month) — the highest savings of any credit score group in the study.

- The highest APR offers for borrowers with the best credit scores (760 and over) are more than twice as high as the lowest.

Lenders offer a wide range of APRs even to borrowers with excellent credit

People with excellent credit scores may feel they can always get the best rate no matter which lender they choose. But LendingTree’s study found the gap between the lowest and the highest APRs offered to those with excellent credit was just as wide as the gap in rates offered to people with average credit.

A person with a 760+ credit score saw a low rate of 7.55 percent APR and a high rate of more than double that amount — 16.38 percent APR. On a three-year personal loan valued at $10,328 — the average amount sought by borrowers — accepting that high rate could add an additional $1,566.11 to the cost of the loan.

The gap between the lowest and highest APRs offered to borrowers with excellent credit scores was 8.82 percentage points, very close to the 8.55 gap found in rates offered to borrowers with fair credit scores (640-679).

The study found an even wider spread between APRs offered for people toeing the line between good credit and excellent credit. For people with scores between 720 to 759, there was a 9.28 percent gap between the lowest APR and the highest APR offered. Over three years, someone who accepted the higher rate would pay nearly $1,700 in added interest charges on their loan.

Shopping is most important when your credit score is low

When looking for a loan, comparing options is always a good idea, but shopping around for the best APR is crucial when a borrower’s credit score is average.

According to the study findings, those with the lowest credit scores have the smallest difference, 8.55 percentage points, between the average lowest and highest APRs. The lowest average is 24.46 percent, and the highest is 33.01 percent for those with credit scores between 640-679.

However, when looking at the total added costs over the lifetime of a loan, people with fair credit who don’t shop around end up paying more than any other credit band analyzed — up to $1,726.03 more. That’s about $160 more than the additional cost added for those with the highest credit scores.

To view the full report, visit https://www.lendingtree.com/personal/lendingtree-study-shopping-around-for-personal-loans-can-save-consumers-35/.

Methodology:

Average offered APRs and loan amount were calculated for consumers with scores of at least 640 who inquired about a personal loan in May 2018 on the LendingTree platform, where users can receive loan offers from multiple lenders. The loan amount represents the average loan amount received by personal loan borrowers in May 2018 on the LendingTree platform.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

Media Contact:

Megan Greuling

(704) 943-8208

Megan.greuling@lendingtree.com