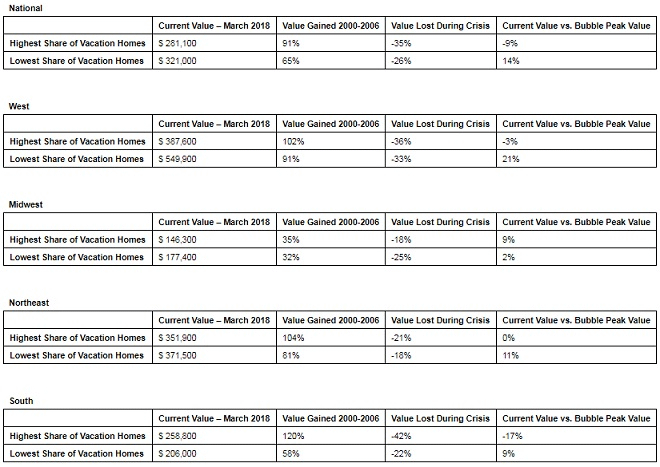

– Markets with the highest concentrations of vacation homes saw a more exaggerated bubble and bust cycle than the rest of the housing market

– Markets with the highest densities of vacation homes remain 9 percent below their pre-crisis peak value, while those where vacation homes are least common are 14 percent above their peak.

– During the housing boom, home values in vacation markets climbed 117 percent, compared to an 83 percent increase in markets with the smallest share of vacation homes.

– Vacation markets have seen slower home-value appreciation than the overall market in all but one year since 2010.

Seattle, WA – June 13, 2018 (PRNewswire) In places where vacation homes are most common, the housing crisis still shows a noticeable effect on the market.

Scattered across the country, vacation home markets(i) experienced a steeper run up in home values during the housing bubble, but also a sharper fall. Vacation home markets gained 117 percent in value between 2000 and 2006, compared with an 83 percent home value increase in places with the smallest share of vacation homes. However, the losses were greater when the housing market crashed, with home values falling 35 percent and 26 percent, respectively.

Along the eastern shore of Hilton Head Island(ii), where 54 percent of homes are vacation homes, the typical home gained 95 percent in value between 2000 and 2006, then lost 41 percent. In comparison, Beaufort County overall gained 67 percent in value, but only fell 36 percent.

In Cape Cod, where 39 percent of homes are vacation homes(iii), the typical home gained 83 percent in value between 2000 and 2006, then lost 19 percent. The state of Massachusetts as a whole only gained 56 percent in value, but also fell 19 percent.

The recovery has also been slower to reach vacation home markets. Since 2010, home value appreciation in these markets has been slower than the rest of the market every year except 2012. Home values grew 0.7 percentage points less in vacation markets in 2017 than they did in the rest of the country.

As a result of this slower home value growth during the recovery, home values in vacation home markets are still 9 percent below the peak reached at the height of the housing bubble. By contrast, markets with the smallest share of vacation homes(iv) are 14 percent more valuable than they were before the recession.

“Vacation home markets have lagged the rest of the country during the economic recovery, despite an exaggerated boom and bust a decade ago,” said Zillow® senior economist Aaron Terrazas. “As the economy improves and more Americans feel secure in their personal finances and primary residences, it is possible that more will look to buy a vacation home. The good news is that there are still bargains to be found in many vacation communities, but recent tax changes will eat into the tax benefits of second-home ownership. Beyond financial considerations, Americans are increasingly conscious of the environmental risks common in many vacation communities, including those from rising sea levels and storm surges, hurricanes and wildfires.”

The Southern and Western regions have the biggest gap between the recovery in vacation markets and the overall housing market. Home values in Southern vacation home markets are still 17 percent below the highest point they reached during the housing bubble, while markets with the smallest share of vacation homes are 9 percent more valuable. In the West, places with the lowest concentration of vacation homes are 21 percent higher than they were during the housing bubble, and vacation home markets are still 3 percent lower than their bubble peak value.

The Midwest is the only region where vacation home markets have recovered better than areas where vacation homes are less common – home values in vacation markets are 9 percent higher than the bubble. In places where vacation homes are least common, home values are 2 percent above their peak levels from the housing bubble.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with great real estate professionals. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow Group’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

(i) Classified as any ZIP code with more than 10 percent of homes whose primary use was “recreational, seasonal or occasional” according to the 2000 Census.

(ii) ZIP code 29928

(iii) https://www.zillow.com/research/places-most-vacation-homes-19835/

(iv) Classified as any ZIP code with less than 5 percent of homes whose primary use was “recreational, seasonal or occasional” according to the 2000 Census.