In the following brief video, from the National Association of REALTORS YouTube channel, NAR reviews its continued commitment to protecting the American dream of homeownership.

In the following brief video, from the National Association of REALTORS YouTube channel, NAR reviews its continued commitment to protecting the American dream of homeownership.

Occupancy remains tight, helped by demand bumps in hurricane-impacted markets

Richardson, TX – January 3rd, 2018 (BUSINESS WIRE) U.S. apartment rents climbed at a moderate pace of 2.5 percent in calendar 2017, according to real estate technology and analytics firm RealPage, Inc. (NASDAQ: RP). Nationally, typical monthly apartment rent is now $1,330.

Effective rents for new leases slipped 0.9 percent during the fourth quarter. Those slight rent cuts late in the year reflect normal seasonality, as slower leasing activity in the colder-weather months can spur housing owners and operators to offer more pricing deals.

“While the apartment rent growth pace has slowed from the performance seen a couple years ago, it’s the longevity of the current cycle that’s so impressive,” said Greg Willett, RealPage’s chief economist. “Rents have climbed substantially for eight consecutive years.”

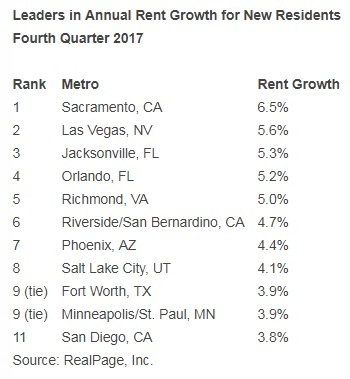

Few local markets are experiencing the price spikes that were common in 2014-2015. Sacramento’s yearly growth is currently the strongest among the country’s bigger metros at 6.5 percent, but the California capital is the only large market posting an increase of more than 6 percent.

Two years ago, more than a dozen big metros registered rent jumps topping 6 percent, with the pace of increase reaching as high as 12 percent in Portland, Oregon, then the country’s rent growth leader. Rents in Portland climbed just 1.9 percent in 2017.

Apartment rents held largely flat during 2017 in several of the nation’s big markets. Rent growth proved minimal at less than 1 percent across Kansas City, Nashville, San Antonio, Pittsburgh, West Palm Beach and Washington, D.C. Prices even dipped a bit in Austin, where average rent slid 0.4 percent.

Occupancy Remains Healthy

National apartment occupancy stands at 95.1 percent at the end of the fourth quarter, unchanged from the year-ago performance.

While year-end occupancy inched down 20 basis points from 95.3 percent in the third quarter, the decline is less than the normal seasonal drop of about 50 basis points that occurs when leasing activity slows as the temperature cools.

That smaller-than-typical seasonal occupancy drop reflected market tightening in a handful of locations where hurricane damage sent displaced households to the apartment stock. In Texas, occupancy jumped 140 basis points on a quarterly basis in the big Houston metro and 220 basis points in the smaller Corpus Christi market. Florida metros, which have received households leaving Puerto Rico, tended to register small occupancy increases in the fourth quarter.

“The country’s apartment market remains tight, with product availability generally limited to recently-completed properties moving through initial leasing,” Willett said. “Unless a renter can afford that expensive new stock, finding a ready-to-lease unit takes some real work in most locations.”

Among the country’s bigger markets, Minneapolis/St. Paul stays atop the occupancy leaderboard, with 97 percent of the existing stock now full.

The Outlook Holds Stable

RealPage market analysts anticipate that 2018’s apartment performance fundamentals will register at levels very similar to the 2017 results. “Minimal shifts in momentum are expected over the coming year,” Willett said. “Apartment demand should stay very solid, but new supply will continue to be delivered at a pace that will keep leasing conditions competitive in the top-tier product niche. In turn, rent growth should remain moderate.”

“The biggest question mark for 2018 may be the construction starts volume,” according to Willett. “At this late stage of the cycle, new building sites are difficult to source, and construction costs have climbed notably. With fewer starts likely in the coming year or so, delivery volumes should fall quite a bit by 2019 and 2020.”

About RealPage

RealPage is a leading global provider of software and data analytics to the real estate industry. Clients use its platform to improve operating performance and increase capital returns. Founded in 1998 and headquartered in Richardson, Texas, RealPage currently serves nearly 12,500 clients worldwide from offices in North America, Europe and Asia. For more information about the company, visit http://www.realpage.com.

Contacts

RealPage, Inc.

Jay Board

(972) 820-4915

jay.board@realpage.com

Are you living an inspired life or are you stuck in that “Eeyore” state of mind?

In this weeks Tom Ferry Show he shows you:

Enjoy!