Community Associations Institute survey results give insight into what’s driving growth and a more than 90 percent property retention rate at top property management company

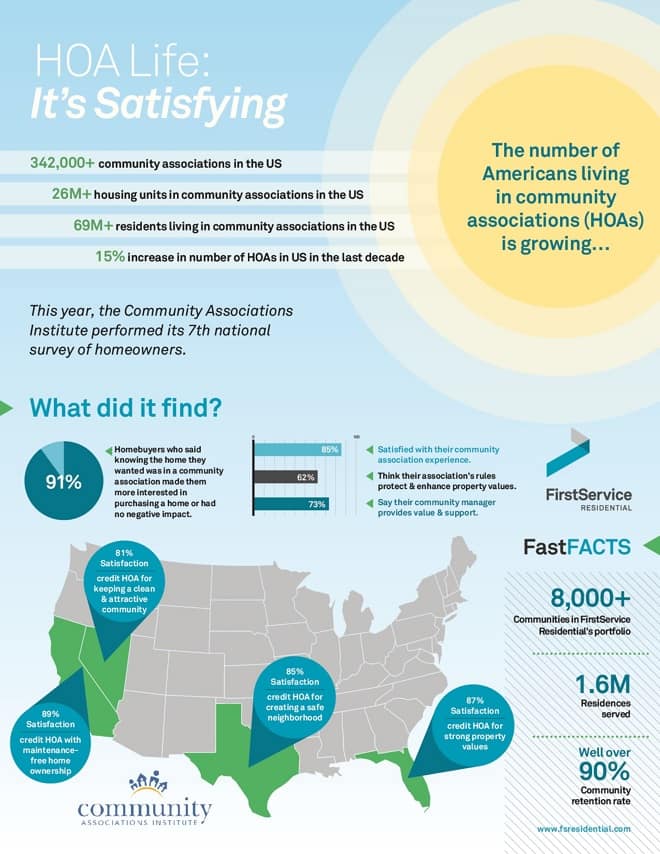

Dania Beach, FL – June 7, 2018 (PRNewswire) Residents of managed communities are happy with their condominium and homeowner associations (HOA) according to the results of the Community Associations Institute’s (CAI) annual homeowner satisfaction survey. Notably, 85 percent of those polled for the 2018 national survey were satisfied with their experience living in a homeowner association. Homebuyers also seem to be seeking out HOA communities. A third of respondents indicated knowing the home they wanted was in a managed community made the property a more desirable purchase.

Conducted biannually since 2005, the CAI survey has consistently shown Americans living in condominium and HOAs are very pleased with their communities. This satisfaction has come amidst a significant period of growth for HOA communities, and the leading property management companies, like FirstService Residential, that manage them. CAI estimates there are now more than 342,000 community associations in North America, representing an almost 15 percent increase over the last decade.

“When FirstService Residential manages a community, we strive to add value and make a difference every day for each resident we serve. It’s gratifying to see that as an industry we’re delivering a positive living experience,” said FirstService Residential CEO Chuck Fallon. “We’re also encouraged to see that CAI’s survey found more than 70 percent of homeowners believe community managers provide a service that enhances their properties.”

The results of CAI’s research also mirror the growth and overall satisfaction of the communities in FirstService Residential’s portfolio of managed properties. The company has had two decades of consistent growth, and currently manages 1.6 million units in more than 8,000 communities across North America. Moreover, by capitalizing on its scale, resources and service excellence culture, FirstService Residential has consistently retained well over 90 percent of its communities.

“Our body of research from thirteen years of studying homeowners’ satisfaction with their community association, along with the incredible growth and retention rates of industry leaders like FirstService Residential, challenges the sometimes negative narrative surrounding HOAs and condominiums,” remarked Thomas M. Skiba, CAE, CAI’s chief executive officer. “Instead, it reveals the reality that homeowners remain pleased with the lifestyle and overall value community associations, and their managers, continue to deliver.”

To learn more about FirstService Residential and its industry-leading customer service, click here.

To learn more about the CAI survey and review this year’s results, visit www.caionline.org.

About FirstService Residential

FirstService Residential is North America’s largest manager of residential communities and the preferred partner of HOAs, community associations and strata corporations in the U.S. and Canada. FirstService Residential’s managed communities include low-, mid- and high-rise condominiums and cooperatives, single-family homes, master-planned, lifestyle and active adult communities, and rental and commercial properties.

With an unmatched combination of deep industry experience, local market expertise and personalized attention, FirstService Residential delivers proven solutions and exceptional service that add value, enhance lifestyles and make a difference, every day, for every resident and community it manages. FirstService Residential is a subsidiary of FirstService Corporation, a North American leader in the property services sector. For more information, visit www.fsresidential.com.

CONTACT:

Michael Radlick

Michael.Radlick@fsresidential.com

(305) 967-6670