New LendingTree study analyzes where and why mortgage shoppers get denied

Charlotte, NC – April 24, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released the findings of its study on the cities with the highest rates of denied mortgage applications and why mortgage shoppers in those areas have been denied.

Since the financial crisis, mortgage lending standards have tightened as underwriting has become more stringent. There are numerous reasons why a lender could deny a loan, from poor credit score to prior bankruptcies, but other reasons can include a lender’s inability to verify a borrower’s employer.

LendingTree delved into data from more than 10 million mortgage applications using the most recent available Home Mortgage Disclosure Act data set to find out the main reasons would-be borrowers were rejected, and to see if location has any correlation for rejection.

Given the dominance of credit history and debt-to-income as the leading reasons for denial across cities, LendingTree also looked at which factors appeared as disproportionately significant and calculated the denial reason in each city that was furthest from the national average.

Key findings:

- Nearly one in 10 borrowers get denied for mortgages. On a national level, 8 percent of loan applications were denied.

- Credit history and debt are the biggest barriers. The leading reasons for denial were credit history (which includes credit score) and debt-to-income ratio, which were each responsible for 26 percent of denied loans. These were followed by collateral at 17 percent and incomplete applications at 14 percent. All other reasons for denial were cited in less than 10 percent of denied mortgage applications.

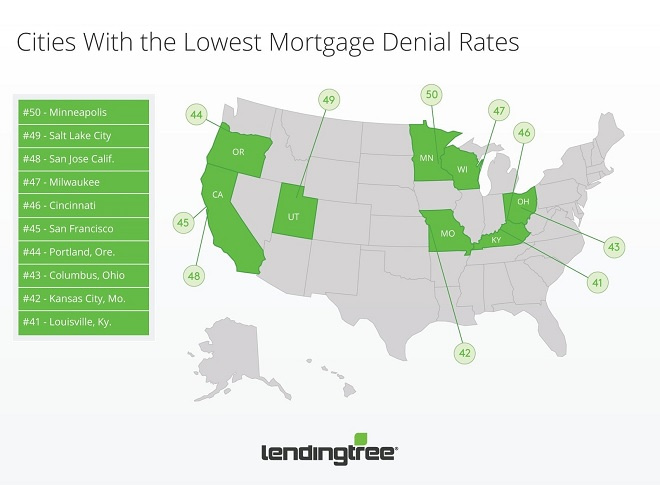

- Debt is a huge barrier to borrowers living in California. Three California cities (Los Angeles, San Francisco, San Jose) had the highest share of borrowers who were denied because of their debt-to-income ratio.

- Credit history is holding borrowers back in Louisville, Ky., Memphis, Tenn. and Philadelphia. Among failed applications in these three metros, LendingTree found the highest rates of denied borrowers due to their credit history.

The 5 leading causes of mortgage denials

The share of mortgage application denials that can be attributed to these reasons:

1. Credit history (which includes credit score): 26%

2. Debt-to-income ratio: 26%

3. Collateral: 17%

4. Incomplete applications: 14%.

5. Other (length of residence, temporary residence): 10%

“The current housing market is particularly competitive,” says LendingTree Chief Economist Tendayi Kapfidze, who led the study. “It’s not unlikely for borrowers to be priced out of a particular housing market based on increasing home prices. The key for homebuyers is to become well-educated on the homebuying process as well as their own financial situations so that there are no surprises once they enter the market. Understanding the key reasons why mortgages are denied can help borrowers avoid missteps, prepare in advance and compete effectively to secure their dream home.”

For more information on the study, visit: lendingtree.com

Methodology

LendingTree analyzed over 10 million mortgage application records from the Federal Financial Institutions Examination Council’s Home Mortgage Disclosure Act 2017 data set, the most recent available, which includes mortgage applications made during 2016. The data represents mortgage applications from over 6,000 financial institutions. https://www.ffiec.gov/hmda/history.htm

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

Media Contact:

Megan Greuling

(704) 943-8208

Megan.greuling@lendingtree.com