New LendingTree report ranks metropolitan areas by the average age of homeowners

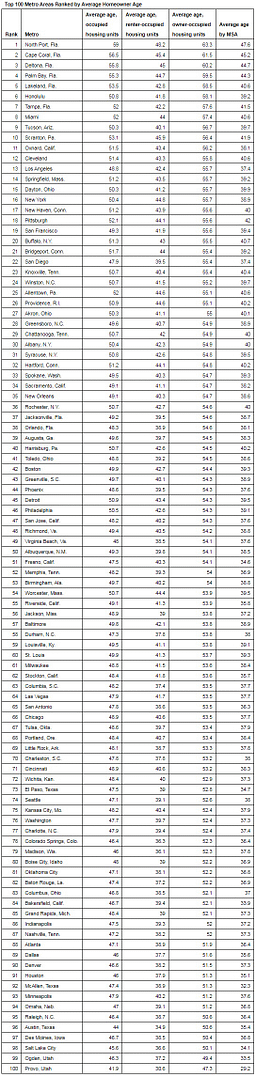

Charlotte, NC – Nov. 19, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, released its report on the average homeowner age across the U.S. Using data from the U.S. Census Bureau’s American Community Survey, LendingTree ranked the 100 largest metropolitan areas by average homeowner age.

“It’s no secret that young and old people gravitate toward different parts of the country,” said Tendayi Kapfidze, Chief Economist at LendingTree. “Florida is a well-known haven for retirees, while places such as San Francisco and Austin, Texas, have emerged as millennial boomtowns over the past few years. As a result, the average age of a homeowner varies by location.”

Key findings

- The average age of a homeowner across the 100 largest metropolitan areas in the United States is 54. Only two metros in the analysis — Provo and Ogden, Utah — have an average homeowner age below 50.

- Homeowners in Florida are older than homeowners in most other states. Seven out of the top 10 metropolitan areas with the highest average homeowner age were in Florida.

- Homeowners in cities in Utah are among the youngest in the country. Out of the top 10 metropolitan areas with the lowest average age for homeowners, metropolitan areas in Utah — Provo, Ogden and Salt Lake City — held the top three spots.

Metropolitan areas in America with the highest average homeowner age

North Port, FL: Average homeowner age: 63.3

Cape Coral, FL: Average homeowner age: 61.5

Deltona, FL: Average homeowner age: 60.2

Metropolitan areas in America with the lowest average homeowner age

Provo: Average homeowner age: 47.3

Ogden: Average homeowner age: 49.4

Salt Lake City: Average homeowner age: 50.1

To view the full report, visit lendingtree.com.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online marketplace that connects consumers with the choices they need to be confident in their financial decisions. LendingTree empowers consumers to shop for financial services the same way they would shop for airline tickets or hotel stays, comparing multiple offers from a nationwide network of over 500 partners in one simple search, and can choose the option that best fits their financial needs. Services include mortgage loans, mortgage refinances, auto loans, personal loans, business loans, student refinances, credit cards and more. Through the My LendingTree platform, consumers receive free credit scores, credit monitoring and recommendations to improve credit health. My LendingTree proactively compares consumers’ credit accounts against offers on our network, and notifies consumers when there is an opportunity to save money. In short, LendingTree’s purpose is to help simplify financial decisions for life’s meaningful moments through choice, education and support. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information, go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

Media Contact: