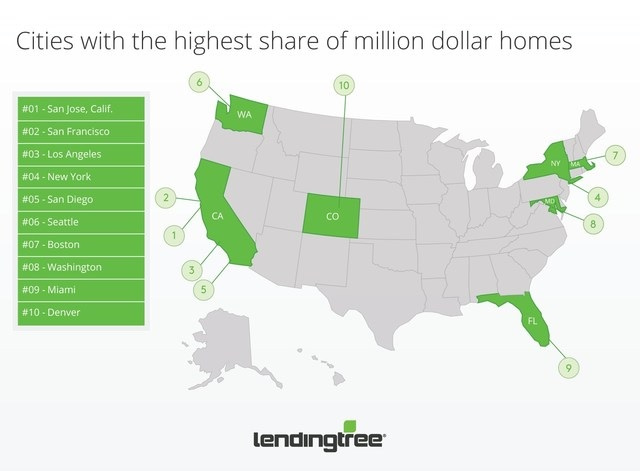

West coast cities dominate the top 10 while Northeast have the lowest concentration of million-dollar homes

Charlotte, NC – July 2, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released a study on the cities with the highest share of homes over $1 million.

Homes over $1 million are rare, but some cities do have larger concentrations of them. LendingTree analysts set out to find out where those million-dollar homes are located and ranked the top 50 cities by the share homes valued over $1 million as recorded in the My LendingTree property value database, which is a collection of real estate data for more than 155 million U.S. properties. The study also includes the median home values.

Key Findings:

- California is home to the top three places with the highest concentration of million-dollar homes. San Jose, San Francisco, Los Angeles and San Diego are also four of the only five metros where more than 10 percent of homes are valued over $1 million.

- Most cities in the top 10 are on the coasts, with the exception of Denver, which is the farthest inland.

- The cities in the top 10 are known for having expensive housing markets in general. They all have median values over $300,000, except for Miami.

- Rust Belt cities dominate the 10 places with the smallest concentration of million-dollar homes. These are also generally more affordable cities and have median values below $200,000, with the exception of Hartford, Conn.

- Buffalo, N.Y. has the lowest share of homes over $1 million with only one out of every 1,000 homes passing the threshold.

Cities with highest share of million-dollar homes

#1 San Jose

- Share of million-dollar homes: 53.81%

- Median value of $1 million-plus homes: $1,505,000

- Median value overall: $1,069,000

#2 San Francisco

- Share of million-dollar homes: 40.03%

- Median value of $1 million-plus homes $1,409,000

- Median value overall: $891,000

#3 Los Angeles

- Share of million-dollar homes: 17.23%

- Median value of $1 million-plus homes: $1,419,000

- Median value overall: $622,000

Cities with lowest share of million-dollar homes

#48 Hartford, Conn.

- Share of million-dollar homes: 0.18%

- Median value of $1 million-plus homes: $1,252,000

- Median value overall: $223,000

#49 Pittsburgh

- Share of million-dollar homes: 0.17%

- Median value of $1 million-plus homes: $1,207,000

- Median value overall: $149,000

#50 Buffalo, N.Y.

- Share of million-dollar homes: 0.10%

- Median value of $1 million-plus homes: $1,280,000

- Median value overall: $141,000

To view the full report, visit: https://www.lendingtree.com/home/mortgage/lendingtree-reveals-cities-highest-share-million-dollar-homes/.

Methodology

To determine the cities with the highest share of million-dollar homes, LendingTree looked at home value data in the 50 largest core-based statistical areas in the U.S. The analysis uses figures pulled on June 26, 2018 from the My LendingTree property value database. The database includes estimated home values for more than 155 million properties in the U.S., based on public tax, deed, mortgage and foreclosure data, as well as proprietary local data used to power home financing recommendations for My LendingTree users. LendingTree determined the concentration of million-dollar homes by dividing the number of homes in the area valued at $1 million or higher by the total number of homes in the CBSA.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

(704) 943-8208

Megan.greuling@lendingtree.com