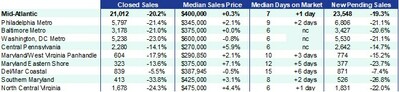

- The median home price in the Mid-Atlantic region in May was $400,000, the highest sales price on record, a 0.3% increase over a year ago

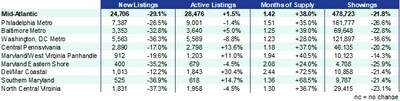

- Active listings at the end of May were up 1.5% compared to a year ago, though supply is still just 40% of 2019 levels

- Half of all homes sold in May were on the market a week or less; homes have not sold this quickly since last summer

North Bethesda, MD – June 13, 2023 (PRNewswire) After two and a half years of robust price growth, home prices in the Mid-Atlantic have been relatively flat for the past three months. However, homes continue to sell very fast and the lack of new listings suggests that prices in the region may have bottomed out and could be set to rebound.

Both pending and closed sales increased between April and May, reflecting seasonal patterns, but pending sales were down 19.3% and closed sales were down 20.2% compared to last year at this time. Persistently high mortgage rates have sidelined some buyers, but a lack of inventory continues to be a major constraint on the market and is the primary reason prices are holding firm across most of the region. The number of active listings on the market totals just 42% of available listings in 2019.

“There is a pool of ‘shadow’ buyers that could be waiting for mortgage rates to drop this summer,” said Lisa Sturtevant, Bright MLS Chief Economist. “However, renewed buyer interest may not translate into more transactions if there is not more inventory. Lower mortgage rates could entice some homeowners to list their home, but it likely won’t be enough to shift the balance in the market.”

That low inventory has meant the market is still moving pretty quickly. The median days on market in the Mid-Atlantic region was 7 in May, the fastest pace of home sales transactions since last June. Buyers have to be ready to make an offer when they find the right home.

Showing activity remains below last year’s level (-21.8%) as would-be buyers have relatively few homes to view. The number of new listings coming onto the market is at a two-decade low, down 29.1% compared to a year ago. Without an influx of new listings—which is not expected any time soon—prices across most Mid-Atlantic markets will remain firm or continue to rise and it will remain a seller’s market.

Key Market Takeaways

- Philadelphia Metro Area: Home Prices in the Philadelphia Metro Area Continue to Rise: Suburban home shoppers find market still competitive

Despite elevated mortgage rates, the median home price in the Philadelphia metro area was up 2.1% in May. Home prices have risen for 69 months in a row, reflecting strong demand, low supply and the relative affordability in the region.

The market looks different depending on whether you are in the city or the suburbs. In some suburban markets, home prices are still rising very quickly as inventory continues to shrink compared to a year ago. In Philadelphia proper, however, inventory is back at near-2019 levels and prices have fallen or remained flat for 11 months in a row. - Baltimore Metro Area: Fewer Buyers in the Market Chasing Low Inventory: Homes are selling faster than they have since last summer

While mortgage rates are definitely a factor in the market, a bigger constraint in the Baltimore region is a lack of supply. The number of active listings increased by 5.0% in May, but supply is still only about a third of what it was in 2019. Home shoppers are competing for very few homes, with the number of new listings coming on the market at its lowest May level in more than two decades.

The low inventory has meant that homes are selling faster than they have since last summer. While the median home price in the Baltimore metro area is unchanged from a year ago, the average sold-to-list price ratio hit 101.6% in May, the highest level since July 2022. Sellers still have the upper hand in the market, finding ready buyers if they have priced their home appropriately. - Washington DC Metro Area: Prices Down for the 3rd Month in a Row: Market is still competitive, with very low inventory

The median price in the Washington, D.C. region was $600,000 in May, the highest in the Mid-Atlantic region. Prices have fallen for 3 months in a row, down from the peaks of last year, but are still about 30% higher than they were before the pandemic.

Limited inventory is a major obstacle to home buyers. With just 1.23 months of supply in the market, inventory is less than half of what it was in 2019 and new listing activity is at a more than two-decade low. - Central Pennsylvania: Low Inventory Pushes Prices Up: Buyers continue to face lough competition and a fast-paced market

Inventory in the Mid-Atlantic was flat compared to last year, but Central Pennsylvania inventory was still increasing in May, up 13.6%. Yet the additional selection for buyers is small and not impacting market competitiveness. The median days on market is only 6 meaning half of homes sold are off the market in under a week.

Prices continue to rise. The median price in Central Pennsylvania is continuing its ascent, now $270,000, up 5.9% versus May 2022. The relatively affordability in the market is still drawing buyers in. - Maryland/West Virginia Panhandle: Inventory is Low in the Region’s Largest Markets: Buyers in the market continue to push prices up

Home prices continue to rise in the region even as price growth has stalled in other parts of the Mid-Atlantic. While the region remains relatively more affordable than some other markets, prices have escalated in recent years and the median home price is now nearly 50% higher than it was in 2019.

Higher prices and elevated mortgage rates are slowing buyer activity, but a lack of inventory continues to be the biggest constraint on the market. It is still decidedly a seller’s market in the Maryland/West Virginia Panhandle region, particularly in the panhandle’s largest markets. - Southern Maryland: Prices Continue Up as Demand Meets Low Inventory: Buyers must submit competitive offers quickly

May’s median sale price of $425,000 is up 3.1% compared to a year ago and is at the same as it was in June and July 2022–the peak of prices before the fall buying season. Prices are supported by the low inventory in the market. The 618 active listings available to buyers in May are only 37% of what buyers back in May 2019 had to choose from.

Half of homes sold in Southern Maryland in May 2023 were purchased in 8 days or less, a pace of home sales transactions that is much faster than it was prior to the pandemic, - Maryland Eastern Shore: Low Inventory Fuels Continued Price Growth: Fresh listings are hard to come by

Inventory has been increasing each month since last June; however, those increases come on the heels of a serious supply deficit. Active listings at the end of May are still only about a third of the number at the end of May 2019.

While price growth has moderated in the nearby Baltimore and Washington regions, the median price on the Eastern Shore was up 7.1% in May. The median days on market was 12, which was up from a year ago but homes are selling much quicker than they did back in 2019 when a typical home was on the market for a month. - Del/Mar Coastal: Home Prices Decline For the First Time Since 2020: Despite more listing activity, inventory is still very low

Inventory in Del/Mar has increased year-over-year for the past 12 months. In May, active listings were up 30.4%. Despite inventory gains, supply is limited, with active listings at just 38% of the amount on market in May 2019. Inventory of homes priced under $500,000 are particularly hard to come by.

The median price in the region declined 0.5% from last year, the first year-over-year drop since May 2020. Del/Mar Coastal buyers face competition when purchasing. The median days on market (15) point to the quickness, especially compared to the 42 days that was typical in May 2019. - North Central Virginia: Despite Lower Activity, Market Still Competitive: Both demand and supply slow, but prices rising

This year, monthly sales and new listing activity across the Mid-Atlantic including North Central Virginia, have been below 2022 levels and May was no exception. While buyer activity is below last year, sellers are even further behind. New listings in the region are at a two-decade low, down 37.3% compared to last year.

Prices increased 4.4% from a year ago in May to $475,000. Prices in the region are nearly 40% higher than they were in 2019.

The full Mid-Atlantic and new area reports are available at BrightMLS.com/MarketInsights.

About Bright MLS

Bright MLS was founded in 2016 as a collaboration between 43 visionary associations and two of the nation’s most prominent MLSs to transform what an MLS is and what it does, so real estate pros and the people they serve can thrive today and into our data-driven future through an open, clear and competitive housing market for all. Bright is proud to be the source of truth for comprehensive real estate data in the Mid-Atlantic, with market intelligence currently covering six states (Delaware, Maryland, New Jersey, Pennsylvania, Virginia, West Virginia) and the District of Columbia. Bright MLS’s innovative tool library—both created and curated—provides services and award-winning support to well over 100K real estate professionals, enabling their delivery on the promise of home to over half a million home buyers and sellers monthly. Learn more at BrightMLS.com.

SOURCE Bright MLS