Source: Statista

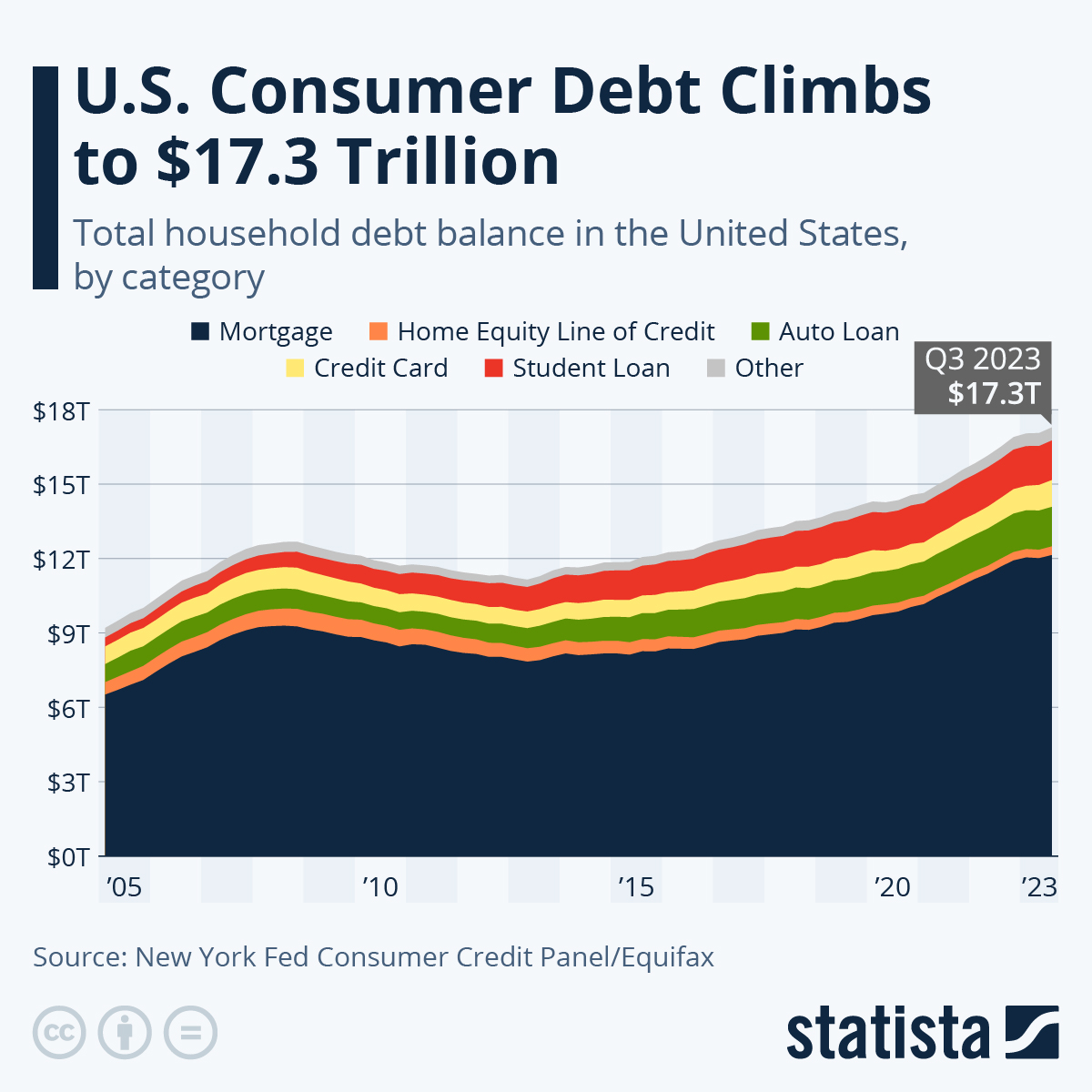

Total household debt in the United States, including mortgages, auto loans, credit card and student debt, climbed to $14.15 trillion in the fourth quarter of 2019, eclipsing the previous peak at the height of the great recession in Q3 2008 by $1.5 trillion in nominal terms.

That’s according to the Federal Reserve Bank of New York’s latest Report on Household Debt and Credit, which also shows that the delinquency rate, in this case the percentage of the total household debt balance that is at least 30 days past due, is significantly lower than it was back then (4.7 percent vs. a peak of 11.9 percent at the end of 2009), indicating that today’s debt burden isn’t as worrisome.

Standing at $9.56 trillion, mortgages still account for the lion’s share of the total debt balance, with student loans a distant second at $1.51 trillion. While credit card debt “only” amounts to $0.93 trillion, 8.4 percent of total credit card debt is 90+ days delinquent, trailing only student loans (11.6 percent) in that unfavorable category.