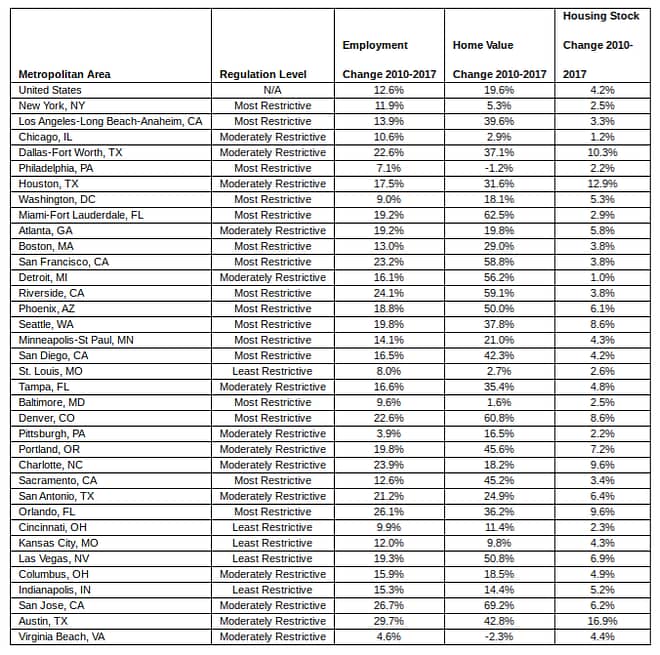

Despite similar job growth, markets with the most restrictive land-use regulations saw much steeper home-value appreciation than those with lighter regulations

Seattle, WA – Aug. 2, 2018 (PRNewswire) As the economy has recovered, both the job market and home values have seen strong growth. But in places where residential land use has the strictest regulations, and which often struggle to accommodate new housing, strong job growth is associated with a much larger increase in home values.

Using the Wharton Residential Land Use Regulation Index[i], Zillow® compared job growth[ii] and home value appreciation since 2010, grouping markets by how strict their regulations are. Job growth overall is correlated with home value growth, but how much home values grew in a given market depended in part on the regulations builders face when adding new homes, including density laws and permit review times.

Between 2010 and 2017, home values across the country increased by 14 percentage-points for every 10 percentage-point increase in jobs. In markets with the most restrictive regulations, home values grew 25 percentage-points for every 10 percentage-point increase in employment over that same time period.

In San Francisco, where strict regulations are combined with physical land limitations, home values rose 58.8 percent between 2010 and 2017 as employment grew 23.2 percent during those years. Similarly, Miami home values grew 62.5 percent as jobs grew 19.2 percent.

Home value appreciation was smaller in areas with less-strict regulations. Job growth in Dallas, a moderately restrictive market, was similar to that in San Francisco, but home value growth was milder, increasing 37.1 percent.

“As the housing market has recovered from the Great Recession and collapse in home values, a new challenge emerged that is driving market dynamics – the shortage of homes for potential buyers,” said Zillow Senior Economist Aaron Terrazas. “We’ve seen inventory falling on an annual basis for more than three years now. As a result of job and population growth, housing demand has overwhelmed the inventory of pre-existing homes and builders are facing a number of challenges in adding new supply, including regulatory costs. In hot job markets with some of the strictest laws about building new residential housing, home values experience the most pressure. It’s helped home values recover and exceed their previous highs, but leaves many home shoppers unable to break into the market.”

Growing job markets add to the demand for housing, and the number of homes[iii] increased as employment grew, regardless of how strict the regulations are. However, markets with the most restrictive laws added less housing than places with easier building laws. Between 2010 and 2017, markets with the tightest building regulations increased their housing stock by 4.4 percent, while markets with the loosest restrictions added 4.6 percent more homes.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with great real estate professionals. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow Group’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ:Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

[i] The most comprehensive nationwide effort to summarize regulatory conditions is the Wharton Residential Land Use Regulation Index, which compiles the results of a survey sent to city planners across the country in 2007. This analysis used the index to categorize all the metropolitan areas with survey responses into three groups: those with the most restrictive, moderately restrictive, and least restrictive regulations.

[ii] Jobs data comes from the Bureau of Labor Statistics

[iii] Housing stock data comes from the U.S. Census Bureau