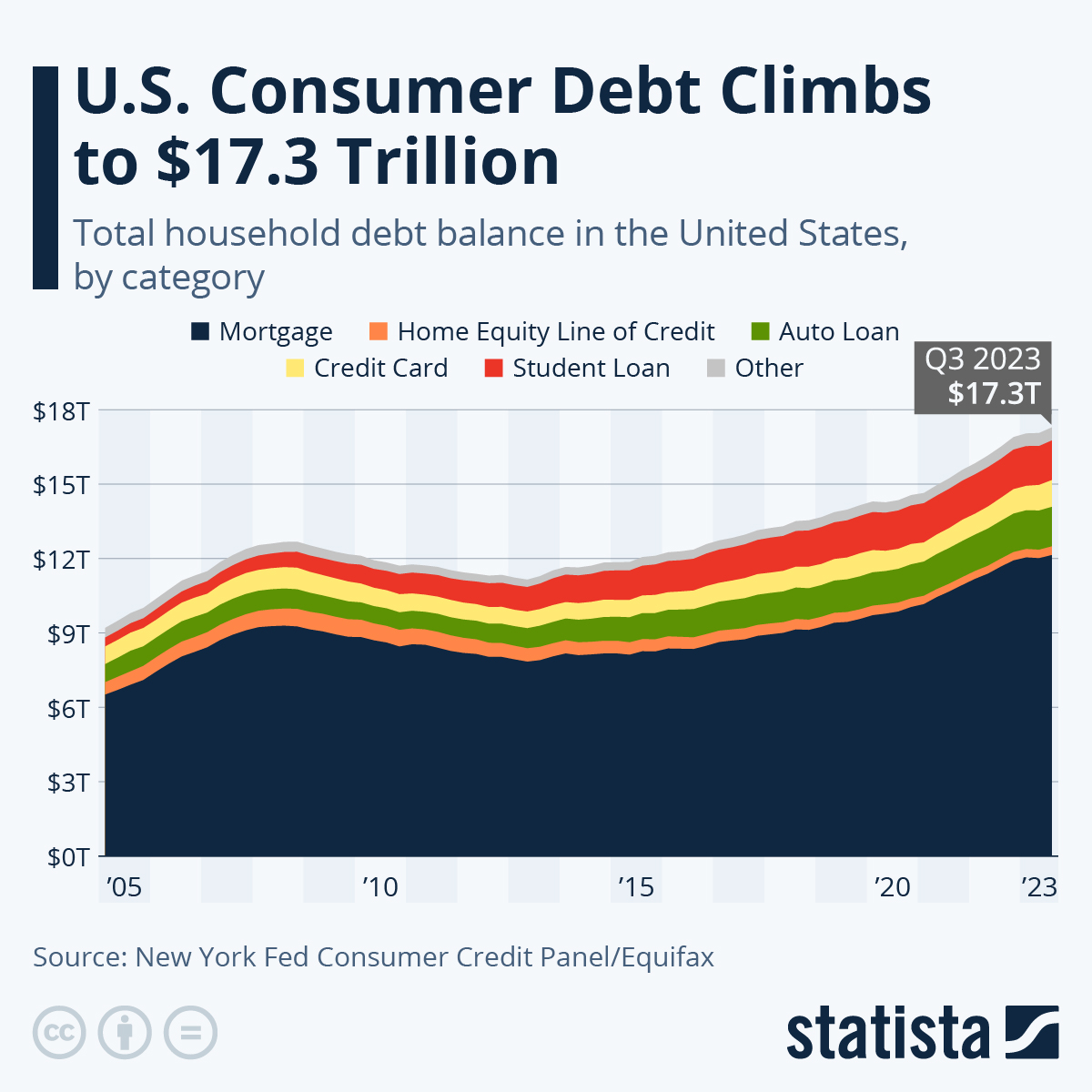

Source: Statista

U.S. household debt climbed to a record high of $14.6 trillion at the end of 2020, as mortgage debt surpassed $10 trillion for the first time. According to the New York Fed’s latest Household Debt and Credit Report, mortgage debt increased by a whopping $183 billion over the past three months alone.

The increase was mainly driven by a record volume of mortgage originations, as many households took advantage of historically low mortgage rates to refinance their mortgages and even take out some cash in the process. In fact, refinances accounted for roughly $700 billion of the almost $1.2 trillion in mortgage originations in the fourth quarter, with 85 percent of that total coming from customers with super-prime credit scores.

Interestingly, the high volume of refinances from super-prime borrowers has also contributed to historically low delinquency rates. With 96.8 percent of total household debt non-delinquent, the current situation is in sharp contrast to the end of 2009, when just 88 percent of consumer debt was non-delinquent.