San Francisco, CA – Nov. 19, 2018 (PRNewswire) LendingHome – the fix-and-flip industry’s No. 1 lender – today released a never-before-seen, inside look at localized market statistics based on a combination of LendingHome proprietary data and publicly available real estate records.

![]()

LendingHome’s inaugural “State of The Flipping Market” focuses on California which experienced the biggest surge in brand-new house flippers – those who buy, rehabilitate (fix), and resell (flip) residential homes – compared to any other state in 2017. California was also LendingHome’s top state for loan originations in 2017.

House flipping is a key component of California’s residential real estate industry, providing a significant upgrade to aging homes in need of repair. According to the U.S. Census Bureau’s American Housing Survey, more than half of all U.S. homes are at least 39 years old.

The “State of The Flipping Market: California” contains data on the number of flips in each county statewide – from 2014 through 2017 – available in a detailed, interactive map. Among other data points, the report contains analyses on:

- Growth in total number of fix-and-flip homes purchased

- Median revenue per flip

- Percent of flips financed with a loan

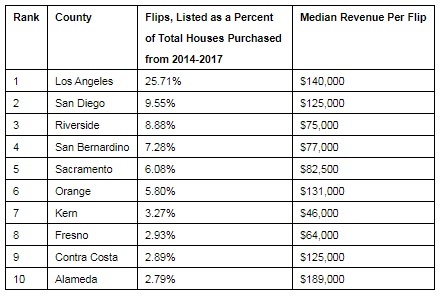

LendingHome’s report also pinpoints California’s Top 10 flipping hot spots by county. [To see how all 58 California counties rank, click here.] Strong flipping activity is typically indicative of a seller’s market. It also signals that people looking to buy a starter home will have success, if they are willing to undertake renovations themselves.

Ranking first was Los Angeles County, where a whopping 25.71% of all houses purchased were flips. The Top 10 in order:

LendingHome found it takes about 180 days, on average, to flip a house in California, which was 20 days faster than the nationwide average.

“After four years of lending, and more than $3 billion in loan originations, LendingHome has a wealth of data that can help real estate investors be strategic in choosing their next investment,” said Matt Humphrey, co-founder and CEO of LendingHome. “Being able to analyze data in a meaningful way is a huge part of how we operate, and it’s great to be able to pass some of those insights back to our customers for them to leverage.”

To access LendingHome’s “State of The Flipping Market: California” report, click here.

Methodology and Key Definitions:

For this report, LendingHome analyzed both LendingHome proprietary loan origination data and more comprehensive, publicly available, real estate data from 2014 through 2017. More specifically, LendingHome looked at sales deed data from 2014 through 2017, available as of July 8, 2018.

LendingHome defines a flipper, or property investor, as someone who has completed at least one home purchase and resale in a year or less, with at least 10% profit, or someone who has purchased and resold at least two homes in 1,000 days or less. A new flipper in any given year is someone who made his/her first flip during that year and, for purpose of this report, someone who hadn’t flipped a house in five years prior to 2017. Gross flipping revenue was calculated by subtracting the price of the first sale (purchase) from the price of the second sale (flip).

About LendingHome:

LendingHome has designed a better way for people to buy a home. Its built-from-scratch technology has transformed a slow, painful, paper-based process into a fast, transparent, online experience. At the same time, LendingHome is a marketplace lender: institutional and accredited investors have access to attractive, high-yield real estate assets. Since it started lending in mid-2014, LendingHome has funded more than $3 billion in mortgage loans. The company is headquartered in San Francisco with an office in Pittsburgh, Pa. To learn more, go to www.lendinghome.com or www.lendinghome.com/careers. NMLS ID #1125207

Media Contact:

Nora Murray

205084@email4pr.com

419-250-0016