Californians, welcome to the “Quarter Century Club”: You’ll need more than 25 years to save a 20% down payment in the Golden State’s four largest cities: San Diego and San Jose (31 years), San Francisco (40 years), and Los Angeles (43 years), according to the Unison 2019 Home Affordability Report

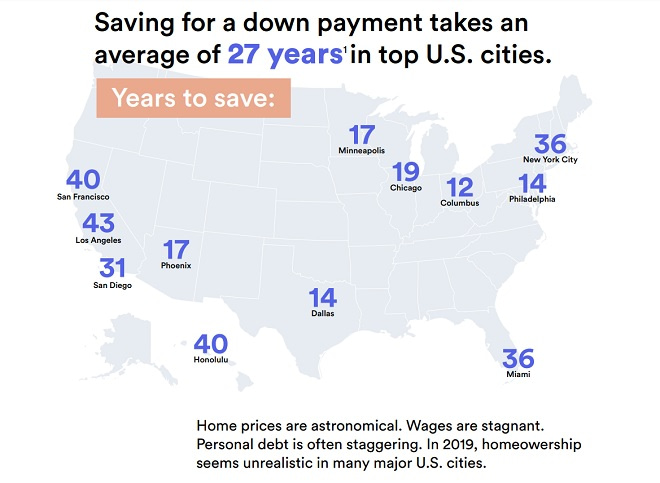

San Francisco, CA – June 11, 2019 (PRNewswire) For millions of Americans, the dream of homeownership remains distant, according to the 2019 Home Affordability Report, published today by Unison, North America’s leading home co-investment partner. Nationwide, it takes 14 years to save for a 20% down payment on a median priced home for those earning the median income. This means that many prospective millennial homebuyers won’t achieve the American dream until well into their 40s.

In the eight least affordable cities, it will take 30 years or longer: Boston (30 years), San Jose and San Diego (31), Miami and Manhattan (36), and Honoluluand San Francisco (40). Los Angeles tops the list at 43 years.

“The way things are going, an entire generation of Americans may be approaching retirement before they can securely own a home or be forced to take on more risk than they can reasonably afford in order to realize their dream of homeownership,” said Unison CEO Thomas Sponholtz. “This is a societal and economic problem that impacts all income levels and can only be addressed through massive infrastructure investments and rapid adoption of smarter and safer non-debt-based finance and homeownership solutions.”

The report provides an in-depth look into home affordability across the country. It is based on the Unison Home Affordability Index, which estimates how many years it takes to save for a 5%, 10% or 20% down payment in hundreds of metro areas and thousands of cities, given the median salary and median home price for each market.

Additional findings of the Unison 2019 Home Affordability report include:

The City of Angels tops the list: With a median home value of $622,523 but a median income of $58,043 ($3,000 below the national median of $61,045), a typical Los Angeles resident earning the median income won’t be able to afford a home until 2061.

The Quarter Century Club: With all four of its largest cities requiring more than 25 years to save for a down payment (San Diego and San Jose, 31 years; San Francisco, 40 years; Los Angeles, 43 years) California is the founding member state. Other cities in the club are Honolulu (40), New York City (36), Miami (36), Boston (30), Washington, DC (28), and Seattle (27).

While Los Angeles leads in longest to save, San Francisco is the most expensive city: With a median home value topping $1 million – the highest in the nation – San Francisco is the most expensive city in the U.S. to purchase a home. A San Francisco resident faces a monthly mortgage payment of $5,052, requiring annual income over $200,000. From 2017 to 2018, median incomes grew more quickly than median home values, cutting the number of years it takes to save for a down payment from 42 to 40. But the income needed to support the typical monthly payment still makes San Francisco prohibitively expensive for most.

Boomtowns where costs are climbing. Booming markets are great for existing homeowners, but in many cities around the country, home price increases have led to rapid increases in monthly payments that far exceed corresponding income growth. Monthly payments are way up in Miami (26%), Las Vegas (24%), Phoenix (20%), and Tampa (17%).

Where aspiring homebuyers can catch a break: Louisville, Indianapolis, Kansas City, MO, Columbus (12 years to save for a down payment), Wichita (11 years), and Detroit (7 years) have more favorable home value to income balances, making homeownership relatively more affordable for typical wage earners.

The most out-of-reach city in the entire U.S. to buy a home is Mountain Village, CO, a ski resort nestled in the San Juanmountains next to Telluride, where it will take you until 2113 (95 years) to save a down payment.

It’s a tough time for buyers, but a great time for owners. Nationwide, the median home value increased 6% from 2017 to 2018. While this pushes the down payment and monthly payment higher for prospective buyers, it underscores the promise of an investment in residential real estate.

To view the report click here.

“Home co-investing is a non-debt alternative that should have always been available to homebuyers and homeowners at all income and home price levels. It enables people to buy their home in balance with their financial reality, risk tolerance, and life goals. It is simply a smarter and better way to buy and own a home, and Unison is proud to lead the way,” Sponholtz said.

Unison partners with institutional investors to offer homeowners and prospective homebuyers debt-free access to cash for the chance to share in a portion of their home’s change in value – up or down. Through its HomeBuyer and HomeOwner programs, users can either use the cash to supplement a down payment on a new home, or unlock equity in their existing home to pay off debt, remodel, fund a major purchase, diversify assets, or fund retirement. Since the arrangement is not a loan, there are no monthly payments and no interest. If the home depreciates, Unison shares in the loss alongside the homeowner.

To read the Unison 2019 Home Affordability Report, visit here.

About Unison

Unison is a San Francisco-based company that is pioneering a smarter, better way to buy and own your home. We are a team of financial and real estate professionals who are committed to helping homebuyers get the home they want, and homeowners finance their life needs without adding debt. We believe in a world where buying and owning a home is not a zero-sum game, and that with the right partners, everyone can win. For additional information, visit www.unison.com or follow us on Facebook, Instagram, LinkedIn, Twitter and YouTube.

Press Contact