Charlotte, NC – Jan. 14, 2019 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released its study on the best places to pay down debt.

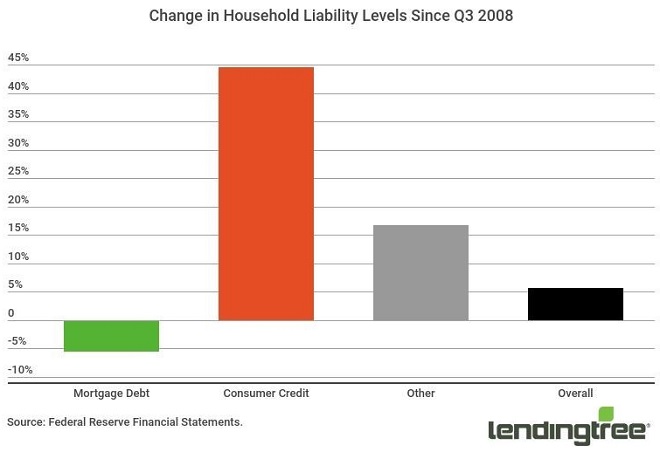

Americans’ debt balances continued climbing in 2018, with total consumer debt tracking to top $4 trillion by the end of that year. With balances climbing high, many borrowers will want to use the new year to prioritize paying off debt.

LendingTree analysts wanted to find out whether some major U.S. cities afford their residents more opportunities to pay down existing debt than others and ranked the 50 most populous U.S. metropolitan areas according to the following factors that reflect residents’ abilities to pay down debt.

- Average credit utilization, as a percentage

- Average monthly rent-to-income ratio, as a percentage

- Regional prices on goods and services

- Local unemployment rate

- State’s scoring on debt-friendly laws and policies

Key takeaways

- Cost of living plays a large role in determining where it’s easiest and hardest to pay down debt. All of the 10 best places to pay off debt have rent-to-income ratios below 20 percent, and all but one have below-average prices on goods and services.

- Cincinnati tops the list of best places to pay down debt, thanks to an exceptionally low cost of living and a relatively good unemployment rate. The metro received a final score of 77.2.

- Milwaukee and Minneapolis follow closely behind with final scores of 75.6 and 75.5, respectively.

- Riverside, Calif., is a tougher place to pay off debt, thanks to a high cost of living and high unemployment. The metro received a final score of 31.8.

- Residents of Detroit and Los Angeles are also challenged, with final scores of 40.8 and 42.3, respectively.

In the 10 best cities to pay down debt, locals have several factors working in their favor. All of these cities have average revolving credit balances that are at or just under a third of their limits, which is right in line with a good credit utilization ratio of 30 percent or less. With lower balances to begin with, borrowers in these cities can more easily wrangle these types of debt.

Low costs of living also work in residents’ favor. Typical rent costs in all 10 cities is less than under 20 percent of income, and Minneapolis is the only city with a goods and services price index above the national average.

Rent costs compared to local wages are lowest in Cincinnati, claiming just 15.9 percent of median gross income. The Ohio city also has the lowest prices on goods and services. Austin locals pay the highest rents relative to their incomes, at 19.9 percent.

Lastly, these 10 cities also boasted below-average unemployment rates and were more likely to have solid protections for debtors.

To view the full report, visit www.lendingtree.com.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online marketplace that connects consumers with the choices they need to be confident in their financial decisions. LendingTree empowers consumers to shop for financial services the same way they would shop for airline tickets or hotel stays, comparing multiple offers from a nationwide network of over 500 partners in one simple search, and can choose the option that best fits their financial needs. Services include mortgage loans, mortgage refinances, auto loans, personal loans, business loans, student refinances, credit cards and more. Through the My LendingTree platform, consumers receive free credit scores, credit monitoring and recommendations to improve credit health. My LendingTree proactively compares consumers’ credit accounts against offers on our network, and notifies consumers when there is an opportunity to save money. In short, LendingTree’s purpose is to help simplify financial decisions for life’s meaningful moments through choice, education and support. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information, go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

Media Contact: