List includes San Jose, Calif.; Seattle and Salt Lake City, as well as some surprises

Santa Clara, CA – April 26, 2018 (PRNewswire) This spring, the largest generation in U.S. history – millennials – is colliding with the toughest home buying season in history, and they will fare better in some markets than others. According to a new analysis released today by realtor.com®, the home of home search, the combination of low inventory, escalating home prices and high demand have made San Jose, Seattle, Salt Lake City, Minneapolis and Omaha, Neb., the toughest areas in the country for millennial buyers this spring.

![]()

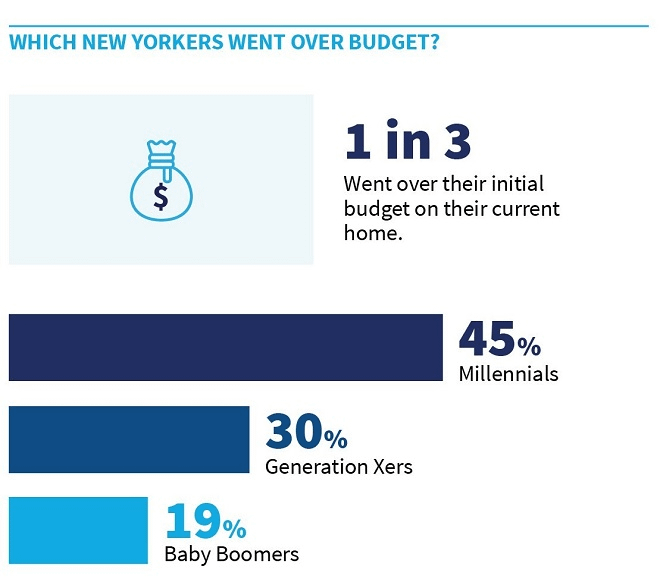

“Millennials want to buy, but record-low inventory is making it extremely difficult,” Danielle Hale, chief economist for realtor.com®. “Our analysis shows millennials are facing challenges in both established markets such as San Jose and Seattle, as well as more recently popular areas like Omaha and Salt Lake City. Despite the difficulties, first-timers are optimistic and more than willing to weather the challenges this spring has to offer.”

Key Dynamics in the Top Five Markets

All the markets on the list are millennial hotspots that have attracted 25- to 34-year-olds with strong economies and high-paying jobs. As a result, millennials make up a higher share of the population, at 14.6 percent, compared to 13.4 percent for the U.S. Household income among 25- to 34 year-olds in these five locations is also significantly higher, at roughly $79,000, compared to the U.S. median of $59,800. Additionally, based on realtor.com® search data, millennials in these markets are very interested in buying a home. In the first quarter, they accounted for 25 percent of views, higher than any other age group.

However, low inventory levels and high prices are making it tough for these would-be buyers. Nationally, inventory is 35 percent lower than the spring of 2012 and prices have reached a new high of $280,000. The shortage is even more acute in these five metros. Compared to this time last year, active listings in these five metros remain 8 percent lower, age of inventory is 7 percent lower, and list prices are 8 percent higher. Supply is nearly three times lower than the rest of the country, at 5.7 listings versus 16.1 listings per 1,000 households. Additionally, listings in these areas are scarcer and selling faster for more money. In these five metros active listings are 9 percent lower, age of inventory is 13 percent lower, and list prices are 14 percent higher from a year ago.

Toughest Housing Markets for Millennials

1. San Jose – The median list price in San Jose is $1,244,000, compared to $280,000 for the U.S. overall. On average, San Jose millennials earn $109,800 annually. Millennials make up 14.3 percent of the total population in San Jose and account for 24.1 percent of total realtor.com® page views in the area.

Millennials are flocking to San Jose in hopes of earning the “tech salary” that everyone is chasing. Apple, Adobe, Intel, and NASA are just a few of the companies that call this area home. With San Jose State University and nearby Stanford University, the area is replete with young students and scholars. The inventory shortage is especially significant in the area and is pushing non-tech industry workers to the outskirts.

2. Seattle – The median list price in Seattle is $553,000. On average, millennials earn $78,300. Millennials make up 15.4 percent of the total population in Seattle and account for 24.2 percent of total realtor.com® page views in the area.

Big tech employers such as Amazon, Microsoft, and Expedia are a big draw for millennial and non-millennial workers to the Seattle area. Beyond the tech scene, Seattle offers great outdoor spaces, such as Kerry Park and a thriving nightlife in Ballard and Capitol Hill. Despite Seattle’s already high home prices, real estate professionals don’t see any end in sight given the large amount of tech money flooding into the area. They also report many millennials are spending more than $1,000,000 on their first home due to the high salaries and home prices in the area.

3. Salt Lake City – The median list price in Salt Lake City is $394,000. On average, millennials earn $67,800 annually. Millennials make up 15.5 percent of the total population in Salt Lake City and account for 26 percent of total realtor.com® page views in the area.

Salt Lake City offers the perfect blend of city life and the great outdoors for millennial professionals. Intermountain Healthcare Medical Center, University Hospital and the University of Utah are the largest employers in the area, with other notable companies such as Delta Air Lines and eBay. Located just an hour from Park City, residents can spend the morning downtown shopping one of the city’s many trendy shopping areas, and be on the slopes by mid-afternoon. However, millennials are struggling to find their place in the hot housing market. Many homes under $350,000 are getting scooped up instantly by older buyers who often have more money.

4. Minneapolis – The median list price in Minneapolis is $283,000. On average, millennials earn $73,600 annually. Millennials make up 13.8 percent of the total population in Minneapolis and account for 25.9 percent of total realtor.com® page views in the area.

Minneapolis is the perfect city for millennials who love a mix of natural amenities and urban living. The area is home to 17 Fortune 500 companies, including UnitedHealth Group, Target, Best Buy, and 3M. It’s also home to a thriving cycling culture, with the second (only to Portland) most bike commuters of all big cities. The city is relatively affordable, but it’s become more difficult for first-time buyers to find homes under $250,000. When they do, they are often outbid by cash offers from boomers.

5. Omaha – The median list price in Omaha is $283,000. On average, millennials earn $63,500 annually. Millennials make up 13.8 percent of the total population in Omaha and account for 25.9 percent of total realtor.com® page views in the area.

Millennials are drawn to Omaha for its low cost of living, strong school system, and thriving job market. With schools such as Spring Ridge Elementary, Aldrich Elementary, and Hitchcock Elementary, all of which scored 9/10 by Greatschools.org, the area is great for millennials who want to start families. It offers strong financial, medical and military jobs with companies such as Nebraska Medicine, Taylor Telecommunications, and Union Pacific Railroad Co. Millennials looking to find homes under $250,000 are struggling, but boomers purchasing more expensive homes continue to have success closing.

Methodology

Realtor.com® analyzed the largest 60 metros in the country with large populations of older millennial markets. Markets were then ranked based on inventory availability and affordability.

About realtor.com®

Realtor.com® is the home of home search, offering the most comprehensive source of for-sale properties, among competing national sites, and the information, tools and professional expertise to help people move confidently through every step of their home journey. It pioneered the world of digital real estate 20 years ago, and today is the trusted resource for home buyers, sellers and dreamers by making all things home simple, efficient and enjoyable. Realtor.com® is operated by News Corp [NASDAQ: NWS, NWSA] [ASX: NWS, NWSLV] subsidiary Move, Inc. under a perpetual license from the National Association of REALTORS®. For more information, visit realtor.com®.

Contact:

Lexie Puckett Holbert

lexie.puckett@move.com