Washington, D.C. – March 14, 2018 (nar.realtor) Home purchases by millennials ticked up over the past year, but inventory constraints and higher housing costs kept their overall activity subdued and prevented some from leaving the more affordable confines of their Gen X and baby boomer parents’ homes.

This is according to the National Association of Realtors® 2018 Home Buyer and Seller Generational Trends study, which evaluates the generational differences(1) of recent home buyers and sellers. The survey additionally found that millennial buyers prioritize living close to friends and family over a home’s location and proximity to schools, and an overwhelming majority used a real estate agent to buy or sell a home.

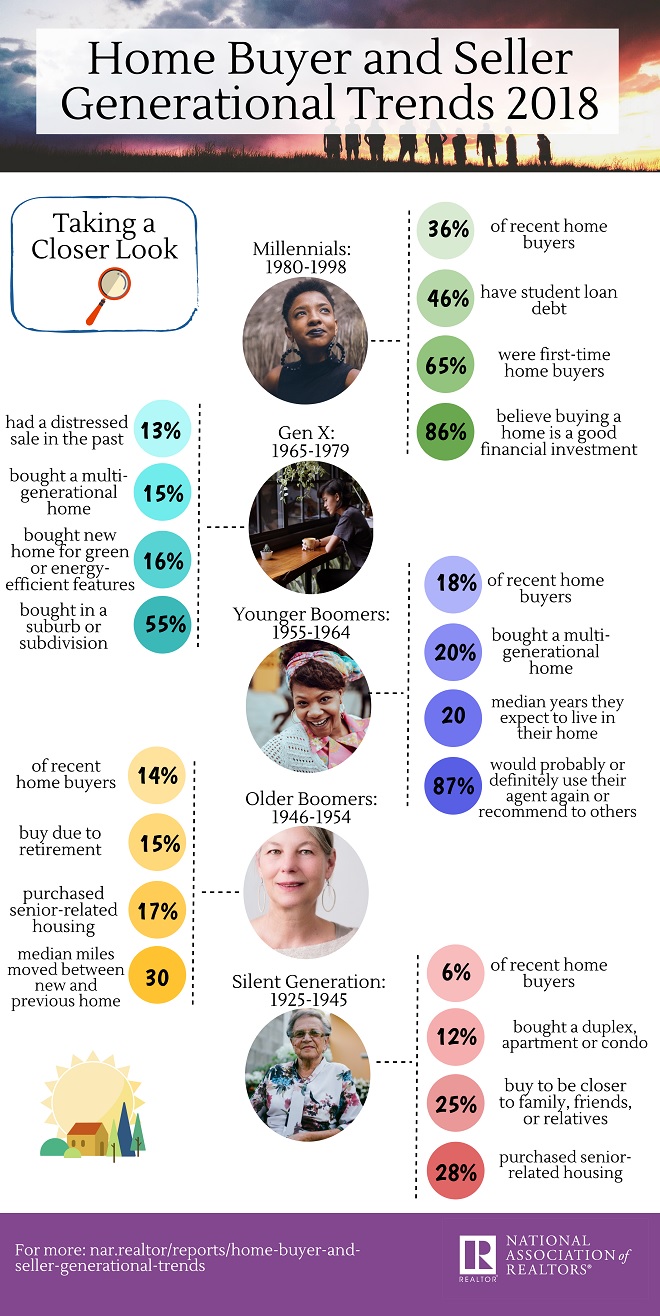

Slightly more than a third of all home purchases were made by millennials over the past year (36 percent; 34 percent in 2017), which kept them as the most active generation of buyers for the fifth consecutive year. Gen X buyers ranked second (26 percent; 28 percent in 2017), followed by younger (18 percent) and older baby boomers (14 percent) and the Silent Generation, those born between 1925 and 1945 (6 percent; 8 percent in 2017).

According to Lawrence Yun, NAR chief economist, this year’s survey findings reveal both what it takes to be a successful millennial buyer in today’s housing market, as well as why, even though sales to millennials reached an all-time survey high, stubbornly low inventory conditions pushed home prices out of reach for many. As a result, the overall share of millennial buyers remains at an underperforming level.

Revealing the greater purchasing power needed over the past year, the typical millennial buyer in the survey had a higher household income ($88,200) than a year ago ($82,000) and purchased the same-sized home (1,800-square-feet) at a more expensive price ($220,000; $205,000 in 2017). Millennials also had higher student debt balances than in last year’s survey, and slightly more of them said saving for a down payment was the most difficult task in buying a home.

“Realtors® throughout the country have noticed both the notable upturn in buyer interest from young adults over the past year, as well as mounting frustration once they begin actively searching for a home to buy,” said Yun. “Prices keep rising for the limited number of listings on the market they can afford, which is creating stark competition, speedy price growth and the need to save more in order to buy.”

Added Yun, “These challenging market conditions have caused – and will continue to cause – many aspiring millennial buyers to continue renting unless more Gen Xers decide to sell, and entry-level home construction picks up significantly.”

Other key findings and notable generational trends of buyers and sellers in this year’s 144-page survey include:

Younger boomers and Gen X buyers increasingly have children and parents living at home

Similar to previous years, younger boomers were the most likely to purchase a multi-generational home (20 percent), with a noteworthy rise in those indicating the top reason they did was for their adult children (above 18 years old) to live at home (39 percent; 30 percent in 2017), as well as their parents (22 percent; 18 percent in 2017).

The survey also found a growing a share of Gen X buyers buying for multi-generational purposes (15 percent; 12 percent in 2017), with a big jump in the top reason being for their adult children (35 percent; 26 percent in 2017) and parents living with them (30 percent; 19 percent in 2017).

“Costly rents and growing student debt balances appear to make living at home more appealing, affordable and increasingly more common among young adults just entering the workforce,” said Yun. “Even in situations where three generations are all cramped under the same roof, it can significantly help some millennials eventually transition straight to homeownership. Eighteen percent of millennial buyers in the survey said their family home was their previous living arrangement.”

Friends and family matter for buyers both young and old

When deciding where to buy a home, quality of the neighborhood is the factor most influencing buyers of all ages, followed closely by convenience to a job for those up to working age (millennials to younger boomers). Interestingly, even more than the location and quality of a school, recent millennial buyers were just as likely as older boomers and the Silent Generation (at 43 percent) to consider proximity to friends and family.

“The sense of community and wanting friends and family nearby is a major factor for many homebuyers of all ages,” said Yun. “Similar to Gen X buyers who have their parents living at home, millennial buyers with kids may seek the convenience of having family nearby to help raise their family.”

Millennials buying condos in the city at a very low rate

The share of millennial buyers with at least one child continues to grow, at 52 percent in this year’s survey and up from 49 percent a year ago and 43 percent in 2015. With the need for a larger house at an affordable price, over half of millennials bought in a suburban location (52 percent), while also being more likely than Gen Xers and younger boomers to choose a home in a small town. After climbing as high as 21 percent in 2015, only 15 percent of recent millennial buyers purchased a home in an urban area.

Led by Gen X (86 percent) and millennial buyers (85 percent), a detached single-family home continues to be the primary type of property purchased, and older and younger boomers were the most likely to buy a multi-family home. Only 2 percent of millennial buyers over the past year bought a condo.

“While there is an overall trend among households young and old to migrate towards urban areas, the very low production of new condos means there are few affordable options for buyers – especially millennials,” said Yun.

Regardless of age, most buyers and sellers work with a real estate agent

Buyers and sellers across all age groups continue to seek the assistance of a real estate agent when buying and selling a home. At 90 percent, millennials were the most likely to purchase a home through a real estate agent, and help understanding the buying process was cited as the top benefit millennials said their agent provided (75 percent). Overall, at least 84 percent in every other generation worked with an agent to close the deal.

On the seller side, Gen X and older boomers were the most likely to use an agent (91 percent), followed closely by millennials (90 percent) and younger boomers (88 percent). The near universal use of an agent to sell a home helped keep for-sale-by-owner transactions at their lowest share ever for the third straight year (8 percent).

“Especially in today’s fast-moving housing market, consumers of all ages want a Realtor® to guide them through the exhilarating, yet nerve-wracking experience of buying or selling a home,” said NAR President Elizabeth Mendenhall, a sixth-generation Realtor® from Columbia, Missouri and CEO of RE/MAX Boone Realty.

NAR mailed a 131-question survey in July 2017 using a random sample weighted to be representative of sales on a geographic basis to 145,800 recent home buyers. Respondents had the option to fill out the survey via hard copy or online; the online survey was available in English and Spanish. A total of 7,866 responses were received from primary residence buyers. After accounting for undeliverable questionnaires, the survey had an adjusted response rate of 5.6 percent. The sample at the 95 percent confidence level has a confidence interval of plus-or-minus 1.10 percent.

The recent home buyers had to have purchased a home between July 2016 and June 2017. All information is characteristic of the 12-month period ending in June 2017 with the exception of income data, which are for 2016.

The National Association of Realtors® is America’s largest trade association, representing 1.3 million members involved in all aspects of the residential and commercial real estate industries.

###

1. Survey generational breakdowns: millennials (ages 37 and under); Generation X (ages 38-52); younger boomers (ages 52-61); older boomers (ages 62-70); and the Silent Generation (ages 71-91).