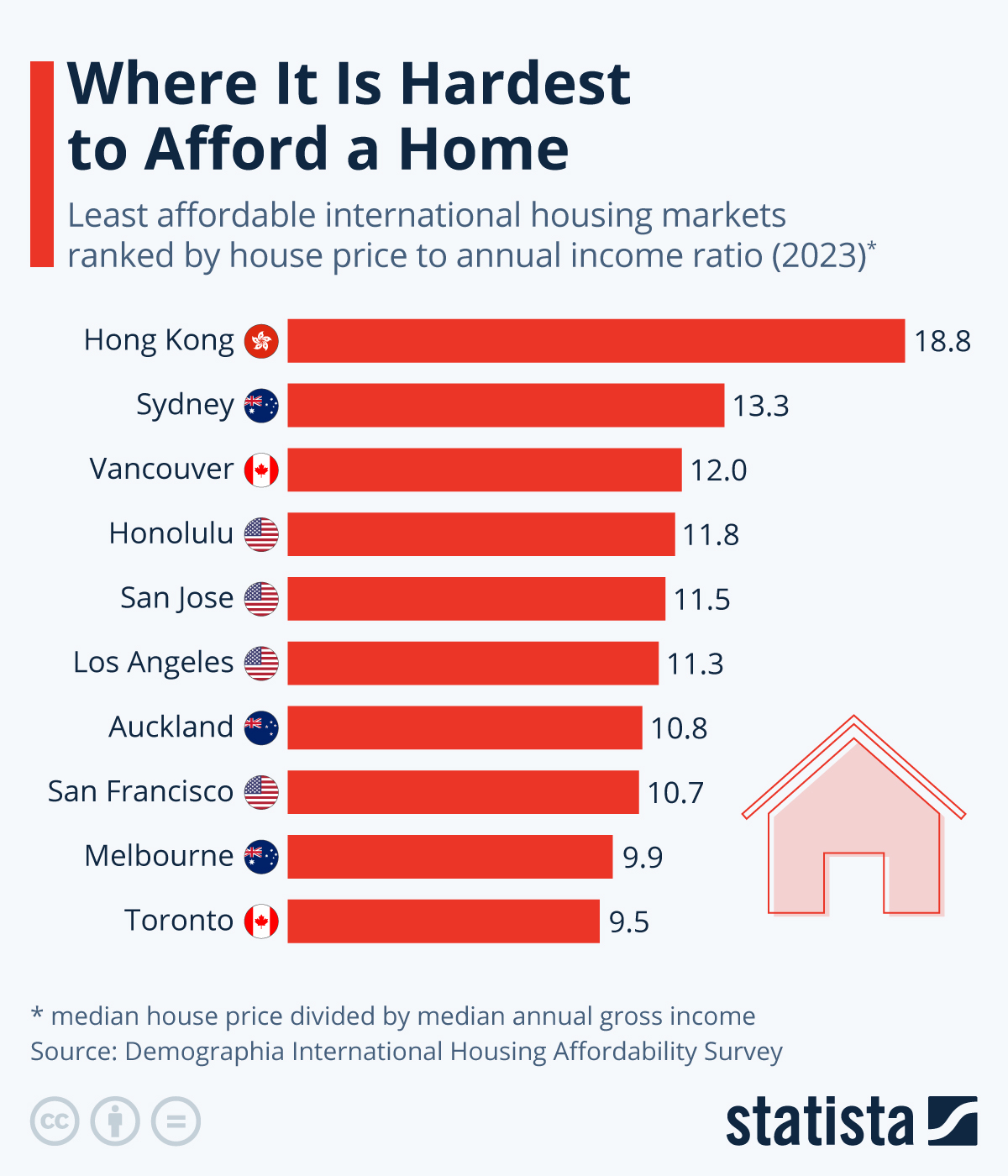

Source: Statista

Big cities like Hong Kong or Los Angeles are well-known for their expensive real estate markets. But there are also a lot of housing markets you wouldn’t necessarily expect among the least affordable – that includes several in Australia, New Zealand and Canada.

According to the 2023 International Housing Affordability Survey by Demographia, three out of the 10 least affordable housing markets are in Australia and New Zealand, two are in Canada and four more are located in the United States. The least affordable housing market is Hong Kong. Here, the median house or apartment price is almost 19 times as high as the median annual gross household income. After Hong Kong, New Zealand and Australia were the least affordable countries overall in the study which looked at the U.S., Canada, the UK, Hong Kong, Singapore, Australia, New Zealand and Ireland.