BuyAbility, an innovative new tool from Zillow Home Loans, combines real-time mortgage rates with a buyer’s credit score and income to determine a home price comfortably within budget

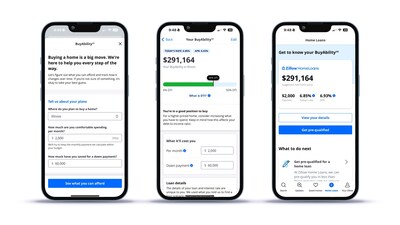

SEATTLE, May 13, 2024 (PRNewswire) Today, Zillow Home Loans is introducing BuyAbility, a new tool that addresses one of the biggest considerations buyers face today: understanding what they can afford. Only offered on Zillow, BuyAbility gives buyers a personalized, real-time estimate of the home price and monthly payment that fits within their budget, and then gives insight into the likelihood of qualifying for a loan. BuyAbility is powered by real-time mortgage rates from Zillow Home Loans.

BuyAbility is a new way for buyers to understand what they can afford, giving them the information they need to make educated decisions about where they call home. The interplay between mortgage rates and a buyer’s credit score are important factors in determining affordability, but most calculators don’t factor this in. Buyers just need to add a few simple inputs unique to their financial situation, such as income, credit score and the monthly amount they’re comfortable spending, into BuyAbility. Within seconds, a personalized, real-time estimate of the home price and monthly payment that fits within their budget pops up, along with insight into their likelihood of getting approved for a mortgage at this price point.

Buyers can get started on the Home Loans tab on Zillow’s app1. A shopper’s BuyAbility calculation will update regularly with changes to mortgage rates and their credit score.

“What many people don’t realize is that your mortgage rate is highly dependent on your credit score,” said Orphe Divounguy, senior economist at Zillow Home Loans. “The better your credit score, the lower the rate you’ll qualify for, potentially saving you hundreds of dollars a month. BuyAbility is personalized to a buyer’s credit score, income and down payment, and updated regularly to reflect current mortgage rates, giving home shoppers a true understanding of their buying power. BuyAbility is a great starting point for buyers who may be hesitant to look under the hood of their finances, or share personal details with a loan officer.”

If mortgage rates change, it impacts the home price a buyer can afford and their likelihood of getting approved for a mortgage, and BuyAbility will adjust for this in real-time. For example, a median-income household would be able to afford a $380,000 home with rates at 7%; if rates went down to 6%, that same household could afford a $420,000 home2. Checking their BuyAbility regularly gives shoppers a clear and current understanding of their financial picture at any given moment.

BuyAbility will change the way people shop for homes. Later this year, Zillow Home Loans will make it possible for buyers to shop for homes on Zillow using their BuyAbility — rather than a price range — allowing them to quickly identify homes that truly fit their budget. And since most people think about their finances in terms of monthly budgets, buyers will soon be able to see how much each home they look at on Zillow would cost them on a monthly basis, based on their BuyAbility.

BuyAbility is an innovation only Zillow Home Loans could accomplish, personalizing Zillow’s world-class shopping experience with a buyer’s unique financial data and real-time mortgage rates from Zillow Home Loans.

About Zillow Group:

Zillow Group, Inc. (Nasdaq: Z and ZG) is reimagining real estate to make home a reality for more and more people. As the most visited real estate website in the United States, Zillow and its affiliates help people find and get the home they want by connecting them with digital solutions, dedicated partners and agents, and easier buying, selling, financing and renting experiences.

Zillow Group’s affiliates, subsidiaries and brands include Zillow®, Zillow Premier Agent®, Zillow Home Loans℠, Trulia®, Out East®, StreetEasy®, HotPads®, ShowingTime+℠, Spruce® and Follow Up Boss®.

All marks herein are owned by MFTB Holdco, Inc., a Zillow affiliate. Zillow Home Loans, LLC is an Equal Housing Lender, NMLS #10287 (www.nmlsconsumeraccess.org). © 2023 MFTB Holdco, Inc., a Zillow affiliate.

(ZFIN)

__________________________

1 Available on iOS only, with Android launching later this year.

2 Assuming fixed rates and a 20% down payment.

SOURCE Zillow