Home Prices Outpacing Wages in 80 Percent of the U.S. Housing Markets

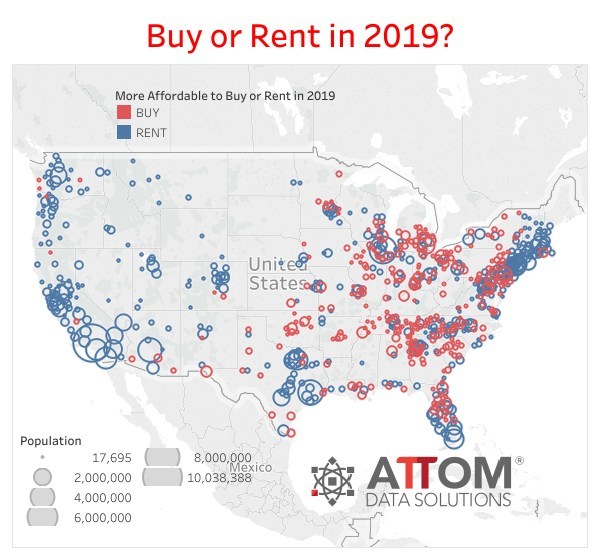

Irvine, CA – Jan. 10, 2019 (PRNewswire) ATTOM Data Solutions, curator of the nation’s premier property database, today released its 2019 Rental Affordability Report, which shows that renting a three-bedroom property is more affordable than buying a median-priced home in 442 of 755 U.S. counties analyzed for the report — 59 percent.

The analysis incorporated recently released fair market rent data for 2019 from the U.S. Department of Housing and Urban Development, wage data from the Bureau of Labor Statistics along with public record sales deed data from ATTOM Data Solutions in 755 U.S. counties with sufficient home sales data (see full methodology below).

“With rental affordability outpacing home affordability in the majority of U.S. housing markets, and home prices rising faster than rental rates, the American dream of owning a home, may be just that — a dream,” said Jennifer von Pohlmann, director of content and PR at ATTOM Data Solutions. “With home price appreciation increasing annually at an average of 6.7 percent in those counties analyzed for this report and rental rates increasing an average of 3.5 percent, coupled with the fact that home prices are outpacing wages in 80 percent of the counties, renting a home is clearly becoming the more attractive option in this volatile housing market.”

More Affordable to Rent Than Buy in Most U.S. Markets

Renting more affordable than buying in nation’s most populated counties

Renting is more affordable than buying a home in the nation’s 18 most populated counties and in 37 of 40 counties with a population of 1 million or more (93 percent) — including Los Angeles County, California; Cook County (Chicago), Illinois; Harris County (Houston), Texas; Maricopa County (Phoenix), Arizona; and San Diego County, California.

Other markets with a population of more than 1 million where it is more affordable to rent than to buy a home included counties in Miami, New York City, Seattle, Las Vegas, San Jose, San Francisco and Boston.

Among the 40 U.S. counties analyzed in the report with a population of 1 million or more, the three where it is more affordable to buy a home than rent were Wayne County (Detroit), Michigan; Philadelphia County, Pennsylvania; and Cuyahoga County (Cleveland), Ohio.

Least affordable rental markets in Northern California, Hawaii, D.C.

The report shows that renting a three-bedroom property requires an average of 38.0 percent of weekly wages across the 755 counties analyzed for the report.

The least affordable markets for renting are Santa Cruz County, California (81.7 percent of average wages to rent); Honolulu County, Hawaii (74.4 percent); Spotsylvania County, Virginia (73.0 percent); Maui County, Hawaii (69.5 percent); San Benito County, California (68.6 percent); Monroe County, Florida (67.3 percent); Sonoma County (Santa Rosa area), California (66.0 percent); Marin County (San Francisco area), California (65.6 percent); and Kings County, New York (63.7 percent).

Most affordable rental markets in Ohio, North Carolina, Wisconsin, Pennsylvania

The most affordable markets for renting are Roane County (Knoxville area), Tennessee (19.7 percent of average wages to rent); Peoria County, Illinois (23.8 percent); Mcminn County (Athens), Tennessee (23.8 percent); Green County (Dayton), Ohio (24.2 percent); and Rhea County (Dayton area), Ohio (24.6 percent).

Among counties with a population of 1 million or more, those most affordable for renting are Allegheny County (Pittsburgh), Pennsylvania (25.1 percent); Cuyahoga County (Cleveland), Ohio (25.6 percent); Saint Louis County, Missouri (26.4 percent); Oakland County (Detroit area), Michigan (26.7 percent); and Wayne County (Detroit), Michigan (27.7 percent).

Rent growth outpacing wage growth in 52 percent of markets

Average fair market rents rose faster than average weekly wages in 394 of the 755 counties analyzed in the report (52 percent), including Los Angeles County, California; Cook County (Chicago), Illinois; Harris County (Houston), Texas; Maricopa County (Phoenix), Arizona; and San Diego County, California.

Average weekly wages rose faster than average fair market rents in 361 of the 755 counties analyzed in the report (48 percent), including Kings County (Brooklyn), New York; Queens County, New York; Clark County (Las Vegas), Nevada; Tarrant County (Dallas-Fort Worth), Texas; Santa Clara (San Jose), California; Broward County (Miami), Florida; and Alameda (San Francisco), California.

Home prices rising faster than wages in 80 percent of markets

Median home prices rose faster than average weekly wages in 601 of the 755 counties analyzed in the report (80 percent), including Los Angeles County, California; Cook County (Chicago), Illinois; Harris County (Houston), Texas; Maricopa County (Phoenix), Arizona; San Diego County, California; Orange County, California; and Miami-Dade County, Florida.

Average weekly wages rose faster than median home prices in 154 of the 755 counties analyzed in the report (20 percent), including Kings County (Brooklyn), New York; Queens County, New York; King County (Seattle), Washington; Suffolk County, New York; and Bronx County, New York.

Home prices rising faster than rents in 70 percent of markets

Median home prices rose faster than average fair market rents in 531 of the 755 counties analyzed in the report, including Cook County (Chicago), Illinois; Harris County (Houston), Texas; Maricopa County (Phoenix), Arizona; Kings County (Brooklyn), New York; Queens County, New York; and Riverside County, California.

Average fair market rents rose faster than median home prices in 224 of the 755 counties analyzed in the report (30 percent), including Los Angeles County, California; San Diego County, California; Orange County, California; Miami-Dade County, Florida; Dallas County, Texas; and Kings County (Seattle), Washington.

Methodology

For this report, ATTOM Data Solutions looked at 50th percentile average rental data for three-bedroom properties in 2018 from the U.S. Department of Housing and Urban Development, along with Q2 2018 average weekly wage data from the Bureau of Labor Statistics (most recent available) and January-November (YTD) 2018 home price data from ATTOM Data Solutions publicly recorded sales deed data in 755 counties nationwide.

Rental affordability is average fair market rent for a three-bedroom property as a percentage of the average monthly wage (based on average weekly wages). Home buying affordability is the monthly house payment for a median-priced home (based on a 3 percent down payment and including mortgage, property tax, homeowner’s insurance and private mortgage insurance) as a percentage of the average monthly wage.

About ATTOM Data Solutions

ATTOM Data Solutions provides premium property data to power products that improve transparency, innovation, efficiency and disruption in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes and enhances the data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 9TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include bulk file licenses, APIs, market trends, marketing lists, match & append and more.

Media Contact:

Christine Stricker

(949) 748-8428

christine.stricker@attomdata.com

Data and Report Licensing:

(949) 502-8313

datareports@attomdata.com