– Quicken Loans’ National HPPI shows appraised values 0.53% lower than homeowners estimated in February

– Home values dipped 0.07% nationally in February, but posted a 6.37% year-over-year increase, according to the Quicken Loans HVI

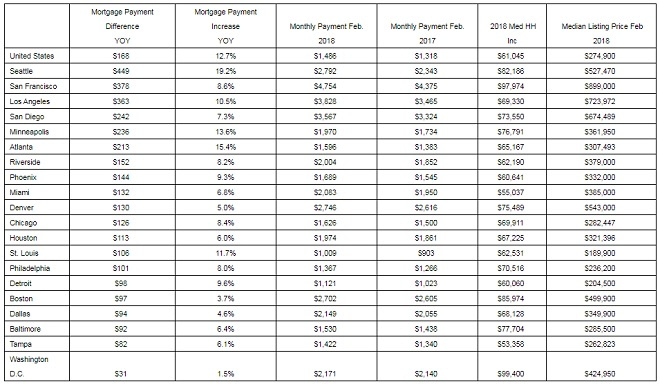

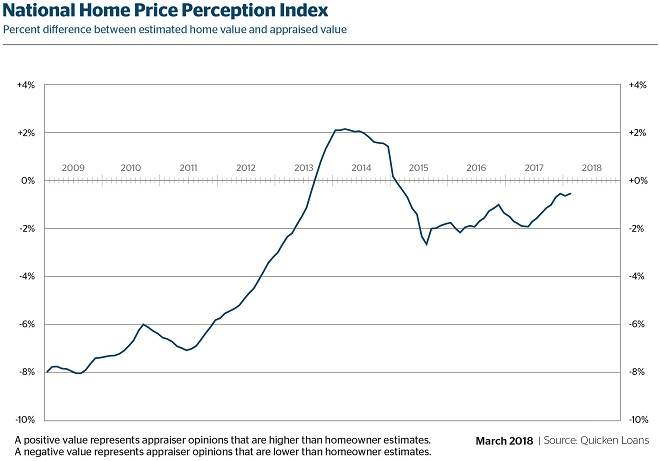

Detroit, MI – March 13, 2018 (PRNewswire) The trend of home value opinions from appraisers and owners moving ever-closer together resumed in February, after taking a step back the previous month. The National Quicken Loans Home Price Perception Index (HPPI) showed appraisal values in February were an average of 0.53 percent below homeowner estimates. This is the fifth consecutive month the gap between the two values has been less than 1 percent.

Home appraisal values were nearly flat in February, posting a 0.07 percent dip from January, according the National Quicken Loans Home Value Index (HVI). Appraisal values jumped 6.37 percent compared to February 2017, which is a smaller annual increase than in January, when values were 7.03 percent higher than the previous year.

Home Price Perception Index (HPPI)

Appraisals continue to fall short of owner expectations, however, the difference between the two data points is shrinking. The Quicken Loans HPPI reported appraiser opinions of home values were an average of 0.53 percent lower than what owners expected, at a national level. Bucking the national trend, more than three quarters of metro areas measured have appraisal values that are higher than owner estimates. The leader among them is Dallas, with appraisals an average of 2.72 percent higher than expected.

“The Home Price Perception Index is a perfect example of how localized housing is across the country,” said Bill Banfield, Quicken Loans Executive Vice President of Capital Markets. “The fact that appraisals are showing home values nearly three percent higher than expected in Dallas, but the average appraisal is lower than the owner estimates by almost 2 percent in Philadelphia, illustrates this to a tee. Dallas is an incredibly hot housing market right now and appraisers are seeing just how fast home values are climbing. When shopping for a home, or even refinancing a current mortgage, consumers should always keep the changes in their local market in mind before estimating a home’s value.”

Home Value Index (HVI)

The Quicken Loans HVI reported that annual home equity continued its ascent in February, but the pace slowed slightly. Appraisal values increased 6.37 percent compared to February 2017, despite a monthly decrease of just 0.07 percent. The West was the only region with a monthly drop in home values, showing a 1.87 percent decrease from January to February. On the other hand, the Midwest had the largest gain in year-over-year home value growth, showing a 7.23 percent jump from February 2017.

“With little movement in the HVI data from January to February, it’s clear the same narrative from the beginning of the year remains,” said Banfield. “Low home inventory continues to be a drag on the housing market. As the economy grows and more consumers are in the right place financially to purchase a home, the high demand is driving prices up. As we move into the spring selling season, all eyes will be on whether today’s strong economy can support the higher prices.”

About the HPPI & HVI

The Quicken Loans HPPI represents the difference between appraisers’ and homeowners’ opinions of home values. The index compares the estimate that the homeowner supplies on a refinance mortgage application to the appraisal that is performed later in the mortgage process. This is an unprecedented report that gives a never-before-seen analysis of how homeowners are viewing the housing market. The HPPI national composite is determined by analyzing appraisal and homeowner estimates throughout the entire country, including data points from both inside and outside the metro areas specifically called out in the above report.

The Quicken Loans HVI is the only view of home value trends based solely on appraisal data from home purchases and mortgage refinances. This produces a wide data set and is focused on appraisals, one of the most important pieces of information to the mortgage process.

The HPPI and HVI are released on the second Tuesday of every month. Both of the reports are created with Quicken Loans’ propriety mortgage data from the 50-state lenders’ mortgage activity across all 3,000+ counties. The indexes are examined nationally, in four geographic regions and the HPPI is reported for 27 major metropolitan areas. All indexes, along with downloadable tables and graphs can be found at QuickenLoans.com/Indexes.

About Quicken Loans

Detroit-based Quicken Loans Inc. is the nation’s largest mortgage lender. The company closed more than $400 billion of mortgage volume across all 50 states from 2013 through 2017. Quicken Loans moved its headquarters to downtown Detroit in 2010, and now more than 17,000 team members from Quicken Loans and its Family of Companies work in the city’s urban core. The company generates loan production from web centers located in Detroit, Cleveland and Scottsdale, Arizona. The company also operates a centralized loan processing facility in Detroit, as well as its San Diego-based One Reverse Mortgage unit.

Quicken Loans ranked “Highest in Customer Satisfaction for Primary Mortgage Origination” in the United States by J.D. Power for the past eight consecutive years, 2010 – 2017, and highest in customer satisfaction among all mortgage servicers the past four years, 2014 – 2017.

Quicken Loans was ranked No. 10 on FORTUNE magazine’s annual “100 Best Companies to Work For” list in 2017, and has been among the top 30 companies for the past 14 consecutive years. The company has been recognized as one of Computerworld magazine’s “100 Best Places to Work in IT” the past 13 years, ranking No. 1 for eight of the past 12 years, including 2017. The company is a wholly-owned subsidiary of Rock Holdings, Inc., the parent company of several FinTech and related businesses. Quicken Loans is also the flagship business of Dan Gilbert’s Family of Companies comprising nearly 100 affiliated businesses spanning multiple industries. For more information and company news visit QuickenLoans.com/press-room.