LendingTree study analyzes the savings available by comparing mortgage rates across the country

Charlotte, NC – N.C., Oct. 17, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released its report on where borrowers can save the most by shopping around for mortgage loans.

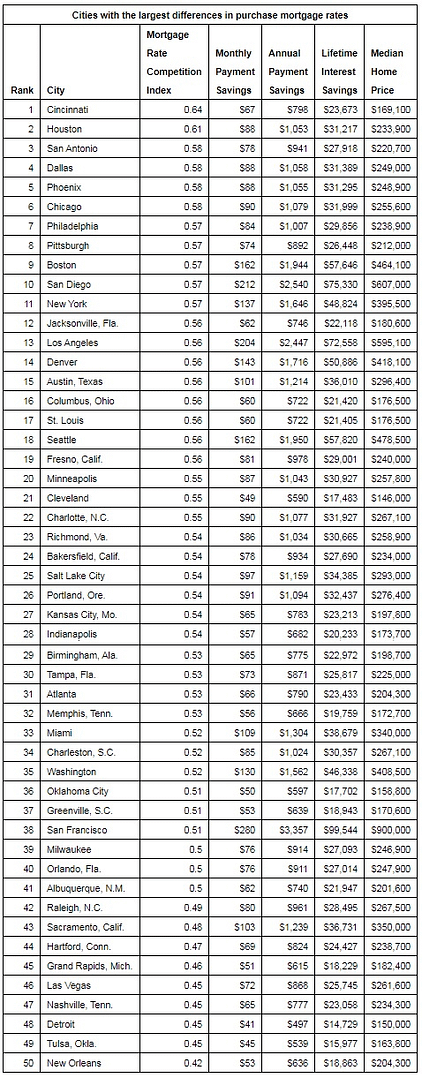

As interest rates rise, the amount of money consumers can save by shopping around and comparing offers can change. To help consumers understand how much they can save, LendingTree created a Mortgage Rate Competition Index that measures the basis point spread between high and low APRs offered to users through the LendingTree marketplace. This report uses that index to analyze the rate difference and dollar savings for the 50 largest metropolitan areas in the United States. Analysts review the same rate difference and savings on a national basis in the weekly Mortgage Rate Competition Index.

“If you are shopping for a home in San Francisco, taking the first mortgage offer you receive and not comparing it could cost you nearly $100,000 in interest over the life of your loan,” said Tendayi Kapfidze, Chief Economist at LendingTree. “In Cincinnati, it could cost you nearly $24,000. LendingTree, the nation’s leading online loan marketplace, allows consumers to shop around and compare mortgage offers, potentially saving them thousands of dollars.”

Key findings:

- Homebuyers in Cincinnati and Houston had the biggest potential rate savings by comparing competing offers. Rates in Cincinnati had a range of 64 basis points, followed by Houston at 61, then San Antonio, Dallas, Phoenix and Chicago at 58.

- Comparing mortgage offers before buying saved the most money in California. Large loan sizes fuel lifetime savings of $99,544 in San Francisco, $75,330 in San Diego and $72,557 in Los Angeles.

- Significant savings for purchase borrowers in every city. The index ranges from 42 basis points in New Orleans to 64 in Cincinnati.

- Monthly savings up to $279. For borrowers in San Francisco, a spread of 51 points translates into $279 a month, given the median home price of $900,000.

- Even less expensive cities register meaningful savings. In Detroit, a low median home price of $150,000 and narrow spread of 45 points still adds up to $14,729 in lifetime interest savings.

- Individual borrower results will vary. LendingTree’s method uses median values, so half of borrowers would see smaller savings. But, just as important, half could see larger savings. There is no way for a borrower to know where they fall in this spectrum without shopping around, so it is imperative to compare offers.

Where purchase borrowers face the largest differences in mortgage rates

Cincinnati

Purchase Mortgage Rate Competition Index: 0.64

With a median home price of $169,100, borrowers here could save $67 in monthly payments, adding up to $798 a year. Lifetime interest savings would be $23,672.

Houston

Purchase Mortgage Rate Competition Index: 0.61

With a median home price of $233,900, borrowers here could save $88 in monthly payments, adding up to $1,053 a year. Lifetime interest savings would be $31,217.

San Antonio

Purchase Mortgage Rate Competition Index: 0.58

With a median home price of $220,700, borrowers here could save $78 in monthly payments, adding up to $941 a year. Lifetime interest savings would be $27,918.

Where purchase borrowers could save the most in lifetime interest expense

San Francisco

Lifetime interest savings: $99,544

An index of 0.51 and median home price of $900,000 adds up to savings of $280 in monthly payments, totaling $3,357 a year.

San Diego

Lifetime interest savings: $75,330

An index of 0.57 and median home price of $607,000 adds up to savings of $212 in monthly payments, totaling $2,540 a year.

Los Angeles

Lifetime interest savings: $72,558

An index of 0.56 and median home price of $595,100 adds up to savings of $204 in monthly payments, totaling $2,447 a year.

Where refinance borrowers face the largest differences in refinance mortgage rates

Bakersfield, Calif.

Refinance Mortgage Rate Competition Index: 0.81

With a median home price of $234,000, borrowers here could save $116 in monthly payments, adding up to $1,389 a year. Lifetime interest savings would be $41,163.

Oklahoma City

Refinance Mortgage Rate Competition Index: 0.72

With a median home price of $158,800, borrowers here could save $70 in monthly payments, adding up to $839 a year. Lifetime interest savings would be $24,893.

Detroit

Refinance Mortgage Rate Competition Index: 0.72

With a median home price of $150,000, borrowers here could save $66 in monthly payments, adding up to $788 a year. Lifetime interest savings would be $23,383.

To view the full report, click here.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online marketplace that connects consumers with the choices they need to be confident in their financial decisions. LendingTree empowers consumers to shop for financial services the same way they would shop for airline tickets or hotel stays, comparing multiple offers from a nationwide network of over 500 partners in one simple search, and can choose the option that best fits their financial needs. Services include mortgage loans, mortgage refinances, auto loans, personal loans, business loans, student refinances, credit cards and more. Through the My LendingTree platform, consumers receive free credit scores, credit monitoring and recommendations to improve credit health. My LendingTree proactively compares consumers’ credit accounts against offers on our network, and notifies consumers when there is an opportunity to save money. In short, LendingTree’s purpose is to help simplify financial decisions for life’s meaningful moments through choice, education and support. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information, go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

Media Contact:

press@lendingtree.com

Like this:

Like Loading...