To publish an AgencyLogic single property Website PowerSite Pro, follow these steps.

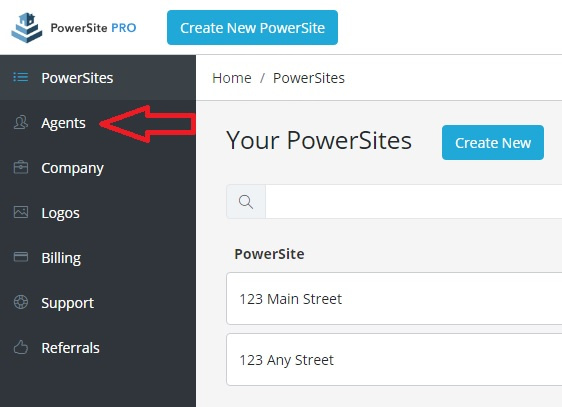

Step 1:

Visit PowerSitePro.com and login:

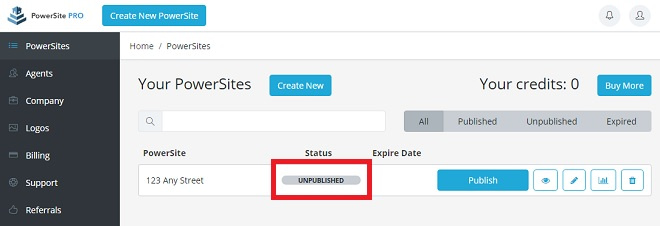

Step 2:

If you have previously create a single property Website, but not published it, you will see the PowerSite listed on the dashboard:

Step 3:

Click the “Publish” button:

Step 4:

Read the “What is Publishing” message, and then click the “OK” button:

Step 5:

Enter the domain name you would like to use for your single Property Website and click the “Search” button (remember to include the Top Level Domain i.e. .com, .net., .info):

A real time lookup of the domain name takes place. If the domain name isn’t available, you will see this message:

If you see this message, you have to chose a different domain name.

Step 6:

If the domain name is available, you will then see the “Payment Selection” window. You can either:

Use a saved credit card

Use a new credit card

Use a pre-purchased site credit.

Select your payment preference and click the “Publish PowerSite” button. Your Website will be live within minutes.

If you have additional questions, email: support@agencylogic.com

Or give us a call on: (888) 201-5160