A shift towards a buyer’s market may be underway, according to a new Trulia analysis

San Francisco, CA – Oct. 11, 2018 (PRNewswire) The share of home listings with a price cut grew to its highest level since 2014, according to a new analysis from Trulia®, a home and neighborhood site for home buyers and renters. In August 2018, 17.2 percent of U.S. listings had a price cut, up from 16.7 percent a year ago.

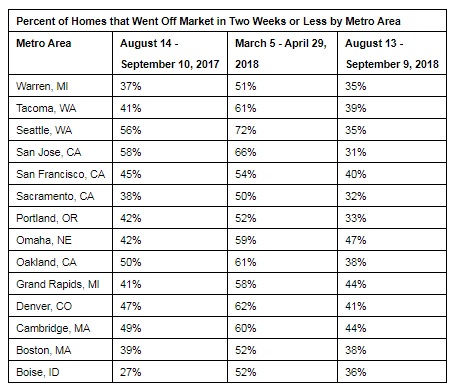

For much of the first half of 2018 the share of listings on Trulia with a price cut was largely unchanged from 2017, before shooting up in July and August. Coupled with home price growth that has begun to slow, and inventory levels that are creeping back up in some places, a higher rate of price cuts could be a critical third confirmation that things may finally be shifting in buyers’ favor.

“Buyers should be encouraged by the signals we’re seeing in the market,” Trulia Housing Economist Felipe Chacon. “But not all buyers will benefit equally, and it pays to do research on your preferred neighborhood. Price reductions typically aren’t uniformly spread out across a given city – some neighborhoods might have a lot of listings with a reduced price, others may have none. Our research shows that price cuts are much more prevalent in higher-cost neighborhoods, so budget-conscious buyers may have some trouble finding a bargain.”

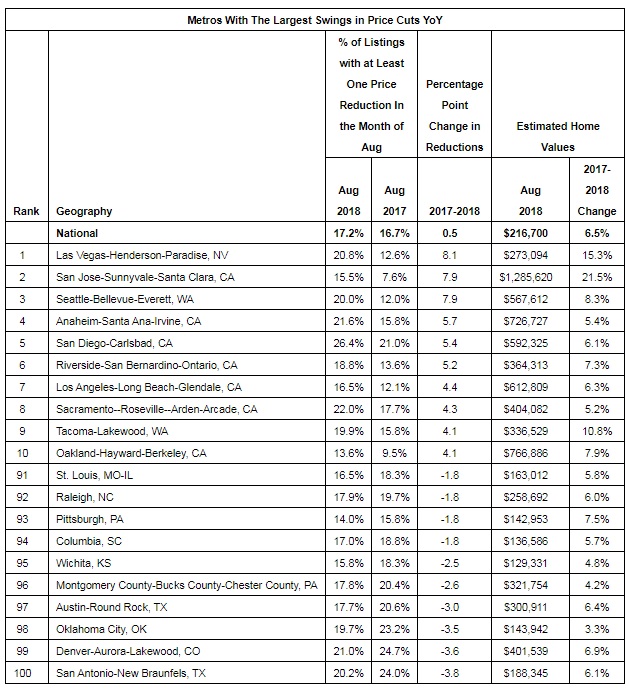

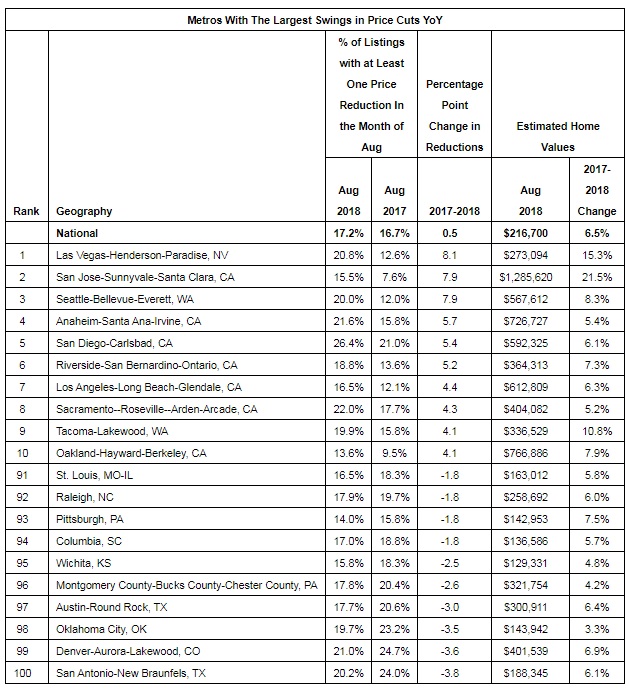

Of the top 100 metros, 63 had a higher share of listings with a price cut this August than last August – and some of the priciest and/or fastest-growing markets experienced the biggest jump. In fast-moving Las Vegas, the share of listings with a price cut rose from roughly one-in-eight a year ago (12.6 percent) to more than one-in-five currently (20.8 percent) – the largest percentage-point jump among all metros analyzed. In San Jose, where the median home is worth more than $1.2 million and home values are growing more than 20 percent year-over-year, the share of listings with a price cut in August more than doubled compared to August 2017.

Better Bargains in Expensive Neighborhoods

While increasing price reductions is welcome news for most, not all home buyers are likely to benefit equally. To run our analysis at the neighborhood level, we examined all listings in a given area over the past 12 months (Sept 2017 – Aug 2018) and calculated the percent of these listings that had at least one price reduction over the course of the year.

In 79 of the largest 100 metros, a higher share of homes listed in more-expensive neighborhoods are experiencing price reductions than those listed in less expensive areas. In Camden, N.J., 21.5 percent of listings in the most expensive neighborhood of Springdale had a price cut; while in Bergen Square, one of Camden’s least-expensive neighborhoods, just 8.6 percent of listings had a price cut. Similarly, Raleigh N.C.’s, more expensive Glenwood and Five Points neighborhoods have seen 18.9 percent and 16.7 percent of their listings go through at least one price cut over the past 12 months; while the less expensive areas of South Raleigh and Southeast Raleigh only saw 5.8 percent and 6.7 percent of listings with a price cut.

Size of Price Cuts Continue to Shrink

Although we’re seeing more price cuts nationwide, the reductions themselves are getting smaller. For the 12 months ending August 2018, the median price reduction nationwide knocked 2.6 percent off the listing price. This has been declining steadily since 2012, when the median price reduction was 4 percent. The median value of a price reduction today is less than the median price reduction at the outset of the recovery in 97 of the 100 largest metros analyzed.

The smallest price cuts today, at just 1.3 percent at the median, can currently be found in San Antonio. The largest price drops are found on homes in San Francisco and Detroit, where listings that go through a price reduction see a median drop of 4.6 percent and 4.1 percent, respectively.

Note: Click here for the full data

For more information, please check out Trulia’s Latest Price Cuts Report for a more detailed analysis.

About Trulia

Trulia’s mission is to build a more neighborly world by helping you discover a place you’ll love to live. Homebuyers and renters use Trulia’s website and suite of mobile apps to get a deeper understanding of homes and neighborhoods across the U.S. through personalized recommendations, insights sourced straight from locals, and 34 neighborhood map overlays that offer details on commute, reported crime, schools, nearby businesses, and more. Founded in 2005, Trulia is based in San Francisco, and owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG). Trulia is a registered trademark of Trulia, LLC.

For further information:

pr@trulia.com

Like this:

Like Loading...