Washington, D.C. – July 12, 2023 (BUSINESS WIRE) Today, Apartments.com – a CoStar Group online marketplace – released an in-depth report of multifamily rent growth trends for the second quarter of 2023. Supply continues to outpace demand across the country with 520,000 new units expected to be delivered by the end of the year.

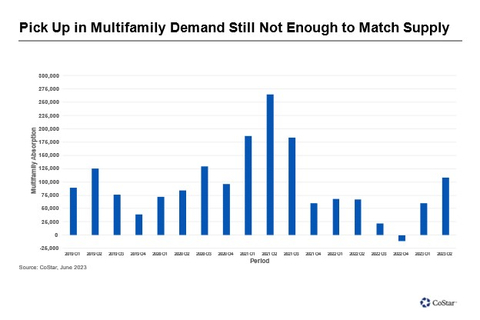

“Over the past six quarters, supply has continued to outpace demand and the second quarter of 2023 was no exception,” said Jay Lybik, National Director of Multifamily Analytics at CoStar Group. “Despite positive absorption and rising renter demand, it was not enough to match the 140,000 units delivered in the quarter which pushed the national vacancy rate higher.”

SUPPLY CONTINUES TO OUTPACE DEMAND

Across the multifamily industry, supply has outpaced demand for the past six quarters and the second quarter of 2023 kept to the same trend. More than 107,000 units were absorbed this quarter – a number that hasn’t been seen since the third quarter of 2021 – as demand began to recover. While a positive sign for apartment demand, it didn’t match the 140,000 units delivered during the second quarter, increasing the national vacancy rate by 10 basis points, to 6.8%, at the end of June.

SUN BELT SUPPLY-DEMAND IMBALANCES GROW

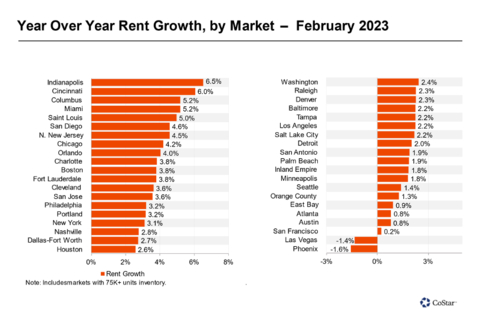

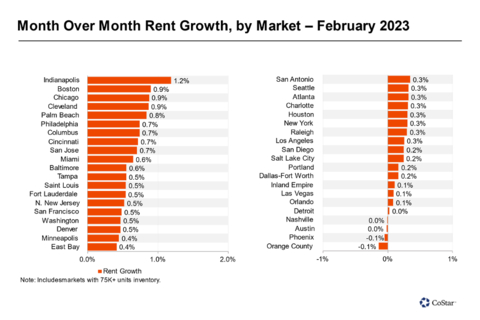

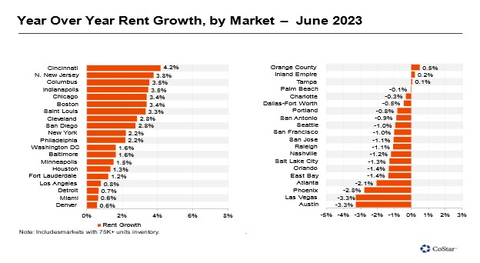

Increasing vacancy rates have led to the deceleration of year-over-year asking rent growth, from 2.8% to 1.1% over the second quarter of 2023. Sun Belt markets, which experienced the fastest rent growth in 2021 and the first half of 2022, are now facing the largest imbalance between supply and demand. Developers continue to deliver record numbers of units, but there are not enough renter households filling them. Many of these markets finished the second quarter with negative year-over-year rent growth, including Las Vegas and Austin with 21.4% and 17.7% rent growth, respectively, at the end of 2021 to negative 3.3% today.

MIDWEST MARKETS DOMINATE RENT GROWTH

On the other hand, Midwest markets dominate the list of those with positive rent growth. Cincinnati holds the top spot for rent growth in the second quarter of 2023 at 4.2% and five other Midwest markets are among the top 10 rent growth leaders. Multifamily conditions are significantly more balanced in the Midwest as opposed to the Sun Belt due to limited new supply additions.

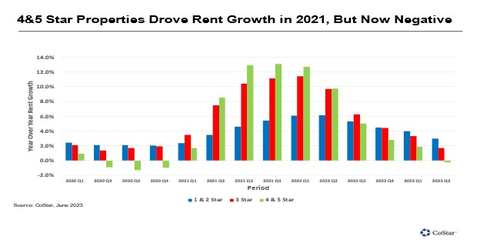

RENT GROWTH DECREASES AMONGST 4- AND 5-STAR PROPERTIES

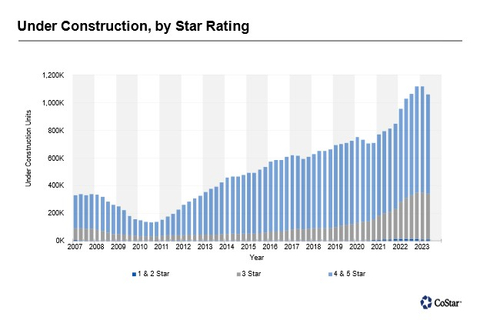

Nationally, multifamily units under construction remain above one million, the largest pipeline since the early 1970s. Of these units, 70% are aimed at the top end of the market. Current projections show 520,000 units will be delivered this year, boosting 4- and 5-star vacancy rates to 9.1% at the end of June and bringing top-end annual rent growth to negative 0.2%.

HIGHER VACANCY RATES AND SLOW RENT GROWTH EXPECTED TO PREVAIL THROUGHOUT 2023

The elevated delivery schedule is expected to persist into 2024 and without a meaningful recovery in demand, vacancy rates will likely rise further and slow to no rent growth will be seen through the first half of 2024. Projections suggest that 16 major markets will experience annual rent growth in the negative by the end of the year, with the majority witnessing annual rent gains slower than their five-year pre-pandemic average.

About CoStar Group

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with over twelve million monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France’s leading commercial real estate news service. Thomas Daily is Germany’s largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group’s websites attract nearly 100 million unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

About Apartments.com

Apartments.com is the leading online apartment listing website, offering renters access to information on more than 1,000,000 available units for rent. Powered by CoStar, the Apartments.com Network of sites includes Apartments.com, ApartmentFinder.com, ApartmentHomeLiving.com, Apartamentos.com, WestsideRentals.com, ForRent.com, ForRentUniversity.com, After55.com and CorporateHousing.com.

Apartments.com is supported by the industry’s largest professional research team, which has visited and photographed over 500,000 properties nationwide. The team makes over one million calls each month to apartment owners and property managers, collecting and verifying current availabilities, rental rates, pet policies, fees, leasing incentives, concessions, and more. Apartments.com offers more rental listings than any other apartments website, and innovative features including a drawing tool that allows users to define their own search areas on a map, and a “Travel Time” feature that lets users search for rentals in proximity to a specific address. Apartments.com creates easy access to its listings through a responsive website and iOS and Android apps, and provides unmatched exposure for its advertisers through an intuitive name, strategic search engine placements and innovative emerging media.

The Apartments.com Network reaches millions of renters nationwide, driving both qualified traffic and highly engaged renters to leasing offices.

This news release includes “forward-looking statements” including, without limitation, statements regarding CoStar’s expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2022 and Form 10-Q for the quarterly period ended March 31, 2023, each of which is filed with the SEC, including in the “Risk Factors” section of those filings, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Contacts

News Media

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com