LendingTree Study Reveals Where Homebuyer Competition is Toughest Based on Down Payment Percentages, Credit Scores and Pre-Approved Financing

Charlotte, NC – Jan. 18, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, has released the findings of its study on where homebuyers will face the fiercest competition to achieve their dream of homeownership in 2018.

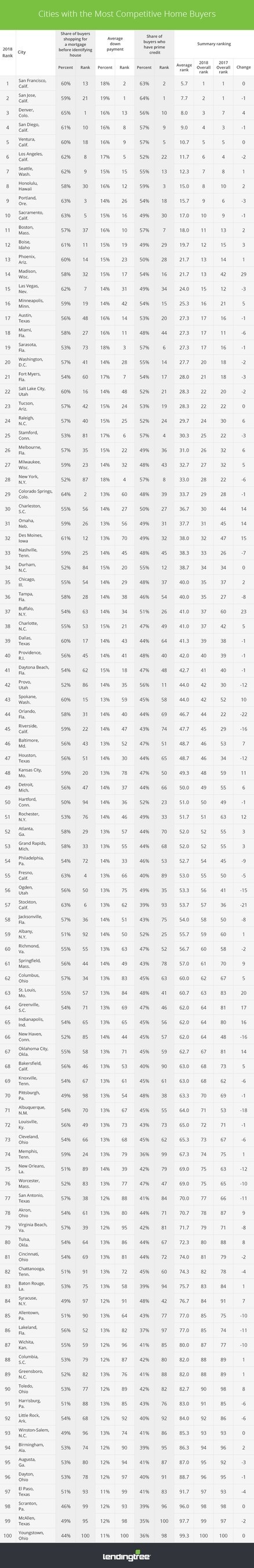

We’ve been hearing for years about competitive housing markets, but with low levels of housing inventory and rising home prices, almost any market can be competitive. What it really comes down to is the competition among buyers. That’s why LendingTree ranked the top 100 Most Competitive Homebuyer Markets based on the house hunters who are putting more money down, have high credit scores and start loan shopping before home shopping.

LendingTree looked at 1.5 million purchase mortgage loan requests that came through the LendingTree marketplace in the 100 largest cities in 2017. The study ranks cities using three criteria:

- The share of buyers shopping for a mortgage before identifying the house they want. Buyers with financing in place are more appealing to sellers and can compete with cash buyers.

- Average down payment percentage. Having a higher amount of money saved for a down payment can enable you to borrow more money or be offered a lower interest rate, allowing you to make a stronger offer.

- Percentage of buyers who have prime credit (above 680). Borrowers with higher scores have more financing options to make more competitive offers. The cities/markets below are ranked for 2018 using the criteria noted above, including the relative data used to determine the ranking along with the market’s overall rank from the prior year.

Key Findings:

California markets dominate the top 10.

Six of the top 10 most competitive housing markets are in California. San Francisco and San Jose lead the rankings in 2018, with a vast number of credit-worthy and well-heeled borrowers making it one of the most challenging markets for prospective home shoppers.

Some 60 percent of home shoppers applied for a mortgage before identifying a house. The two cities also came to the table with the highest average down payment of any region, at 19 percent. Furthermore, nearly two-thirds (64%) of Bay Area shoppers had prime credit scores, above 680.

Tech industries are key.

The strength in the Bay Area may be attributed to the concentration of high-paying technology jobs. This also applies to Seattle, which came in at No. 7, and Portland at No. 9.

Go west. When you get to the water, keep going.

The top 10 are all in western states. If you go further west you get to Honolulu, another top 10 city. The rest of the country comes into play with Boston at No. 11, also a technology hub.

The opposite to being the most competitive is not a bad thing. Here are the most accessible cities:

At the other end of the list are three cities where less than half of home shoppers apply for their mortgage before house hunting; the average home shopper offers a down payment of just 12 percent and less than 40 percent of shoppers have prime credit scores. This is great news for buyers in Youngstown, Ohio, McAllen, Texas, and Scranton, Pa., and other accessible cities, which are often in rustbelt and southern states, as homeownership is accessible to a larger part of the population.

Regardless of the level of competition in your area, being a well-prepared buyer increases your odds of securing that dream home. The most significant of the three variables is having financing in place, giving homebuyers a leg up on the competition and reducing delays in the process. Buyers with less cash available for a down payment or those with less than perfect credit should start the loan process even earlier to get pre-approved before house hunting. Homebuyers across the credit or down payment spectrum should check their credit scores beforehand, know what they can reasonably afford, and shop around for multiple loan offers since interest rates vary between lenders – regardless of whether they are in the hottest, or most accessible housing markets in America.

For more information on the study, click here.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

(704) 943-8208

Megan.greuling@lendingtree.com

Like this:

Like Loading...