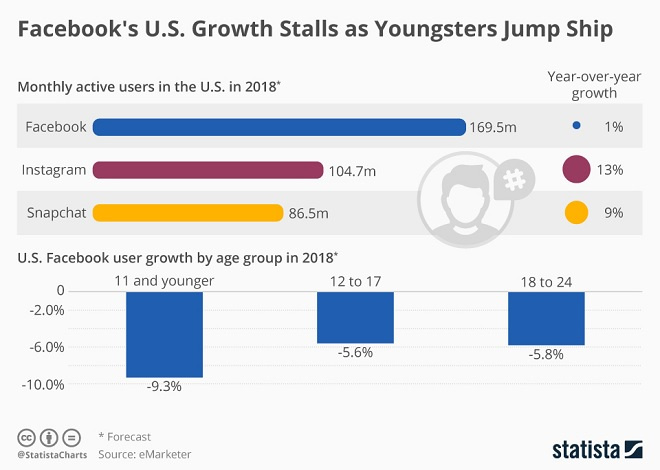

Source: Statista

When Facebook reported its fourth quarter results on January 31, the company had to admit for the first time that its user base in the United States and Canada had stopped growing on a quarter-over-quarter basis. While the number of monthly active users remained flat at 239 million between Q3 and Q4 2017, the number of daily active users even declined from 185 to 184 million users.

According to eMarketer’s latest forecast on social network usage in the United States, this trend will continue through 2018. eMarketer predicts that Facebook’s U.S. user base will grow by less than 1 percent this year as young Americans appear to lose interest in what they probably feel has become a social network for the elderly.

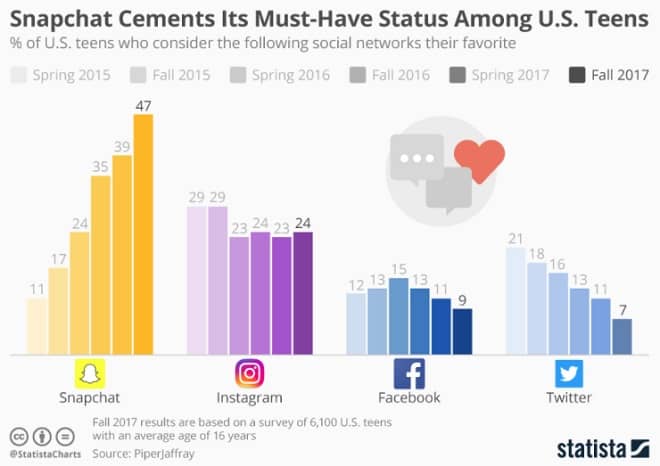

As our chart illustrates, Facebook is expected to see an exodus of users aged 11 to 24 this year. While a lost user is never good for the company running the affected platform, Facebook can probably take solace in the fact that most of its young deserters will remain active on Instagram, the platform that Facebook foresightedly acquired in 2012.