Boston and San Jose Both Saw Home-Sale Prices Fall Year Over Year in December

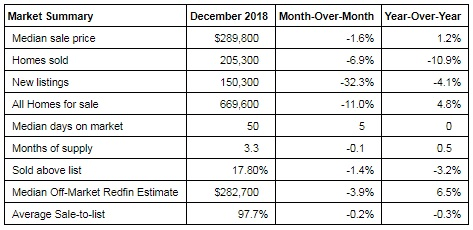

Seattle, WA – Jan. 17, 2019 (PRNewswire) (NASDAQ: RDFN) — U.S. home-sale prices increased just 1.2 percent in December compared to a year ago to a median of $289,800, according to a housing market analysis from Redfin (www.redfin.com), the next-generation real estate brokerage. The year-over-year increase in home prices was the smallest since the number went positive in March 2012.

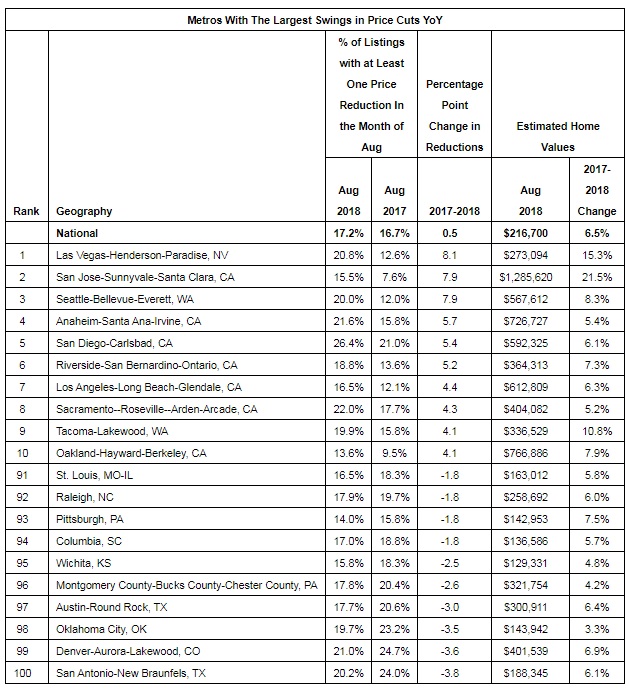

The median sale price of homes sold in December fell since last year in nine of the 76 largest metro areas Redfin tracks, including San Jose (-7.3%) and Boston (-1.0%). December was the first month either metro saw home prices fall year over year since January 2012. The swing in home prices has been especially dramatic in San Jose, which saw year-over-year gains in excess of 20 percent between November 2017 and June 2018.

Meanwhile, the national number of completed home sales fell faster than it has in two and a half years, down 10.9 percent from December 2017. Home sales declined in 69 of the 76 largest metro areas that Redfin tracks.

“December may feel like a foot on the brake, but the housing market was going over the speed limit,” said Redfin chief economist Daryl Fairweather. “Home prices have been growing faster than wages since 2012, and that can’t go on forever. Now that price growth has slowed down and more homes are sitting on the market, buyers will have the upper hand in 2019. Buyers will have more options with more homes for sale, and it will be sellers working to woo buyers into making an offer. And as a bonus, buyers, for the time being, have the benefit of mortgage interest rates that are lower than they were in late 2018, which will make borrowing more affordable.”

The number of homes newly listed for sale in December fell from a year earlier (-4.1%), but due to the large decrease in home sales, the growth in the number of homes for sale on the market hit a 42-month high, rising 4.8 percent in December.

“Buyers shopping now are benefiting from sellers who are willing to negotiate, since it’s anyone’s guess what the spring real estate market will look like,” said Seattle-based Redfin agent Jessie Culbert. “Well-priced, appealing homes are seeing the return of pre-inspections and even multiple offer situations, so it may be too soon to get comfortable with the idea of a slower market.”

Of the 76 largest metro areas in the country, 46 saw an increase in the number of homes for sale compared to a year earlier, with the largest gains coming in San Jose (+131.3%), Seattle (+117.8%) and Oakland (+69.0%). The metro areas with the biggest decline in homes for sale were New Orleans (-32.3%), Montgomery County, PA (-24.3%) and Philadelphia (-22.4%).

Across Redfin metros, the typical home that sold in December went under contract in a median of 50 days, the same speed as a year earlier. This past December, 18 percent of homes sold above the list price, down from 21 percent from the prior December. Meanwhile the share of homes with a price drop dipped to 16 percent, slightly higher than December 2017’s share of 14 percent. The share of homes that went under contract within two weeks was up month-over-month, increasing from 25 percent in November to 31 percent in December, but was down from 34 percent in December 2017.

Other December Highlights

Competition

- Grand Rapids, MI was the fastest market, with half of all homes pending sale in just 21 days, down from 26 days a year earlier. Boston and Omaha, NE were the next fastest markets with 23 median days on market, followed by Philadelphia (25) and Rochester, NY (28).

- The most competitive market in December was San Francisco where 52.2% of homes sold above list price, followed by 41.5% in Oakland, CA, 39.6% in San Jose, CA, 32.8% in Tacoma, WA, and 31.9% in Buffalo, NY.

Prices

- Pittsburgh had the nation’s highest price growth, rising 11.7% since last year to $162,000. Salt Lake City had the second highest growth at 10.0% year-over-year price growth, followed by Greenville, SC (9.5%), New Haven, CT (8.8%), and Las Vegas (8.6%).

- 9 metros saw price declines in December. Honolulu home prices declined the most since last year falling 9 percent to $537,000.

Sales

Sacramento, CA saw the largest decline in sales since last year, falling 26.4%. Home sales in Orange County, CA and Seattle declined by 22.5% and 22.0%, respectively.

Nassau & Suffolk Counties, NY led the nation in year-over-year sales growth, up 22.1%, followed by Camden, NJ, up 17.0%. Detroit rounded out the top three with sales up 6.9% from a year ago.

Inventory

- San Jose, CA had the highest increase in the number of homes for sale, up 131.3% year over year, followed by Seattle (117.8%) and Oakland, CA (69.0%).

- New Orleans had the largest decrease in overall inventory, falling 32.3% since December 2017. Montgomery County, PA (-24.3%), Philadelphia (-22.4%), and Rochester, NY (-22.3%) also saw far fewer homes available on the market than a year ago.

To read the full report, complete with graphs, charts and market-level data, please visit: www.redfin.com.

About Redfin

Redfin (www.redfin.com) is the next-generation real estate brokerage, combining its own full-service agents with modern technology to redefine real estate in the consumer’s favor. Founded by software engineers, Redfin has the country’s #1 brokerage website and offers a host of online tools to consumers, including the Redfin Estimate, the automated home-value estimate with the industry’s lowest published error rate for listed homes. Homebuyers and sellers enjoy a full-service, technology-powered experience from Redfin real estate agents, while saving thousands in commissions. Redfin serves more than 85 major metro areas across the U.S. The company has closed more than $60 billion in home sales.