Boca Raton, FL – Jan. 3, 2019 (PRNewswire) National housing prices as a whole are slightly overheated and residential real estate markets are experiencing minimal downward pressure on the demand for home ownership, according to a new study from faculty at the Florida Atlantic University College of Business.

The study’s author, Ken Johnson, Ph.D., a real estate economist with FAU’s College of Business, said the U.S. is nearing the peak of the current housing cycle, evidenced by the fact that property prices around the country are increasing but at a decreasing rate, meaning property appreciation is slowing.

The study, “Where Are We Now with Housing: A Report,” investigates and compares the current status of U.S. housing at a national level with that of housing at the peak of the last cycle in July 2006.

“All evidence is suggesting that the national housing market is peaking,” Johnson said. “However, this time around from a national perspective things should turn out quite differently.”

Based on scores from the Beracha, Hardin & Johnson Buy vs. Rent Index, which Johnson coauthors, and data from the S&P CoreLogic Case-Shiller 20 City Composite Home Price NSA Index, the study finds that housing prices are currently 7.3 percent above their long-term pricing trend, with minimal downward pressure on the demand for homeownership.

For comparison, at the peak of the last housing cycle, prices were 31 percent above their long-term pricing trend. Johnson’s BH&J Index was nearing a score of 1 (the highest possible score) in the summer of 2006, indicating extreme downward pressure on the demand for home ownership. Today, that score stands at .039.

“It looks like we’re in for more of a very high tide, as opposed to a tsunami, as residential pries peak in this latest cycle,” Johnson said. “At a minimum, we can expect flatter housing price growth. At worst, we could experience price declines slightly below the long-term pricing trend.”

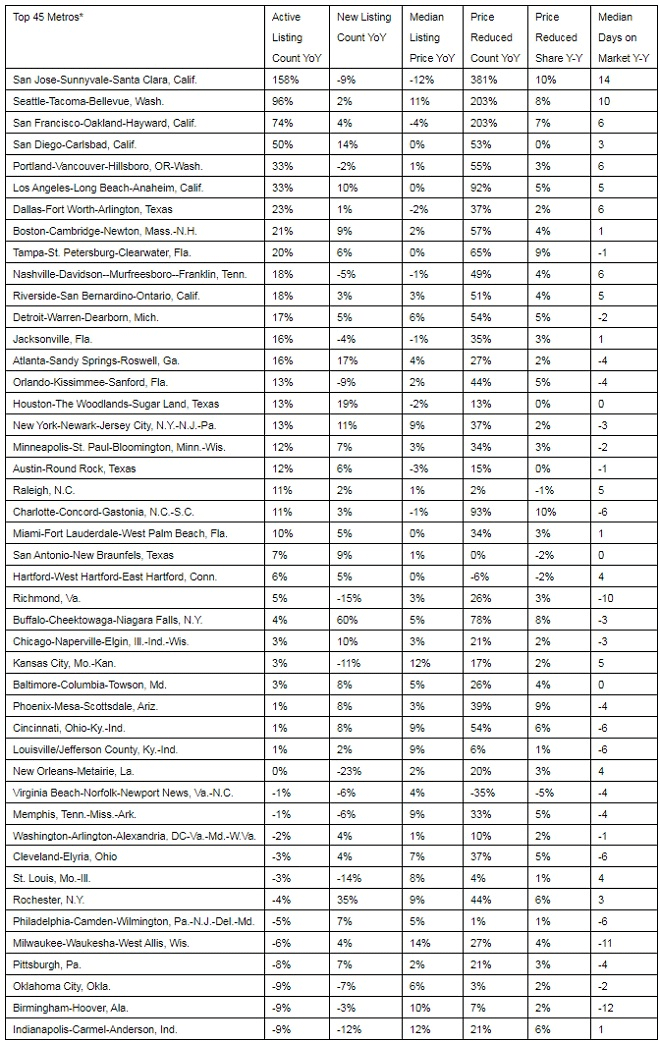

Johnson’s research is based on a national composite of housing prices and estimates of the downward pressure on the demand for home ownership, so the housing picture in some cities will look vastly different from others. For instance, three metropolitan markets – Dallas, Denver and Houston – are all currently significantly above their long-term housing price trends, with very high scores on the BH&J Index.