LendingTree’s Chief Economist analyzes April’s mortgage offers

Charlotte, NC – May 9, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released its monthly Mortgage Offers Report which analyzes data from actual loan terms offered to borrowers on LendingTree.com by lenders on LendingTree’s network. The purpose of the report is to empower consumers by providing additional information on how their credit profile affects their loan prospects.

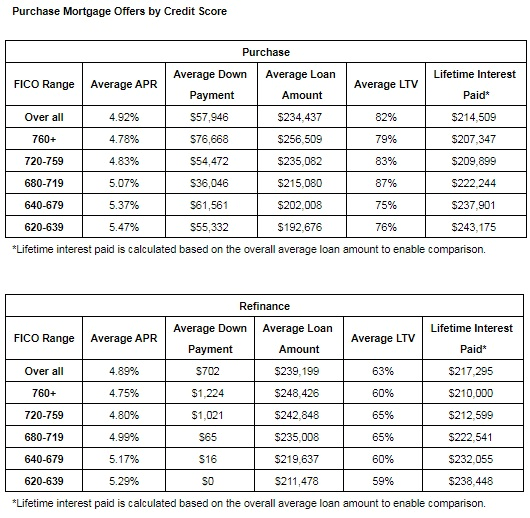

- April’s best offers for borrowers with excellent profiles had an average APR of 4.26% for conforming 30-year fixed purchase loans, up from 4.25% in March. Refinance loan offers were down 1 bps to 4.23%. Mortgage rates vary depending upon parameters including a borrower’s credit score, loan-to-value ratio, income and property type.

- For the average borrower, purchase APRs for conforming 30-year fixed loans offered on LendingTree’s platform were up 7 bps to 4.92%. The loan note rate of 4.81% hit the highest since March 2016 and was up 6 bps from March 2018. We prefer to emphasize the APR as lenders often make changes to other fees in response to changing interest rates.

- Consumers with the highest credit scores (760+) saw offered APRs of 4.78% in April, versus 5.07% for consumers with scores of 680-719. The APR spread of 29 bps between these score ranges was up 2 bps from March and the widest since this data series began in March 2016. The spread represents almost $15,000 in additional costs for borrowers with lower credit scores over 30 years for the average purchase loan amount of $234,437. The additional costs are due to higher interest rates, larger fees or a combination of the two.

- Refinance APRs for conforming 30-year fixed loans were up 6 bps to 4.89%. The credit score bracket spread remained at 24 bps, amounting to nearly $13,000 in extra costs over the life of the loan for lower credit score borrowers given an average refinance loan of $239,199.

- Average proposed purchase down payments were down nearly $5,000 from March at $57,946.

“We are in the core of the spring selling season for homes,” said Tendayi Kapfidze, LendingTree’s Chief Economist and report author. “Supply problems are dampening sales of existing homes and are particularly acute for lower-priced homes. Sales for homes under $100,000 were down 21% Y/Y in March, and those between $100,000 and $250,000 were down 8% Y/Y. Low inventory is the defining characteristic of the current housing market, and buyers should do all they can to position themselves competitively. We advise improving your credit score, getting financing in place ahead of the house hunt and shopping around for the best mortgage rates.”

About the Report

The LendingTree Mortgage Offers Report contains data from actual loan terms offered to borrowers on LendingTree.com by lenders. We believe it is an important addition to standard industry surveys and reports on mortgage rates. Most quoted industry rates are for a hypothetical borrower with prime credit who makes a 20% down payment. Most borrowers do not fit this profile. Our report includes the average quoted APR by credit score, together with the average down payment and other metrics described below. We stratify by credit score, so borrowers have added information on how their credit profile affects their loan prospects. The report covers conforming 30-yr fixed loans for both purchase and refinance.

- APR: Actual APR offers to borrowers on our platform

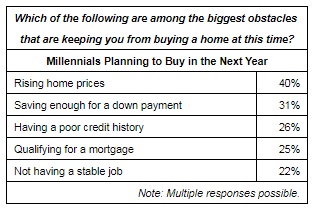

- Down Payment: Though analogous to the LTV, we find that borrowers identify more closely with the down payment. Academic studies have also found that the down payment is the primary concern for homebuyers and one of the main impediments to entering the homebuying market.

- Loan Amount: The average loan amount borrowers are offered

- LTV: Actual LTV offered to borrowers on our platform

- Lifetime Interest Paid: This is the total cost a borrower incurs for the loan, inclusive of fees.

To view the original report, visit https://www.lendingtree.com/home/mortgage-offers-report-april-2018/.

About LendingTree:

LendingTree (NASDAQ: TREE) is the nation’s leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

Media Contact:

Megan Greuling

(704) 943-8208

Megan.greuling@lendingtree.com