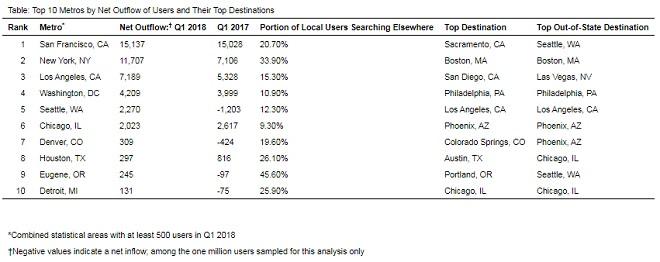

Seattle, WA – May 23, 2018 (PRNewswire) (NASDAQ: RDFN)– In the first three months of 2018, Denver posted a “net outflow” of Redfin users for the first time, meaning that more Denver-based Redfin users were searching for homes in other metro areas than Redfin users elsewhere looking to move in. This is according to the latest Migration Report by Redfin (www.redfin.com), the next-generation real estate brokerage. The analysis is based on a sample of more than 1 million Redfin.com users searching for homes across 75 metro areas from January through March.

Of all Denverites using Redfin, 20 percent were searching for homes in another metro, up from 15 percent during the same time period a year earlier. Nationally, 23.9 percent of Redfin.com users looked to relocate to another metro area last quarter, up from 19.8 percent a year earlier.

Seattle, which is grappling with a controversial tax related to the city’s housing crisis, has posted two consecutive quarters of net outflow, based on Redfin user data. In the first quarter, 12 percent of Seattle-based Redfin users were looking in other metro areas, up from 9 percent during the same period last year.

“Home searches are a forward-looking indicator of what is likely to happen to a city’s population,” said Taylor Marr, senior economist at Redfin. “We saw this in 2015 in the Bay Area, when more Bay Area Redfin users were searching elsewhere. By 2016, the U.S. Census Bureau showed San Francisco had lost residents. Now we see signs that Denver and Seattle, cities that once attracted those fleeing high home prices, are becoming unaffordable as well.”

Below are the metros with the highest net outflows of Redfin users:

Census data shows that Denver peaked at 40,000 net domestic migrations in 2015, meaning that many more people moved to Denver than left. Since then, while still positive, the net migration has declined each year. Looking ahead, based on Redfin user search trends, the company expects Denver to see a negative net migration, or a loss of residents, in the 2019 Census.

Meanwhile in Seattle, the Census data reveal peak net domestic migration in 2016, a year later than Denver, and the decline in 2017 was less dramatic. Redfin search data, however, shows users increasingly looking to leave the Seattle area. Since October 2017, more Seattleites are looking at homes elsewhere than the other way around.

Where are they going?

Residents looking to leave Seattle and Denver last quarter were mostly looking in areas that were more affordable and less competitive. Los Angeles looks like an exception on the surface, because the metro area on average is more expensive than Denver and Seattle. However, when they looked at the county level, analysts found that the most common areas homebuyers were looking at were more affordable areas of the LA market, like the Inland Empire (Riverside County, CA).

Phoenix was a top destination for both Seattle and Denver last quarter, and had the largest net gain of Redfin users looking to move to the area from elsewhere. This was up significantly—34 percent—from a year ago. Phoenix is also much more affordable, with a median home sale price of $257,000 as of April, compared to $415,000 in Denver and $580,000 in Seattle.

Major cities in Texas, as well as Chicago and Portland, are also attractive to those leaving Seattle and Denver. This has resulted in a disbursement of wealth throughout the country to cities that have made it easier to build new housing.

Which Cities Will be Next?

Below are the 10 metros that are the most likely to receive big inflows of new residents in the next year from expensive coastal markets, based on the number of users looking to relocate there versus leave. With these new residents, economic growth and rising home prices will likely follow, as we saw in Seattle and Denver.

The new destinations will be at risk for becoming unaffordable over time as well, unless they build enough new homes to keep up with the influx of people. Cities like Las Vegas, Atlanta and Austin are building thousands of new housing units to accommodate this growth.

Meanwhile Sacramento, Portland and San Diego are good examples of markets experiencing early signs of slowing growth, with smaller net inflows of Redfin users in the first quarter of this year than in the same time period in 2017. These metro areas have not expanded housing as rapidly to dampen growth in housing costs.

To read the full report, complete with more data and interactive charts, please visit: https://www.redfin.com/blog/2018/05/denver-joins-seattle-and-san-francisco-with-outmigration.html.

About Redfin

Redfin (www.redfin.com) is the next-generation real estate brokerage, combining its own full-service agents with modern technology to redefine real estate in the consumer’s favor. Founded by software engineers, Redfin has the country’s #1 brokerage website and offers a host of online tools to consumers, including the Redfin Estimate, the automated home-value estimate with the industry’s lowest published error rate for listed homes. Homebuyers and sellers enjoy a full-service, technology-powered experience from Redfin real estate agents, while saving thousands in commissions. Redfin serves more than 80 major metro areas across the U.S. The company has closed more than $60 billion in home sales.

Like this:

Like Loading...