Source: car.org

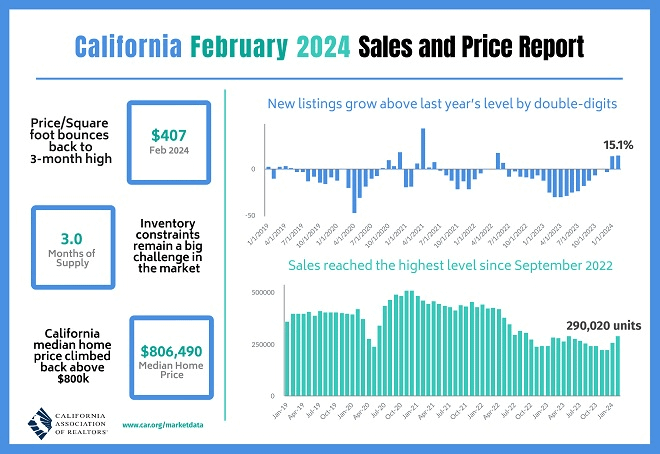

Los Angeles, CA – March 19, 2024 (PRNewswire) Despite a recent uptick in mortgage rates, California’s housing market continued to demonstrate resilience in February, reaching sales levels not seen since September 2022, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 290,020 in February, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2024 if sales maintained the February pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

February’s sales pace jumped 12.8 percent higher from the revised 257,040 homes sold in January and rose 1.3 percent from a year ago, when a revised 286,290 homes were sold on an annualized basis. The monthly sales increase was the second straight month of double-digit gains for California. It was also the second consecutive month of year-over-year gains, but the improvement was mild. The sales pace remained below the 300,000 threshold for the 17th consecutive month. While it is likely that sales will stay below this level in the first quarter of 2024, statewide home sales on a year-to-date basis remained positive with an increase of 3.4 percent, suggesting a better spring homebuying season than that experienced last year.

“Housing supply conditions in California continued to improve in February with new active listings rising more than 10 percent for the second straight month,” said C.A.R. President Melanie Barker, a Yosemite REALTOR®. “This is great news for buyers who have been competing for a dearth of homes for sale, and the momentum will hopefully build further as we enter the spring home buying season.”

Infographic: https://www.car.org/Global/Infographics/2024-02-Sales-and-Price

The statewide median price recorded a strong year-over-year gain in February, gaining 9.7 percent from $735,300 in February 2023 to $806,490 in February 2024. California’s median home price was 2.2 percent higher than January’s $789,480. The near-double-digit, year-over-year gain was the eighth straight month of annual price increases for the Golden State. It was the tenth time in the last 11 months that the median price for an existing single-family home was above $800,000. With mortgage rates on the uptick since the start of the year and concerns about rates staying elevated for at least the first half of 2024, the housing market could struggle to build on the momentum exhibited in the first two months of this year. However, tight inventory conditions should keep the market highly competitive and provide support for prices.

Moreover, sales of homes priced at or above $1 million have been holding up better in the last few months than more affordable options. The high-end market segment continued to grow year-over-year in February by double digits, while the more affordable segment declined again modestly. The mix of sales toward higher priced homes continued to provide support to the statewide median price and was partly responsible for the strong surge year-over-year price growth rate in February.

“Consumers have been feeling more positive about buying and selling since the beginning of the year, as increases in sales activity and home prices are reflected in the latest improvement in optimism,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “While the recent upward movement in interest rates may result in more moderate sales in March, we expect homebuyers on the sidelines to reenter the market as the economy slows and rates begin to trend down again in the second quarter.”

Other key points from C.A.R.’s February 2024 resale housing report include:

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state and represent statistics of existing single-family detached homes only. County sales data is not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower end or the upper end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its original list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 51 counties.

Leading the way…® in California real estate for more than 118 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

| February 2023 County Sales and Price Activity (Regional and condo sales data not seasonally adjusted) | |||||||||

| February 2024 | Median Sold Price of Existing Single-Family Homes | Sales | |||||||

| State/Region/County | Feb.2024 | Jan.2024 | Feb.2023 | Price MTM % Chg | Price YTY% Chg | Sales MTM% Chg | Sales YTY% Chg | ||

| Calif. Single-family home | $806,490 | $789,480 | r | $735,300 | r | 2.2 % | 9.7 % | 12.8 % | 1.3 % |

| Calif. Condo/Townhome | $660,000 | $630,000 | $615,000 | 4.8 % | 7.3 % | 24.3 % | 15.0 % | ||

| Los Angeles Metro Area | $790,000 | $750,000 | $710,000 | 5.3 % | 11.3 % | 13.2 % | 6.7 % | ||

| Central Coast | $950,000 | $926,000 | $856,000 | 2.6 % | 11.0 % | 15.6 % | 18.7 % | ||

| Central Valley | $478,200 | $460,000 | $450,000 | r | 4.0 % | 6.3 % | 11.2 % | 0.8 % | |

| Far North | $379,000 | $361,500 | $369,000 | 4.8 % | 2.7 % | 1.4 % | 12.5 % | ||

| Inland Empire | $576,500 | $559,280 | $549,900 | 3.1 % | 4.8 % | 14.8 % | 3.9 % | ||

| San Francisco Bay Area | $1,256,500 | $1,100,000 | $1,025,000 | r | 14.2 % | 22.6 % | 24.8 % | 14.9 % | |

| Southern California | $825,000 | $786,000 | r | $744,400 | r | 5.0 % | 10.8 % | 14.7 % | 7.0 % |

| San Francisco Bay Area | |||||||||

| Alameda | $1,300,000 | $1,103,000 | $1,066,000 | r | 17.9 % | 22.0 % | 40.6 % | 9.8 % | |

| Contra Costa | $850,000 | $770,000 | $750,000 | r | 10.4 % | 13.3 % | 20.0 % | 11.9 % | |

| Marin | $1,610,000 | $1,524,500 | $1,447,500 | 5.6 % | 11.2 % | 19.0 % | -9.2 % | ||

| Napa | $882,500 | $989,500 | $830,000 | -10.8 % | 6.3 % | 52.9 % | 36.8 % | ||

| San Francisco | $1,590,000 | $1,530,000 | $1,465,000 | 3.9 % | 8.5 % | 46.2 % | 41.7 % | ||

| San Mateo | $1,922,500 | $1,975,000 | $2,080,000 | -2.7 % | -7.6 % | 56.7 % | 22.1 % | ||

| Santa Clara | $1,808,890 | $1,710,440 | $1,500,000 | 5.8 % | 20.6 % | 25.9 % | 32.8 % | ||

| Solano | $580,000 | $575,000 | $555,000 | 0.9 % | 4.5 % | -0.5 % | 5.8 % | ||

| Sonoma | $826,500 | $829,900 | $774,500 | -0.4 % | 6.7 % | -2.9 % | -3.4 % | ||

| Southern California | |||||||||

| Imperial | $355,000 | $380,000 | $325,000 | -6.6 % | 9.2 % | 2.9 % | -2.7 % | ||

| Los Angeles | $817,100 | $833,000 | $726,870 | -1.9 % | 12.4 % | 8.4 % | 6.3 % | ||

| Orange | $1,350,000 | $1,320,000 | $1,159,000 | 2.3 % | 16.5 % | 23.6 % | 12.4 % | ||

| Riverside | $636,000 | $610,000 | $595,000 | 4.3 % | 6.9 % | 23.1 % | 7.0 % | ||

| San Bernardino | $477,070 | $477,500 | $466,500 | -0.1 % | 2.3 % | 1.1 % | -1.8 % | ||

| San Diego | $980,000 | $925,000 | $878,000 | r | 5.9 % | 11.6 % | 20.9 % | 8.1 % | |

| Ventura | $890,000 | $870,000 | $805,000 | 2.3 % | 10.6 % | 9.6 % | 14.2 % | ||

| Central Coast | |||||||||

| Monterey | $860,000 | $825,000 | $775,500 | 4.2 % | 10.9 % | 5.4 % | -2.0 % | ||

| San Luis Obispo | $900,000 | $910,000 | $795,000 | -1.1 % | 13.2 % | 24.8 % | 36.0 % | ||

| Santa Barbara | $976,000 | $1,280,000 | $860,000 | -23.8 % | 13.5 % | 13.8 % | 23.4 % | ||

| Santa Cruz | $1,232,500 | $1,190,000 | $1,201,000 | 3.6 % | 2.6 % | 16.4 % | 12.3 % | ||

| Central Valley | |||||||||

| Fresno | $420,000 | $406,000 | $385,000 | 3.4 % | 9.1 % | 7.7 % | -1.3 % | ||

| Glenn | $360,000 | $349,000 | $295,000 | 3.2 % | 22.0 % | 22.2 % | 57.1 % | ||

| Kern | $386,500 | $375,000 | $375,000 | 3.1 % | 3.1 % | 9.5 % | 8.0 % | ||

| Kings | $339,950 | $365,000 | $352,000 | -6.9 % | -3.4 % | 14.3 % | 9.8 % | ||

| Madera | $417,880 | $466,080 | $378,000 | -10.3 % | 10.6 % | 53.5 % | 46.7 % | ||

| Merced | $401,600 | $380,000 | $381,950 | 5.7 % | 5.1 % | 8.2 % | 50.0 % | ||

| Placer | $650,000 | $620,000 | $631,250 | r | 4.8 % | 3.0 % | 19.4 % | -9.0 % | |

| Sacramento | $530,000 | $515,000 | $499,000 | 2.9 % | 6.2 % | 18.0 % | 0.4 % | ||

| San Benito | $795,000 | $760,000 | $730,000 | 4.6 % | 8.9 % | 16.7 % | 25.0 % | ||

| San Joaquin | $529,000 | $530,000 | $513,900 | r | -0.2 % | 2.9 % | -2.0 % | -9.4 % | |

| Stanislaus | $460,000 | $450,000 | $430,000 | r | 2.2 % | 7.0 % | 1.8 % | -4.7 % | |

| Tulare | $359,990 | $349,000 | $340,000 | 3.1 % | 5.9 % | -2.5 % | -5.4 % | ||

| Far North | |||||||||

| Butte | $451,120 | $390,000 | $405,000 | 15.7 % | 11.4 % | 13.8 % | -12.0 % | ||

| Lassen | $263,000 | $229,000 | $212,500 | 14.8 % | 23.8 % | 28.6 % | 50.0 % | ||

| Plumas | $370,000 | $363,620 | $305,000 | 1.8 % | 21.3 % | 0.0 % | 112.5 % | ||

| Shasta | $366,250 | $395,000 | $350,000 | -7.3 % | 4.6 % | -6.5 % | 13.4 % | ||

| Siskiyou | $340,000 | $329,000 | $208,000 | 3.3 % | 63.5 % | 10.5 % | 23.5 % | ||

| Tehama | $349,000 | $340,000 | $332,000 | 2.6 % | 5.1 % | -11.5 % | 4.5 % | ||

| Trinity | $280,000 | $402,500 | NA | -30.4 % | NA | 250.0 % | NA | ||

| Other Calif. Counties | |||||||||

| Amador | $407,500 | $444,500 | $415,000 | r | -8.3 % | -1.8 % | -15.8 % | 3.2 % | |

| Calaveras | $475,000 | $434,500 | $437,500 | 9.3 % | 8.6 % | -29.5 % | 3.3 % | ||

| Del Norte | $295,000 | $295,000 | $300,000 | 0.0 % | -1.7 % | 33.3 % | 50.0 % | ||

| El Dorado | $647,500 | $650,000 | $622,000 | r | -0.4 % | 4.1 % | 34.5 % | 29.0 % | |

| Humboldt | $420,000 | $410,000 | $417,250 | 2.4 % | 0.7 % | 18.5 % | 28.0 % | ||

| Lake | $315,000 | $325,000 | $305,000 | -3.1 % | 3.3 % | -8.9 % | 7.9 % | ||

| Mariposa | $390,000 | $431,500 | $353,000 | -9.6 % | 10.5 % | -33.3 % | 60.0 % | ||

| Mendocino | $499,000 | $494,000 | $495,500 | 1.0 % | 0.7 % | -21.4 % | 22.2 % | ||

| Mono | $1,097,500 | $1,304,500 | $802,500 | -15.9 % | 36.8 % | 300.0 % | 300.0 % | ||

| Nevada | $530,000 | $525,000 | $475,000 | 1.0 % | 11.6 % | -5.3 % | 2.9 % | ||

| Sutter | $415,000 | $435,000 | $412,500 | r | -4.6 % | 0.6 % | -2.8 % | -20.5 % | |

| Tuolumne | $430,000 | $360,750 | $361,000 | 19.2 % | 19.1 % | -8.3 % | 77.4 % | ||

| Yolo | $618,940 | $600,360 | $545,000 | r | 3.1 % | 13.6 % | 9.2 % | 18.6 % | |

| Yuba | $426,500 | $455,000 | $432,760 | r | -6.3 % | -1.4 % | 30.4 % | 22.4 % | |

| r = revised |

| NA = not available |

| February 2023 County Unsold Inventory and Days on Market (Regional and condo sales data not seasonally adjusted) | ||||||||||

| February 2024 | Unsold Inventory Index | Median Time on Market | ||||||||

| State/Region/County | Feb.2024 | Jan.2024 | Feb.2023 | Feb.2024 | Jan.2024 | Feb.2023 | ||||

| Calif. Single-family home | 3.0 | 3.2 | 3.1 | r | 22.0 | 32.0 | 35.0 | r | ||

| Calif. Condo/Townhome | 2.9 | 3.2 | 2.8 | r | 21.0 | 31.0 | 29.0 | r | ||

| Los Angeles Metro Area | 3.2 | 3.4 | 3.4 | 27.0 | 32.0 | 42.0 | r | |||

| Central Coast | 3.4 | 3.6 | 3.5 | 20.0 | 29.0 | 21.0 | r | |||

| Central Valley | 2.9 | 3.1 | 2.7 | r | 21.0 | 30.0 | 35.0 | r | ||

| Far North | 4.4 | 4.6 | 5.0 | 47.0 | 43.0 | 45.0 | ||||

| Inland Empire | 3.6 | 4.0 | 3.7 | 37.0 | 40.0 | 53.0 | r | |||

| San Francisco Bay Area | 2.1 | 2.3 | 2.5 | r | 14.0 | 31.0 | 20.0 | r | ||

| Southern California | 3.0 | 3.2 | 3.2 | 23.0 | 30.0 | 38.0 | r | |||

| San Francisco Bay Area | ||||||||||

| Alameda | 1.5 | 1.9 | 1.8 | r | 11.0 | 19.0 | 12.0 | r | ||

| Contra Costa | 1.6 | 1.7 | 2.2 | r | 11.0 | 28.5 | 20.0 | r | ||

| Marin | 2.9 | 2.5 | 2.4 | 70.0 | 57.5 | 30.5 | ||||

| Napa | 4.4 | 6.0 | 5.8 | 77.5 | 104.0 | 29.0 | ||||

| San Francisco | 2.3 | 2.8 | 3.4 | 42.0 | 85.0 | 42.5 | r | |||

| San Mateo | 2.1 | 2.7 | 2.4 | 10.0 | 17.5 | 12.0 | ||||

| Santa Clara | 1.9 | 1.8 | 2.9 | 8.0 | 11.0 | 9.0 | ||||

| Solano | 2.9 | 2.7 | 2.7 | 50.5 | 49.0 | 57.0 | ||||

| Sonoma | 3.5 | 3.1 | 3.2 | 66.5 | 65.0 | 55.5 | ||||

| Southern California | ||||||||||

| Imperial | 3.1 | NA | NA | 16.0 | 36.0 | 71.0 | ||||

| Los Angeles | 3.1 | 3.2 | 3.4 | 21.0 | 28.0 | 37.0 | r | |||

| Orange | 2.5 | 2.7 | 2.9 | 20.0 | 28.0 | 35.0 | r | |||

| Riverside | 3.4 | 4.0 | 3.6 | 36.0 | 40.0 | 54.0 | r | |||

| San Bernardino | 4.0 | 3.9 | 3.8 | 40.0 | 40.0 | 52.0 | r | |||

| San Diego | 2.3 | 2.6 | 2.3 | 13.0 | 21.5 | 19.0 | r | |||

| Ventura | 2.7 | 2.9 | 3.3 | 32.0 | 37.0 | 39.5 | r | |||

| Central Coast | ||||||||||

| Monterey | 3.9 | 3.9 | 3.9 | 15.5 | 29.0 | 23.0 | ||||

| San Luis Obispo | 3.2 | 3.6 | 3.7 | 39.0 | 31.0 | 18.0 | r | |||

| Santa Barbara | 3.1 | 3.5 | 3.0 | 12.5 | 21.5 | 20.0 | ||||

| Santa Cruz | 3.6 | 3.6 | 3.5 | 16.0 | 40.0 | 23.0 | ||||

| Central Valley | ||||||||||

| Fresno | 3.4 | 3.5 | 3.3 | 22.0 | 31.0 | 29.0 | r | |||

| Glenn | 3.2 | 4.3 | 6.0 | 32.0 | 10.0 | 46.0 | ||||

| Kern | 2.8 | 2.8 | 2.8 | 23.0 | 24.0 | 31.0 | ||||

| Kings | 3.6 | 3.6 | 3.7 | 16.0 | 22.0 | 39.0 | ||||

| Madera | 3.9 | 6.5 | 5.0 | 39.0 | 52.5 | 35.0 | r | |||

| Merced | 2.9 | 3.2 | 5.0 | 37.0 | 47.0 | 32.0 | r | |||

| Placer | 2.7 | 3.0 | 2.4 | r | 23.0 | 35.0 | 45.0 | r | ||

| Sacramento | 2.2 | 2.4 | 2.0 | r | 17.0 | 26.0 | 31.0 | r | ||

| San Benito | 3.3 | 3.7 | 3.5 | 40.0 | 55.5 | 38.5 | ||||

| San Joaquin | 3.0 | 2.6 | 2.1 | r | 25.5 | 31.5 | 43.0 | r | ||

| Stanislaus | 2.7 | 2.7 | 2.4 | r | 16.0 | 31.0 | 35.0 | r | ||

| Tulare | 3.7 | 3.7 | 3.4 | 28.0 | 28.0 | 29.0 | ||||

| Far North | ||||||||||

| Butte | 3.4 | 3.8 | 3.4 | 36.5 | 29.0 | 44.0 | r | |||

| Lassen | 9.1 | 13.1 | 15.7 | 110.0 | 41.0 | 73.0 | ||||

| Plumas | 3.9 | 4.2 | 10.1 | 81.0 | 89.0 | 39.0 | r | |||

| Shasta | 3.7 | 3.6 | 4.5 | 39.5 | 37.0 | 36.0 | ||||

| Siskiyou | 7.9 | 8.4 | 9.0 | 79.0 | 27.0 | 68.0 | ||||

| Tehama | 4.2 | 4.0 | 5.5 | 62.0 | 69.0 | 57.5 | ||||

| Trinity | 13.4 | 43.0 | NA | 160.0 | 258.0 | NA | ||||

| Other Calif. Counties | ||||||||||

| Amador | 5.6 | 4.3 | 4.8 | r | 47.0 | 64.0 | 42.0 | |||

| Calaveras | 6.4 | 4.0 | 5.4 | 68.0 | 54.5 | 91.0 | ||||

| Del Norte | 6.7 | 9.2 | 9.3 | 38.5 | 38.0 | 29.5 | r | |||

| El Dorado | 3.7 | 4.7 | 3.3 | r | 58.0 | 58.5 | 55.5 | r | ||

| Humboldt | 6.8 | 7.7 | 7.1 | 52.0 | 30.5 | 29.5 | ||||

| Lake | 8.1 | 7.3 | 7.3 | 61.0 | 93.0 | 92.0 | r | |||

| Mariposa | 9.6 | 6.2 | 12.0 | 36.5 | 71.5 | 27.0 | r | |||

| Mendocino | 8.4 | 6.4 | 8.8 | 77.0 | 96.0 | 119.0 | ||||

| Mono | 1.8 | 9.5 | 12.5 | 76.5 | 21.5 | 130.5 | ||||

| Nevada | 3.6 | 3.6 | 3.3 | r | 41.0 | 50.0 | 70.0 | r | ||

| Sutter | 2.7 | 2.6 | 3.0 | 16.0 | 16.0 | 27.5 | r | |||

| Tuolumne | 3.5 | 3.2 | 4.9 | 77.0 | 55.5 | 48.0 | r | |||

| Yolo | 2.2 | 2.6 | 2.2 | r | 32.0 | 40.5 | 40.0 | r | ||

| Yuba | 3.7 | 4.2 | 4.1 | r | 31.5 | 57.0 | 28.0 | r | ||

| r = revised |

| NA = not available |

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)

Los Angeles, CA – Feb. 16, 2024 (PRNewswire) California existing home sales rebounded in January to the highest level in six months as mortgage rates pulled back sharply at the end of 2023, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) said today.

Closed escrow sales of existing, single-family detached homes in California totaled a seasonally adjusted annualized rate of 256,160 in January, according to information collected by C.A.R. from more than 90 local REALTOR® associations and MLSs statewide. The statewide annualized sales figure represents what would be the total number of homes sold during 2024 if sales maintained the January pace throughout the year. It is adjusted to account for seasonal factors that typically influence home sales.

January’s sales pace climbed 14.4 percent higher from the revised 224,000 homes sold in December and was down 5.9 percent from a year ago, when a revised 241,920 homes were sold on an annualized basis. While the increase in January was the first year-over-year sales gain in 31 months, the sales pace stayed below the 300,000-unit threshold for the 16th straight month and will likely stay below that level in the first quarter of 2024. With interest rates moderating sharply at the end of 2023 and leveling off nearly 100 basis points below the most recent peak, home sales should continue to grow year-over-year in February, but the improvement will be modest.

“It’s encouraging to see California’s housing market kick off the year with positive sales growth in January,” said C.A.R. President Melanie Barker, a Yosemite REALTOR®. “While we’ll likely experience some ups and downs in home sales in the coming months as rates continue to fluctuate, the lending environment is expected to be more favorable in 2024, so the market should see more pent-up demand translate into sales.”

Infographic: https://www.car.org/Global/Infographics/2024-01-Sales-and-Price

While California’s statewide median home price decreased 3.8 percent from December’s $819,740 to $788,940 in January, it registered a 5.0 year-over-year gain, the seventh straight month of annual price gains. The monthly price decline was due primarily to seasonal factors, and the January figure marked the first time in ten months that the median price dropped below the $800,000 benchmark. With mortgage rates softening since mid-October, home prices will likely maintain their upward momentum, and the market should continue to observe a mid- to single-digit, year-over-year growth rate in California’s median price in at least the early part of 2024.

“The increase in new active listings for the first time in 19 months was great news for the California housing market,” said C.A.R. Senior Vice President and Chief Economist Jordan Levine. “With rates climbing back up to a two-month high earlier this week due to the latest inflation concerns, potential home sellers could hit the pause button on listing their house on the market and wait until rates begin to ease again. In general, rates are expected to decline later this year, and available inventory should slowly improve throughout 2024.”

Other key points from C.A.R.’s January 2024 resale housing report include:

Note: The County MLS median price and sales data in the tables are generated from a survey of more than 90 associations of REALTORS® throughout the state and represent statistics of existing single-family detached homes only. County sales data is not adjusted to account for seasonal factors that can influence home sales. Movements in sales prices should not be interpreted as changes in the cost of a standard home. The median price is where half sold for more and half sold for less; medians are more typical than average prices, which are skewed by a relatively small share of transactions at either the lower end or the upper end. Median prices can be influenced by changes in cost, as well as changes in the characteristics and the size of homes sold. The change in median prices should not be construed as actual price changes in specific homes.

*Sales-to-list-price ratio is an indicator that reflects the negotiation power of home buyers and home sellers under current market conditions. The ratio is calculated by dividing the final sales price of a property by its original list price and is expressed as a percentage. A sales-to-list ratio with 100 percent or above suggests that the property sold for more than the list price, and a ratio below 100 percent indicates that the price sold below the asking price.

**Price per square foot is a measure commonly used by real estate agents and brokers to determine how much a square foot of space a buyer will pay for a property. It is calculated as the sale price of the home divided by the number of finished square feet. C.A.R. currently tracks price-per-square foot statistics for 51 counties.

Leading the way…® in California real estate for more than 117 years, the CALIFORNIA ASSOCIATION OF REALTORS® (www.car.org) is one of the largest state trade organizations in the United States with more than 200,000 members dedicated to the advancement of professionalism in real estate. C.A.R. is headquartered in Los Angeles.

| January 2023 County Sales and Price Activity | |||||||||

| (Regional and condo sales data not seasonally adjusted) | |||||||||

| January 2024 | Median Sold Price of Existing Single-Family Homes | Sales | |||||||

| State/Region/County | Jan.2024 | Dec.2023 | Jan.2023 | Price MTM% Chg | Price YTY% Chg | Sales MTM% Chg | Sales YTY% Chg | ||

| Calif. Single-family homes | $788,940 | $819,740 | $751,700 | r | -3.8 % | 5.0 % | 14.4 % | 5.9 % | |

| Calif. Condo/Townhomes | $630,000 | $635,000 | $580,000 | -0.8 % | 8.6 % | -7.8 % | 14.2 % | ||

| Los Angeles Metro Area | $750,000 | $760,000 | $700,000 | -1.3 % | 7.1 % | -14.6 % | 2.8 % | ||

| Central Coast | $926,000 | $979,500 | $894,500 | -5.5 % | 3.5 % | -11.3 % | 5.2 % | ||

| Central Valley | $460,000 | $462,000 | $430,750 | r | -0.4 % | 6.8 % | -9.2 % | 12.5 % | |

| Far North | $361,500 | $364,500 | $369,000 | r | -0.8 % | -2.0 % | -6.9 % | 6.8 % | |

| Inland Empire | $559,280 | $570,000 | $540,000 | -1.9 % | 3.6 % | -12.1 % | 5.3 % | ||

| San Francisco Bay Area | $1,100,000 | $1,182,000 | $995,000 | r | -6.9 % | 10.6 % | -24.3 % | 6.2 % | |

| Southern California | $790,000 | $790,000 | $738,250 | 0.0 % | 7.0 % | -12.2 % | 2.2 % | ||

| San Francisco Bay Area | |||||||||

| Alameda | $1,103,000 | $1,175,000 | $1,015,000 | r | -6.1 % | 8.7 % | -33.6 % | -10.7 % | |

| Contra Costa | $770,000 | $800,000 | $725,000 | r | -3.8 % | 6.2 % | -17.0 % | 8.7 % | |

| Marin | $1,524,500 | $1,555,000 | $1,201,000 | -2.0 % | 26.9 % | -38.3 % | 56.8 % | ||

| Napa | $989,500 | $925,000 | $790,000 | 7.0 % | 25.3 % | -30.6 % | 3.0 % | ||

| San Francisco | $1,530,000 | $1,450,000 | $1,385,000 | 5.5 % | 10.5 % | -20.5 % | -5.1 % | ||

| San Mateo | $1,975,000 | $1,800,000 | $1,625,000 | 9.7 % | 21.5 % | -45.7 % | -7.0 % | ||

| Santa Clara | $1,710,440 | $1,725,000 | $1,530,000 | -0.8 % | 11.8 % | -22.8 % | 19.7 % | ||

| Solano | $575,000 | $562,000 | $580,000 | 2.3 % | -0.9 % | 2.0 % | 11.5 % | ||

| Sonoma | $829,900 | $812,930 | $781,930 | 2.1 % | 6.1 % | -19.0 % | 15.1 % | ||

| Southern California | |||||||||

| Los Angeles | $833,000 | $853,340 | $778,540 | -2.4 % | 7.0 % | -17.1 % | 0.8 % | ||

| Orange | $1,320,000 | $1,300,000 | $1,194,500 | 1.5 % | 10.5 % | -14.8 % | -1.0 % | ||

| Riverside | $610,000 | $607,500 | $585,000 | 0.4 % | 4.3 % | -9.7 % | -0.1 % | ||

| San Bernardino | $477,500 | $506,000 | $446,900 | -5.6 % | 6.8 % | -15.9 % | 15.6 % | ||

| San Diego | $925,000 | $911,500 | $824,900 | r | 1.5 % | 12.1 % | -0.9 % | 0.0 % | |

| Ventura | $870,000 | $882,500 | $815,000 | -1.4 % | 6.7 % | -10.0 % | 15.8 % | ||

| Central Coast | |||||||||

| Monterey | $825,000 | $929,000 | $850,000 | -11.2 % | -2.9 % | -9.7 % | -4.1 % | ||

| San Luis Obispo | $910,000 | $956,000 | $795,750 | -4.8 % | 14.4 % | -8.3 % | 28.7 % | ||

| Santa Barbara | $1,280,000 | $1,190,000 | $890,000 | 7.6 % | 43.8 % | -1.7 % | 1.8 % | ||

| Santa Cruz | $1,190,000 | $1,050,000 | $1,170,000 | 13.3 % | 1.7 % | -32.1 % | -9.8 % | ||

| Central Valley | |||||||||

| Fresno | $406,000 | $397,000 | $375,000 | 2.3 % | 8.3 % | -9.6 % | 15.5 % | ||

| Glenn | $349,000 | $349,500 | $392,500 | -0.1 % | -11.1 % | -47.1 % | -25.0 % | ||

| Kern | $375,000 | $374,180 | $357,500 | 0.2 % | 4.9 % | 6.4 % | 4.0 % | ||

| Kings | $365,000 | $380,000 | $365,000 | -3.9 % | 0.0 % | -31.0 % | -7.5 % | ||

| Madera | $466,080 | $410,500 | $387,460 | 13.5 % | 20.3 % | -41.9 % | 28.4 % | ||

| Merced | $380,000 | $385,000 | $369,000 | -1.3 % | 3.0 % | 15.1 % | 45.2 % | ||

| Placer | $620,000 | $633,020 | $620,000 | r | -2.1 % | 0.0 % | -14.8 % | 13.8 % | |

| Sacramento | $515,000 | $535,000 | $499,000 | r | -3.7 % | 3.2 % | -10.8 % | 5.5 % | |

| San Benito | $760,000 | $789,890 | $719,000 | -3.8 % | 5.7 % | -9.1 % | 66.7 % | ||

| San Joaquin | $530,000 | $530,000 | $509,900 | r | 0.0 % | 3.9 % | -2.2 % | 21.9 % | |

| Stanislaus | $450,000 | $462,500 | $410,000 | r | -2.7 % | 9.8 % | 3.8 % | 24.6 % | |

| Tulare | $349,000 | $362,000 | $332,720 | -3.6 % | 4.9 % | -11.0 % | 3.2 % | ||

| Far North | |||||||||

| Butte | $390,000 | $418,000 | $410,000 | -6.7 % | -4.9 % | -18.3 % | -14.7 % | ||

| Lassen | $229,000 | $272,500 | $260,000 | -16.0 % | -11.9 % | -68.2 % | -22.2 % | ||

| Plumas | $363,620 | $360,000 | $350,000 | 1.0 % | 3.9 % | 0.0 % | 54.5 % | ||

| Shasta | $395,000 | $355,760 | $373,750 | 11.0 % | 5.7 % | 11.6 % | 11.6 % | ||

| Siskiyou | $329,000 | $331,500 | $385,860 | -0.8 % | -14.7 % | -32.1 % | 72.7 % | ||

| Tehama | $340,000 | $305,000 | $314,900 | 11.5 % | 8.0 % | 18.2 % | 4.0 % | ||

| Trinity | $402,500 | $287,000 | $380,000 | 40.2 % | 5.9 % | -66.7 % | -33.3 % | ||

| Other Calif. Counties | |||||||||

| Amador | $444,500 | $415,000 | $399,000 | r | 7.1 % | 11.4 % | 40.7 % | 22.6 % | |

| Calaveras | $434,500 | $437,500 | $455,000 | -0.7 % | -4.5 % | 29.4 % | 7.3 % | ||

| Del Norte | $295,000 | $487,000 | $300,000 | -39.4 % | -1.7 % | -25.0 % | 28.6 % | ||

| El Dorado | $650,000 | $660,000 | $575,000 | r | -1.5 % | 13.0 % | -9.2 % | 25.3 % | |

| Humboldt | $410,000 | $425,000 | $395,000 | -3.5 % | 3.8 % | -42.6 % | 5.9 % | ||

| Lake | $325,000 | $315,000 | $310,000 | 3.2 % | 4.8 % | 21.6 % | 4.7 % | ||

| Mariposa | $431,500 | $442,000 | $372,500 | -2.4 % | 15.8 % | -25.0 % | 0.0 % | ||

| Mendocino | $494,000 | $599,000 | $389,000 | -17.5 % | 27.0 % | 68.0 % | 55.6 % | ||

| Mono | $1,304,500 | $1,052,500 | $1,125,500 | 23.9 % | 15.9 % | -66.7 % | -50.0 % | ||

| Nevada | $525,000 | $537,000 | $470,000 | -2.2 % | 11.7 % | -22.7 % | 31.6 % | ||

| Sutter | $435,000 | $429,500 | $395,000 | r | 1.3 % | 10.1 % | -14.3 % | -16.3 % | |

| Tuolumne | $360,750 | $444,000 | $388,000 | -18.8 % | -7.0 % | 5.3 % | 62.2 % | ||

| Yolo | $600,360 | $630,000 | $530,000 | r | -4.7 % | 13.3 % | 13.4 % | 40.7 % | |

| Yuba | $455,000 | $440,000 | $425,000 | 3.4 % | 7.1 % | 7.0 % | 9.5 % | ||

r = revised

| January 2023 County Unsold Inventory and Days on Market | ||||||||||

| (Regional and condo sales data not seasonally adjusted) | ||||||||||

| January 2024 | Unsold Inventory Index | Median Time on Market | ||||||||

| State/Region/County | Jan.2024 | Dec.2023 | Jan.2023 | Jan.2024 | Dec.2023 | Jan.2023 | ||||

| Calif. Single-family homes | 3.2 | 2.5 | 3.5 | r | 32.0 | 26.0 | 39.0 | r | ||

| Calif. Condo/Townhomes | 3.2 | 2.5 | 3.5 | 31.0 | 27.0 | 36.0 | r | |||

| Los Angeles Metro Area | 3.4 | 2.7 | 3.8 | 32.0 | 27.0 | 41.0 | r | |||

| Central Coast | 3.6 | 3.0 | 3.5 | 29.0 | 19.0 | 33.0 | r | |||

| Central Valley | 3.1 | 2.6 | 3.5 | r | 30.0 | 25.0 | 39.0 | r | ||

| Far North | 4.6 | 3.2 | 4.9 | r | 43.0 | 37.0 | 50.0 | r | ||

| Inland Empire | 4.0 | 3.3 | 4.4 | 40.0 | 34.0 | 46.0 | r | |||

| San Francisco Bay Area | 2.3 | 1.5 | 2.6 | r | 31.0 | 23.0 | 33.0 | r | ||

| Southern California | 3.2 | 2.6 | 3.6 | 30.0 | 26.0 | 39.0 | r | |||

| San Francisco Bay Area | ||||||||||

| Alameda | 1.9 | 0.9 | 2.0 | r | 19.0 | 15.0 | 27.0 | r | ||

| Contra Costa | 1.7 | 1.2 | 2.4 | r | 28.5 | 18.0 | 31.0 | r | ||

| Marin | 2.5 | 1.5 | 4.5 | 57.5 | 66.0 | 72.0 | ||||

| Napa | 6.0 | 4.1 | 5.9 | 104.0 | 85.0 | 84.0 | ||||

| San Francisco | 2.8 | 1.5 | 2.9 | 85.0 | 48.0 | 49.5 | r | |||

| San Mateo | 2.7 | 1.1 | 2.4 | 17.5 | 17.0 | 22.0 | ||||

| Santa Clara | 1.8 | 1.1 | 2.5 | 11.0 | 12.0 | 22.5 | ||||

| Solano | 2.7 | 2.9 | 2.9 | 49.0 | 45.0 | 58.0 | ||||

| Sonoma | 3.1 | 2.5 | 3.3 | 65.0 | 61.5 | 43.5 | ||||

| Southern California | ||||||||||

| Los Angeles | 3.2 | 2.6 | 3.7 | 28.0 | 23.0 | 37.0 | r | |||

| Orange | 2.7 | 2.0 | 3.1 | 28.0 | 24.0 | 41.0 | r | |||

| Riverside | 4.0 | 3.3 | 4.3 | 40.0 | 32.0 | 45.0 | r | |||

| San Bernardino | 3.9 | 3.3 | 4.7 | 40.0 | 38.0 | 47.0 | r | |||

| San Diego | 2.6 | 2.2 | 2.7 | 21.5 | 18.0 | 32.0 | r | |||

| Ventura | 2.9 | 2.4 | 3.4 | 37.0 | 37.0 | 41.0 | r | |||

| Central Coast | ||||||||||

| Monterey | 3.9 | 3.2 | 3.9 | 29.0 | 14.0 | 33.0 | ||||

| San Luis Obispo | 3.6 | 3.1 | 4.3 | 31.0 | 27.0 | 41.0 | r | |||

| Santa Barbara | 3.5 | 3.2 | 2.6 | 21.5 | 14.5 | 18.5 | ||||

| Santa Cruz | 3.6 | 2.2 | 3.3 | 40.0 | 24.0 | 35.0 | ||||

| Central Valley | ||||||||||

| Fresno | 3.5 | 3.1 | 4.2 | 31.0 | 21.0 | 36.0 | r | |||

| Glenn | 4.3 | 1.9 | 2.9 | 10.0 | 54.0 | 36.5 | r | |||

| Kern | 2.8 | 2.8 | 3.1 | 24.0 | 19.0 | 32.5 | ||||

| Kings | 3.6 | 2.2 | 3.5 | 22.0 | 42.0 | 53.0 | ||||

| Madera | 6.5 | 3.5 | 7.2 | 52.5 | 30.0 | 38.0 | r | |||

| Merced | 3.2 | 3.2 | 4.4 | 47.0 | 36.0 | 47.5 | r | |||

| Placer | 3.0 | 2.4 | 3.8 | r | 35.0 | 33.0 | 43.0 | r | ||

| Sacramento | 2.4 | 2.0 | 2.7 | r | 26.0 | 27.0 | 39.5 | r | ||

| San Benito | 3.7 | 3.0 | 5.6 | 55.5 | 39.0 | 27.5 | ||||

| San Joaquin | 2.6 | 2.4 | 2.9 | r | 31.5 | 22.0 | 46.0 | r | ||

| Stanislaus | 2.7 | 2.7 | 3.3 | r | 31.0 | 19.0 | 36.0 | r | ||

| Tulare | 3.7 | 3.0 | 3.8 | 28.0 | 26.0 | 34.5 | ||||

| Far North | ||||||||||

| Butte | 3.8 | 3.1 | 3.9 | 29.0 | 27.0 | 50.0 | r | |||

| Lassen | 13.1 | 4.2 | 10.9 | 41.0 | 47.0 | 128.0 | ||||

| Plumas | 4.2 | 4.9 | 6.9 | 89.0 | 102.0 | 85.0 | r | |||

| Shasta | 3.6 | 1.6 | 4.2 | 37.0 | 33.5 | 41.5 | ||||

| Siskiyou | 8.4 | 6.1 | 13.2 | 27.0 | 37.5 | 134.0 | r | |||

| Tehama | 4.0 | 5.0 | 5.8 | 69.0 | 83.5 | 66.0 | ||||

| Trinity | 43.0 | 14.2 | NA | 258.0 | 139.5 | 33.0 | ||||

| Other Calif. Counties | ||||||||||

| Amador | 4.3 | 6.6 | 4.6 | r | 64.0 | 34.0 | 58.0 | r | ||

| Calaveras | 4.0 | 5.2 | 4.4 | 54.5 | 69.5 | 81.0 | ||||

| Del Norte | 9.2 | 7.3 | 10.1 | 38.0 | 69.0 | 63.0 | r | |||

| El Dorado | 4.7 | 3.2 | 4.4 | 58.5 | 50.0 | 51.0 | r | |||

| Humboldt | 7.7 | 4.1 | 6.8 | 30.5 | 37.5 | 24.0 | ||||

| Lake | 7.3 | 8.8 | 6.4 | 93.0 | 55.0 | 59.0 | r | |||

| Mariposa | 6.2 | 4.8 | 5.4 | 71.5 | 31.0 | 65.5 | r | |||

| Mendocino | 6.4 | 11.7 | 8.4 | 96.0 | 109.0 | 131.0 | ||||

| Mono | 9.5 | 2.8 | 6.3 | 21.5 | 71.5 | 160.5 | ||||

| Nevada | 3.6 | 2.7 | 3.9 | 50.0 | 53.0 | 50.0 | r | |||

| Sutter | 2.6 | 2.4 | 2.8 | 16.0 | 28.0 | 40.0 | r | |||

| Tuolumne | 3.2 | 3.9 | 5.2 | 55.5 | 48.0 | 66.0 | r | |||

| Yolo | 2.6 | 2.7 | 3.0 | r | 40.5 | 34.0 | 44.5 | r | ||

| Yuba | 4.2 | 4.7 | 4.9 | r | 57.0 | 36.0 | 45.5 | r | ||

r = revised

SOURCE CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.)