- The share of U.S. borrowers who were in serious mortgage delinquency (90 days or more late on payments) dropped to 0.9% in August, the lowest recorded since January 1999.

- The overall national mortgage delinquency rate (30 days or more late) was at 2.6% in August, also a historic low.

- The U.S. foreclosure rate held steady at 0.3% in August, unchanged since early 2022.

- Only Idaho and Utah saw slight annual upticks in overall mortgage delinquency growth in August, both up by 0.1 percentage point.

- Fifty-one metro areas posted year-over-year mortgage delinquency rate increases in August.

Irvine, CA – October 26, 2023 (BUSINESS WIRE) CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its monthly Loan Performance Insights Report for August 2023.

In August 2023, 2.6% of all mortgages in the U.S. were in some stage of delinquency (30 days or more past due, including those in foreclosure), representing a 0.2 percentage point decrease compared with 2.8% in August 2022 and a 0.1 percentage point decrease from July 2023.

To gain a complete view of the mortgage market and loan performance health, CoreLogic examines all stages of delinquency. In August 2023, the U.S. delinquency and transition rates and their year-over-year changes, were as follows:

- Early-Stage Delinquencies (30 to 59 days past due): 1.3%, up from 1.2% in August 2022.

- Adverse Delinquency (60 to 89 days past due): 0.4%, up from 0.3% in August 2022.

- Serious Delinquency (90 days or more past due, including loans in foreclosure): 0.9%, down from 1.2% in August 2022 and a high of 4.3% in August 2020.

- Foreclosure Inventory Rate (the share of mortgages in some stage of the foreclosure process): 0.3%, unchanged from August 2022.

- Transition Rate (the share of mortgages that transitioned from current to 30 days past due): 0.6%, unchanged from August 2022.

The share of U.S. mortgages that fell into serious delinquency — representing borrowers who are three months late on payments — dropped to the lowest level in nearly 25 years in August, at 0.9%. Nationwide, overall mortgage delinquencies (2.6%) and foreclosures (0.3%) also remained near historic lows, a clear sign that most U.S. homeowners can currently cover their monthly payments. But as interest rates have approached 8% in October, more prospective buyers could be sidelined, a factor that makes timing the housing market crucial to building long-term wealth.

“U.S. mortgage performance remained strong in August, supported by a robust job market and a healthy economy,” said Molly Boesel, principal economist at CoreLogic. “However, this thriving job market comes at a time when interest rates are quickly rising, which is keeping many potential homebuyers from being able to secure a mortgage.”

State and Metro Takeaways:

- Of U.S. states, Idaho and Utah posted small annual increases (both up by 0.1 percentage point) in overall mortgage delinquency rates in August. Overall delinquency rates were unchanged year over year in Arizona, Florida, Indiana and Oregon. The remaining states’ annual delinquency rates declined between 0.1 and 0.8 percentage points.

- In August, 51 U.S. metro areas posted increases in overall year-over-year delinquency rates. The metros with the largest increases were Elkhart-Goshen, Indiana (up by 0.6 percentage points); and Kokomo, Indiana and Punta Gorda, Florida (both up by 0.5 percentage points).

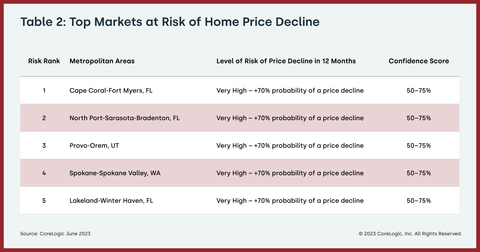

- In August, three U.S. metro areas posted an increase in serious delinquency rates (defined as 90 days or more late on a mortgage payment), while changes in other metros ranged from – 1.4 percentage points to 0.0 percentage points. The metros that posted annual serious delinquency increases were Punta Gorda, Florida (up by 0.5 percentage points); Cape Coral-Fort Myers, Florida (up by 0.4 percentage points) and Cheyenne, Wyoming (up by 0.1 percentage point).

The next CoreLogic Loan Performance Insights Report will be released on November 30, 2023, featuring data for September 2023. For ongoing housing trends and data, visit the CoreLogic Intelligence Blog: www.corelogic.com/intelligence.

Methodology

The data in The CoreLogic LPI report represents foreclosure and delinquency activity reported through August 2023. The data in this report accounts for only first liens against a property and does not include secondary liens. The delinquency, transition and foreclosure rates are measured only against homes that have an outstanding mortgage. Homes without mortgage liens are not subject to foreclosure and are, therefore, excluded from the analysis. CoreLogic has approximately 75% coverage of U.S. foreclosure data.

Source: CoreLogic

The data provided is for use only by the primary recipient or the primary recipient’s publication or broadcast. This data may not be re-sold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Robin Wachner at newsmedia@corelogic.com. For sales inquiries, please visit https://www.corelogic.com/support/sales-contact/. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic is a leading provider of property insights and innovative solutions, working to transform the property industry by putting people first. Using its network, scale, connectivity and technology, CoreLogic delivers faster, smarter, more human-centered experiences that build better relationships, strengthen businesses and ultimately create a more resilient society. For more information, please visit www.corelogic.com.

CORELOGIC and the CoreLogic logo are trademarks of CoreLogic, Inc. and/or its subsidiaries.

Contacts

Media Contact:

Robin Wachner

CoreLogic

newsmedia@corelogic.com

Sales Contact:

https://www.corelogic.com/support/sales-contact/