New York, NY – July 25, 2023 (PRNewswire) S&P Dow Jones Indices (S&P DJI) today released the latest results for the S&P CoreLogic Case-Shiller Indices, the leading measure of U.S. home prices. Data released today for May 2023 show all 20 major metro markets reported month-over-month price increases for the third straight month. More than 27 years of history are available for the data series and can be accessed in full by going to www.spglobal.com/spdji/en/index-family/indicators/sp-corelogic-case-shiller.

YEAR-OVER-YEAR

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a -0.5% annual decrease in May, down from a loss of -0.1% in the previous month. The 10-City Composite showed a decrease of -1.0%, which is a tick up from the -1.1% decrease in the previous month. The 20-City Composite posted a -1.7% year-over-year loss, same as in the previous month.

Chicago, Cleveland, and New York reported the highest year-over-year gains among the 20 cities in May. Chicago moved up one to the top spot with a 4.6% year-over-year price increase, while Cleveland came in at number two with a 3.9% increase, and New York entered the top three in third with a 3.5% increase. There was an even split of 10 cities reporting lower prices and those reporting higher prices in the year ending May 2023 versus the year ending April 2023.

MONTH-OVER-MONTH

Before seasonal adjustment, the U.S. National Index posted a 1.2% month-over-month increase in May, while the 10-City and 20-City Composites both posted increases of 1.5%.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.7%, while the 10-City Composite gained 1.1% and 20-City Composites posted an increase of 1.0%.

ANALYSIS

“The rally in U.S. home prices continued in May 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “Our National Composite rose by 1.2% in May, and now stands only 1.0% below its June 2022 peak. The 10- and 20-City Composites also rose in May, in both cases by 1.5%.

“The ongoing recovery in home prices is broadly based. Before seasonal adjustment, prices rose in all 20 cities in May (as they had also done in March and April). Seasonally adjusted data showed rising prices in 19 cities in May, repeating April’s performance. (The outlier is Phoenix, down 0.1% in both months.) On a trailing 12-month basis, the National Composite is 0.5% below its May 2022 level, with the 10- and 20-City Composites also negative on a year-over-year basis.

“Regional differences continue to be striking. This month’s league table shows the Revenge of the Rust Belt, as Chicago (+4.6%), Cleveland (+3.9%), and New York (+3.5%) were the top performers. If this seems like an unusual occurrence to you, it seems that way to me too. It’s been five years to the month since a cold-weather city held the top spot (and that was Seattle, which isn’t all that cold). Since May 2018, the top-ranked cities have been Las Vegas (12 months), Phoenix (33 months), Tampa (5 months), and Miami (9 months).

“At the other end of the scale, the worst performers continue to cluster near the Pacific coast, with Seattle (-11.3%) and San Francisco (-11.0%) at the bottom. This month the Midwest (+2.7%) unseated the Southeast (+2.1%) as the country’s strongest region. The West (-6.9%) remains weakest.

“Home prices in the U.S. began to fall after June 2022, and May’s data bolster the case that the final month of the decline was January 2023. Granted, the last four months’ price gains could be truncated by increases in mortgage rates or by general economic weakness. But the breadth and strength of May’s report are consistent with an optimistic view of future months.”

SUPPORTING DATA

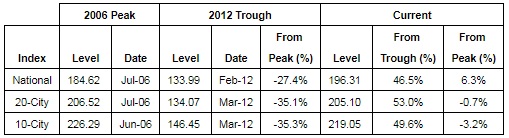

Table 1 below shows the housing boom/bust peaks and troughs for the three composites along with the current levels and percentage changes from the peaks and troughs.

| 2006 Peak | 2012 Trough | Current | |||||||

| Index | Level | Date | Level | Date | From Peak (%) | Level | From Trough (%) | From Peak (%) | |

| National | 184.61 | Jul-06 | 134.00 | Feb-12 | -27.4 % | 305.15 | 127.7 % | 65.3 % | |

| 20-City | 206.52 | Jul-06 | 134.07 | Mar-12 | -35.1 % | 312.02 | 132.7 % | 51.1 % | |

| 10-City | 226.29 | Jun-06 | 146.45 | Mar-12 | -35.3 % | 325.72 | 122.4 % | 43.9 % | |

Table 2 below summarizes the results for May 2023. The S&P CoreLogic Case-Shiller Indices could be revised for the prior 24 months, based on the receipt of additional source data.

| May 2023 | May/April | April/March | 1-Year | ||||

| Metropolitan Area | Level | Change (%) | Change (%) | Change (%) | |||

| Atlanta | 234.65 | 0.9 % | 1.3 % | 2.1 % | |||

| Boston | 314.53 | 1.2 % | 3.0 % | 0.2 % | |||

| Charlotte | 261.12 | 1.2 % | 1.4 % | 2.3 % | |||

| Chicago | 192.96 | 2.3 % | 1.8 % | 4.6 % | |||

| Cleveland | 178.84 | 2.7 % | 2.3 % | 3.9 % | |||

| Dallas | 293.17 | 1.6 % | 1.4 % | -3.8 % | |||

| Denver | 316.16 | 0.7 % | 1.6 % | -4.9 % | |||

| Detroit | 176.53 | 2.3 % | 2.2 % | 2.1 % | |||

| Las Vegas | 272.67 | 0.9 % | 0.7 % | -7.8 % | |||

| Los Angeles | 410.13 | 1.2 % | 1.7 % | -3.1 % | |||

| Miami | 408.52 | 1.2 % | 0.8 % | 3.4 % | |||

| Minneapolis | 235.56 | 1.6 % | 1.7 % | 0.3 % | |||

| New York | 283.03 | 1.9 % | 1.6 % | 3.5 % | |||

| Phoenix | 314.13 | 0.9 % | 0.7 % | -7.6 % | |||

| Portland | 324.93 | 1.0 % | 1.5 % | -5.1 % | |||

| San Diego | 409.85 | 1.9 % | 2.0 % | -4.2 % | |||

| San Francisco | 350.34 | 1.0 % | 2.2 % | -11.0 % | |||

| Seattle | 367.42 | 1.9 % | 2.3 % | -11.3 % | |||

| Tampa | 374.80 | 1.0 % | 0.8 % | 0.7 % | |||

| Washington | 310.17 | 1.5 % | 1.6 % | -0.1 % | |||

| Composite-10 | 325.72 | 1.5 % | 1.7 % | -1.0 % | |||

| Composite-20 | 312.02 | 1.5 % | 1.7 % | -1.7 % | |||

| U.S. National | 305.15 | 1.2 % | 1.5 % | -0.5 % | |||

| Sources: S&P Dow Jones Indices and CoreLogic | |||||||

| Data through May 2023 | |||||||

Table 3 below shows a summary of the monthly changes using the seasonally adjusted (SA) and non-seasonally adjusted (NSA) data. Since its launch in early 2006, the S&P CoreLogic Case-Shiller Indices have published, and the markets have followed and reported on, the non-seasonally adjusted data set used in the headline indices. For analytical purposes, S&P Dow Jones Indices publishes a seasonally adjusted data set covered in the headline indices, as well as for the 17 of 20 markets with tiered price indices and the five condo markets that are tracked.

| May/April Change (%) | April/March Change (%) | |||||||

| Metropolitan Area | NSA | SA | NSA | SA | ||||

| Atlanta | 0.9 % | 0.4 % | 1.3 % | 0.8 % | ||||

| Boston | 1.2 % | 0.7 % | 3.0 % | 1.6 % | ||||

| Charlotte | 1.2 % | 0.6 % | 1.4 % | 0.7 % | ||||

| Chicago | 2.3 % | 1.4 % | 1.8 % | 0.9 % | ||||

| Cleveland | 2.7 % | 1.7 % | 2.3 % | 1.7 % | ||||

| Dallas | 1.6 % | 0.7 % | 1.4 % | 0.4 % | ||||

| Denver | 0.7 % | 0.4 % | 1.6 % | 0.4 % | ||||

| Detroit | 2.3 % | 1.6 % | 2.2 % | 0.9 % | ||||

| Las Vegas | 0.9 % | 0.2 % | 0.7 % | 0.0 % | ||||

| Los Angeles | 1.2 % | 0.9 % | 1.7 % | 1.0 % | ||||

| Miami | 1.2 % | 0.8 % | 0.8 % | 0.2 % | ||||

| Minneapolis | 1.6 % | 0.6 % | 1.7 % | 0.5 % | ||||

| New York | 1.9 % | 1.8 % | 1.6 % | 1.2 % | ||||

| Phoenix | 0.9 % | -0.1 % | 0.7 % | -0.1 % | ||||

| Portland | 1.0 % | 0.3 % | 1.5 % | 0.7 % | ||||

| San Diego | 1.9 % | 1.5 % | 2.0 % | 1.1 % | ||||

| San Francisco | 1.0 % | 0.8 % | 2.2 % | 0.9 % | ||||

| Seattle | 1.9 % | 1.3 % | 2.3 % | 0.4 % | ||||

| Tampa | 1.0 % | 0.7 % | 0.8 % | 0.3 % | ||||

| Washington | 1.5 % | 1.0 % | 1.6 % | 0.5 % | ||||

| Composite-10 | 1.5 % | 1.1 % | 1.7 % | 1.0 % | ||||

| Composite-20 | 1.5 % | 1.0 % | 1.7 % | 0.9 % | ||||

| U.S. National | 1.2 % | 0.7 % | 1.5 % | 0.6 % | ||||

| Sources: S&P Dow Jones Indices and CoreLogic | ||||||||

| Data through May 2023 | ||||||||

For more information about S&P Dow Jones Indices, please visit www.spglobal.com/spdji.

ABOUT S&P DOW JONES INDICES

S&P Dow Jones Indices is the largest global resource for essential index-based concepts, data and research, and home to iconic financial market indicators, such as the S&P 500® and the Dow Jones Industrial Average®. More assets are invested in products based on our indices than products based on indices from any other provider in the world. Since Charles Dow invented the first index in 1884, S&P DJI has been innovating and developing indices across the spectrum of asset classes helping to define the way investors measure and trade the markets.

S&P Dow Jones Indices is a division of S&P Global (NYSE: SPGI), which provides essential intelligence for individuals, companies, and governments to make decisions with confidence. For more information, visit www.spglobal.com/spdji.

FOR MORE INFORMATION:

April Kabahar

Global Head of Communications

New York, USA

(+1) 212 438 7530

april.kabahar@spglobal.com

S&P Dow Jones Indices’ interactive blog, IndexologyBlog.com, delivers real-time commentary and analysis from industry experts across S&P Global on a wide-range of topics impacting residential home prices, homebuilding and mortgage financing in the United States. Readers and viewers can visit the blog at www.indexologyblog.com, where feedback and commentary are welcomed and encouraged.

The S&P CoreLogic Case-Shiller Indices are published on the last Tuesday of each month at 9:00 am ET. They are constructed to accurately track the price path of typical single-family homes located in each metropolitan area provided. Each index combines matched price pairs for thousands of individual houses from the available universe of arms-length sales data. The S&P CoreLogic Case-Shiller U.S. National Home Price Index tracks the value of single-family housing within the United States. The index is a composite of single-family home price indices for the nine U.S. Census divisions and is calculated quarterly. The S&P CoreLogic Case-Shiller 10-City Composite Home Price Index is a value-weighted average of the 10 original metro area indices. The S&P CoreLogic Case-Shiller 20-City Composite Home Price Index is a value-weighted average of the 20 metro area indices. The indices have a base value of 100 in January 2000; thus, for example, a current index value of 150 translates to a 50% appreciation rate since January 2000 for a typical home located within the subject market.

These indices are generated and published under agreements between S&P Dow Jones Indices and CoreLogic, Inc.

The S&P CoreLogic Case-Shiller Indices are produced by CoreLogic, Inc. In addition to the S&P CoreLogic Case-Shiller Indices, CoreLogic also offers home price index sets covering thousands of zip codes, counties, metro areas, and state markets. The indices, published by S&P Dow Jones Indices, represent just a small subset of the broader data available through CoreLogic.

Case-Shiller® and CoreLogic® are trademarks of CoreLogic Case-Shiller, LLC or its affiliates or subsidiaries (“CoreLogic”) and have been licensed for use by S&P Dow Jones Indices. None of the financial products based on indices produced by CoreLogic or its predecessors in interest are sponsored, sold, or promoted by CoreLogic, and neither CoreLogic nor any of its affiliates, subsidiaries, or predecessors in interest makes any representation regarding the advisability of investing in such products.

SOURCE S&P Dow Jones Indices