New LendingTree study shows the top uses of home equity loans by city

Charlotte, NC – June 18, 2018 (PRNewswire) LendingTree®, the nation’s leading online loan marketplace, today released its study on the top uses of home equity loans by city.

LendingTree assessed home equity loan requests since the start of 2018 to reveal the primary reasons borrowers are utilizing the funds and compared the data across cities to find regional biases in how home equity loans are used. The study also provides other metrics including loan size, LTV and the age of the borrowers. LendingTree data tracks six uses for home equity loans — home improvement, debt consolidation, retirement income, investment property, emergency funds and other uses.

“Home prices have been steadily increasing and have now surpassed the pre-financial crisis highs,” said Tendayi Kapfidze, LendingTree’s Chief Housing Economist. “While this may pose a challenge for those looking to purchase homes, those who own homes can stand to benefit by leveraging the growing equity in their homes, using those funds for other expenses.”

“Responsible home equity borrowing can be a valuable source of funds for life events,” Kapfidze added. “It’s important to note that this new wave of home equity lending is far different from the equity extraction that occurred prior to the financial crisis, and lending standards are much more stringent today. Most home equity borrowers today have far higher credit scores and borrow less of the accumulated appreciation in their home.”

Key findings from the study include:

- Home improvement tops the list of uses for home equity loans. The most common use was home improvement, at 43 percent of home equity loan requests.

- Real estate investors borrow the most. Borrowers who were looking to invest in another property had the highest property values and requested loan amounts. For property investments, borrowers requested an average of $103,625.

- For non-property investments, which likely include small businesses, borrowers requested $80,241.

- Just over 1 percent of requests were to fund retirement. Not surprisingly, this cohort had the highest average age of 63 — 12 years above the next highest average age.

- A small share accessed their home equity for emergency expenses. This group had the lowest loan amount requested of $35,747 and kept their LTV low at 51 percent.

- Debt consolidators push the limits on LTV. Borrowers looking to consolidate debt had the highest LTV of 74 percent.

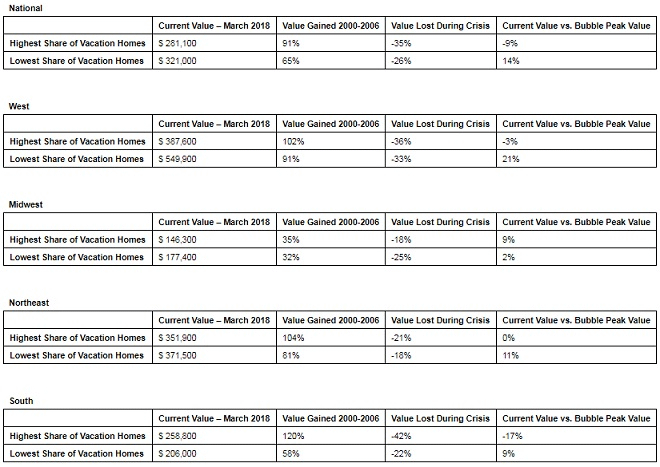

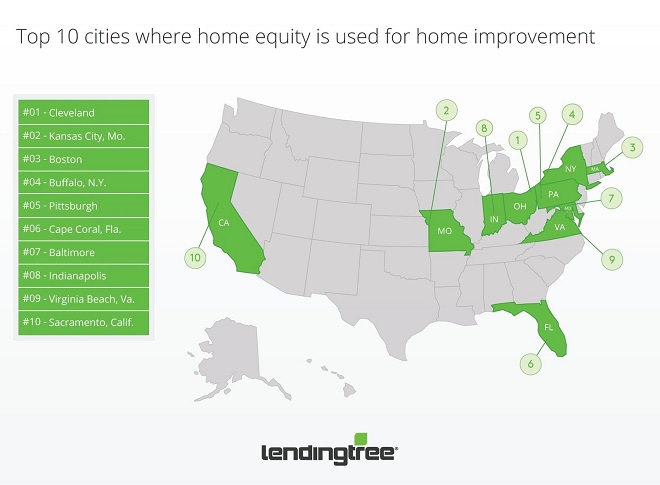

Top cities for home improvement

#1 Cleveland

- Share of home equity loan requests: 50%

- Median loan amount: $30,000

#2 Kansas City, Mo.

- Share of home equity loan requests: 49%v

- Median loan amount: $30,000

#3 Boston

- Share of home equity loan requests: 49%

- Median loan amount: $50,000

Top cities for debt consolidation

#1 Raleigh, N.C.

- Share of home equity loan requests: 48%

- Median loan amount: $30,000

#2 Minneapolis

- Share of home equity loan requests: 47%

- Median loan amount: $30,000

#3 Las Vegas, N.V.

- Share of home equity loan requests: 47%

- Median loan amount: $35,000

Top cities for other investment purposes

#1 San Jose, Calif.

- Share of home equity loan requests: 15%

- Median loan amount: $160,000

#2 Miami

- Share of home equity loan requests: 12%

- Median loan amount: $82,500

#3 Austin, Texas

- Share of home equity loan requests: 11%

- Median loan amount: $85,000

Top cities for retirement

#1 Cape Coral, Fla

- Share of home equity loan requests: 5.1%

- Median loan amount: $50,000

#2 Daytona Beach, Fla

- Share of home equity loan requests: 3.3%

- Median loan amount: $50,000

#3 Charleston, S.C.

- Share of home equity loan requests: 2.5%

- Median loan amount: $50,000

Top cities for investment property

#1 San Jose, Calif.

- Share of home equity loan requests: 1.2%

- Median loan amount: $300,000

#2 Raleigh, N.C.

- Share of home equity loan requests: 0.8%

- Median loan amount: $75,000

#3 Miami

- Share of home equity loan requests: 0.7%

- Median loan amount: $65,000

To view the full ranking and report, visit: www.lendingtree.com.

About LendingTree

LendingTree (NASDAQ: TREE) is the nation’s leading online loan marketplace, empowering consumers as they comparison-shop across a full suite of loan and credit-based offerings. LendingTree provides an online marketplace which connects consumers with multiple lenders that compete for their business, as well as an array of online tools and information to help consumers find the best loan. Since inception, LendingTree has facilitated more than 65 million loan requests. LendingTree provides free monthly credit scores through My LendingTree and access to its network of over 500 lenders offering home loans, personal loans, credit cards, student loans, business loans, home equity loans/lines of credit, auto loans and more. LendingTree, LLC is a subsidiary of LendingTree, Inc. For more information go to www.lendingtree.com, dial 800-555-TREE, like our Facebook page and/or follow us on Twitter @LendingTree.

MEDIA CONTACT:

Megan Greuling

(704) 943-8208

Megan.greuling@lendingtree.com