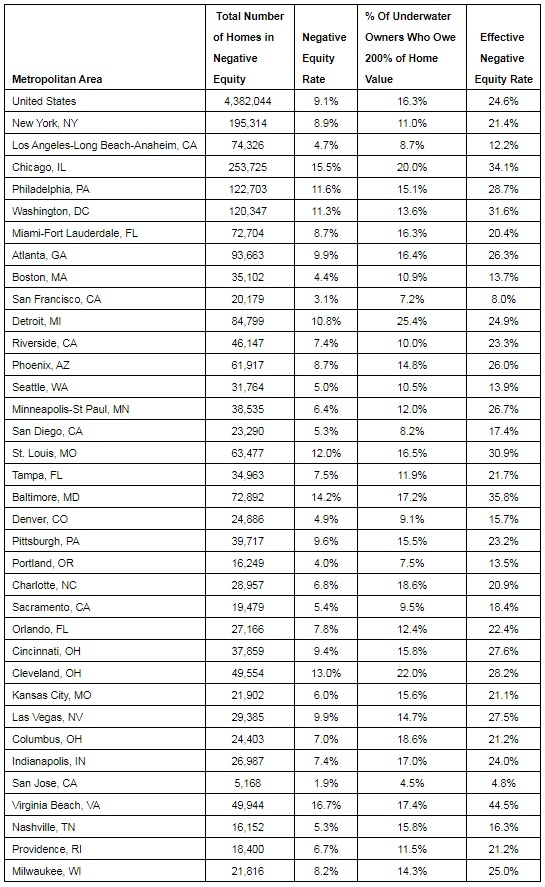

– When the housing crisis was at its lowest point, more than 30 percent of homeowners owed lenders more than the value of their homes

– Almost 4.5 million American homeowners still owe more on their mortgages than their homes are worth.

– About one in seven homeowners with a mortgage (15.4 percent) have some equity in their home, but likely not enough to sell and comfortably use the proceeds for a down payment on another home.

– Detroit has the largest share of deeply underwater homeowners, who owe twice as much as their homes are worth.

Seattle, WA – May 30, 2018 (PRNewswire) More than a decade after the housing market collapsed, the recovery has passed another milestone. The share of homeowners who owe more than the value of their home is 9.1 percent, falling below 10 percent for the first time since the housing market fell, according to Zillow®’s 2017 Q4 Negative Equity Reporti.

The typical U.S. home lost more than a quarter of its value when the market crashed, sending millions of homeowners into negative equity, when their homes’ values were lower than the balances on their mortgages. Now, though, national home values are higher than ever, and many owners who held on to their homes throughout the housing crisis have resurfaced on their mortgages.

Still, despite the progress made as the negative equity rate falls, 4.4 million homeowners remain underwater, and about 713,000 of them owe at least twice as much as their homes’ value.

Negative equity acts as a drag on the overall housing market, extending beyond homeowners who are underwater. Low inventory is one of the main factors in driving home values higher, as demand from millennials – the largest group of homebuyers – exceeds the available supply. Underwater homeowners are contributing to this shortage, holding on to their homes instead of selling for a loss.

“For much of the country the Great Recession is an increasingly distant memory – the American economy is booming once again and markets are now shifting their gaze to future downturn risks,” said Zillow senior economist Aaron Terrazas. “But scattered in neighborhoods across the country, the legacy of the mid-2000s housing bubble and bust lingers among the millions of Americans still underwater on their mortgages, trapped in their homes with no easy options to regain equity other than waiting. Their struggles mean there are fewer homes on the market for homebuyers today. In corners of the country where home values have been stagnant in recent years, recent homebuyers can easily fall underwater, particularly those who buy with small down payments.”

Nationally, roughly one in seven homeowners with a mortgage (15.4 percent) have some equity in their home, but likely not enough to sell and comfortably use the proceeds for a down payment on another home. Including these homeowners with limited equity, the nation’s “effective” negative equity rate jumps to 24.6 percent.

Detroit homeowners have the furthest to go to regain positive equity. In the metro, 25.4 percent of homeowners currently in negative equity – or about 22,000 – still owe at least double the value of their home.

Zillow

Zillow is the leading real estate and rental marketplace dedicated to empowering consumers with data, inspiration and knowledge around the place they call home, and connecting them with great real estate professionals. In addition, Zillow operates an industry-leading economics and analytics bureau led by Zillow Group’s Chief Economist Dr. Svenja Gudell. Dr. Gudell and her team of economists and data analysts produce extensive housing data and research covering more than 450 markets at Zillow Real Estate Research. Zillow also sponsors the quarterly Zillow Home Price Expectations Survey, which asks more than 100 leading economists, real estate experts and investment and market strategists to predict the path of the Zillow Home Value Index over the next five years. Launched in 2006, Zillow is owned and operated by Zillow Group, Inc. (NASDAQ: Z and ZG), and headquartered in Seattle.

Zillow is a registered trademark of Zillow, Inc.

(i) The data in the Zillow Negative Equity Report incorporates mortgage data from TransUnion, a global leader in credit and information management, to calculate various statistics. The report includes, but is not limited to, negative equity, loan-to-value ratios, and delinquency rates. To calculate negative equity, the estimated value of a home is matched to all outstanding mortgage debt and lines of credit associated with the home, including home equity lines of credit and home equity loans. All personally identifying information (“PII”) is removed from the data by TransUnion before delivery to Zillow. Overall, this report covers more than 870 metros, 2,400 counties, and 23,000 ZIP